In a significant move marking the rise of cryptocurrency in corporate finance, Marti Technologies has announced an initiative to hold approximately 20% of its cash reserves in Bitcoin (BTC). This reflects an emerging trend as companies increasingly embrace digital assets to enhance their treasury management practices.

Marti Technologies Introduces Innovative Bitcoin Allocation

According to a release today, Marti Technologies, listed on the New York Stock Exchange (NYSE), is set to allocate up to 20% of its available cash resources to Bitcoin. The company has indicated a potential increase in this allocation to as much as 50% in the future, considering other cryptocurrencies like Ethereum (ETH) and Solana (SOL).

This strategic move places Marti Technologies in the company of a growing cohort of publicly traded firms that are turning to digital assets as part of their overall financial strategy. The company regards Bitcoin and similar cryptocurrencies as viable long-term wealth preservation tools.

While there is a notable institutional appetite for digital currencies, the stock market reacted with skepticism. Reportedly, shares of Marti Technologies fell by over 6% in pre-market trading, sitting at around $2.49.

In its announcement, Marti Technologies confirmed that its Bitcoin holdings would be safeguarded through a regulated institutional provider, adhering to relevant regulations and industry best practices. In his comments, Marti Technologies CEO Oguz Alper Aktem emphasized the importance of this new strategy:

In light of recent economic uncertainties, our decision to diversify into crypto reflects our belief that Bitcoin and other digital currencies will maintain their value similarly to traditional assets such as gold.

Aktem further addressed the current economic climate, highlighting inflationary pressures and risks to currency stability. He expressed Marti’s commitment to becoming a long-term holder of cryptocurrencies, with expectations to grow its asset base over time.

Rising Interest in Corporate Cryptocurrency Holdings

The calculated entry of Marti Technologies into the realm of digital assets is part of a broader wave of corporate engagement with cryptocurrencies, a trend that has gained substantial traction in 2025.

In a related development, Bitcoin mining giant MARA Holdings recently completed a monumental $950 million fundraising round aimed at increasing their Bitcoin holdings. Currently, MARA ranks as the second-largest public entity in terms of Bitcoin ownership, boasting approximately 50,000 BTC.

Globally, interest in Bitcoin is also proliferating beyond the United States. For example, French tech company Sequans has recently fortified its balance sheets with an additional 1,264 BTC.

In the UK, Satsuma Technology has unveiled plans to expand its cryptocurrency assets, while another tech company, The Smarter Web Company, has recently acquired 225 BTC, signaling a growing inclination towards Bitcoin among UK firms.

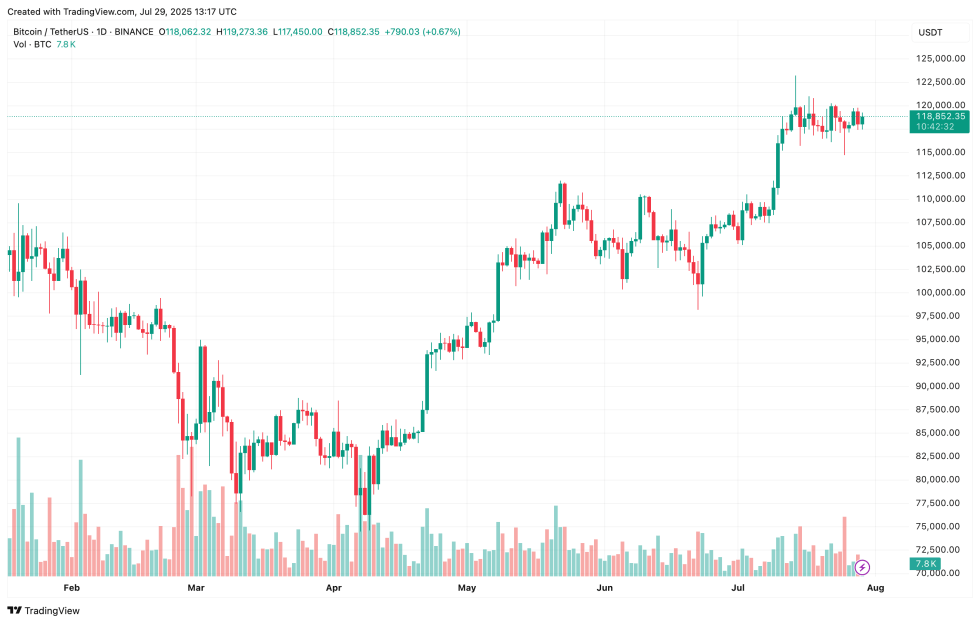

Moreover, the demand for other cryptocurrencies, particularly Ethereum, continues to surge. As of this writing, Bitcoin is trading at approximately $118,852, showing a slight increase of 0.1% within the last day.