The crypto landscape continues to evolve, marked by significant moves and strategic decisions. Recently, a major player in the market has ramped up its acquisition of Bitcoin with a substantial investment, underscoring the growing confidence in digital assets.

Major Bitcoin Acquisition Announced

In a notable announcement, the firm Strategic Holdings has added a substantial quantity of Bitcoin to its portfolio. The acquisition puts them in possession of an additional 21,021 BTC, procured at an average price of $117,256 each.

This acquisition, amounting to approximately $2.46 billion, was financed through the successful launch of their own Preferred Stock offering. The recent IPO, consisting of over 28 million shares, represents one of the most significant public offerings in 2025 to date. According to Chairman Michael Saylor, the preferred stock will be listed on Nasdaq and is poised to offer unique benefits for investors.

The launch of this perpetual preferred security is a groundbreaking move, highlighting our commitment to innovation in the digital asset space while providing monthly dividends to our investors.

With this latest addition, Strategic Holdings has amassed a remarkable total of 628,791 BTC, with a weighted average purchase price of $73,277 per Bitcoin, bringing their total investment to about $46.08 billion.

Market analyst Maartunn recently shared a visualization that effectively illustrates the scope of this new acquisition compared to previous purchases, reinforcing the growing trend of institutional investment in Bitcoin.

The insights derived from the chart reveal that this latest buy marks the largest since late November, around eight months ago, when a previous acquisition amounted to over $5 billion. That earlier transaction was a pivotal moment, with multiple strategic purchases throughout the month, showcasing Saylor’s aggressive accumulation strategy.

Currently, the valuation of Strategic’s Bitcoin holdings stands at around $74.04 billion, representing an impressive profit margin of approximately $27.96 billion or about 60.6%. This positions the organization strongly as they continue their asset accumulation strategy.

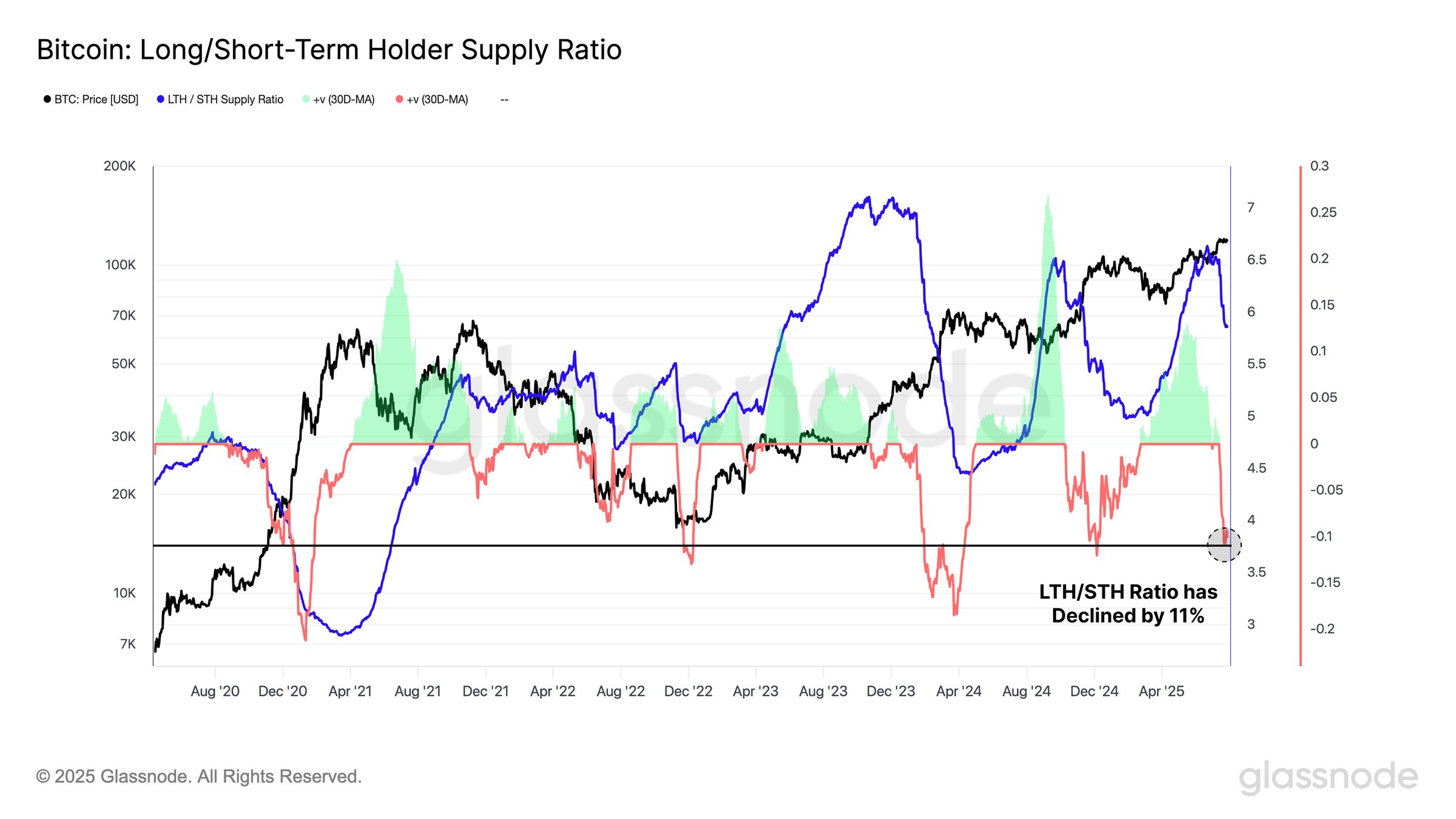

While Strategic Holdings maintains its bullish stance on Bitcoin, recent trends indicate a shift in market dynamics. On-chain analytical firm Glassnode has observed that while institutional investors are holding, many smaller investors appear to be cashing out.

The chart presented illustrates the changing ratio between short-term holders and long-term holders of Bitcoin. Investors acquired within the past 155 days are categorized as short-term holders, while those purchasing earlier remain long-term. A noteworthy 11% decline in this ratio over the past month indicates a capital rotation toward short-term holders, which historically has been a precursor to significant price movements in the market.

Current Market Outlook for Bitcoin

As of the latest update, Bitcoin’s price hovers around $117,800, reflecting a slight dip of 1% in the last 24 hours. The market remains volatile, and traders are keenly watching for potential price movements and opportunities.