Recent developments in the realm of cryptocurrency investments reveal an exciting trend, with a surge in weekly inflows reaching a staggering $3.7 billion, as highlighted by CoinShares’ latest report published on Monday.

This impressive figure marks the second-largest weekly inflow for digital asset funds to date, bringing the overall annual total to a remarkable $22.7 billion. According to James Butterfill, Head of Research at CoinShares, July 10 stands out as a significant day, recording the third-highest daily inflow ever, which underscores the revitalized confidence of investors.

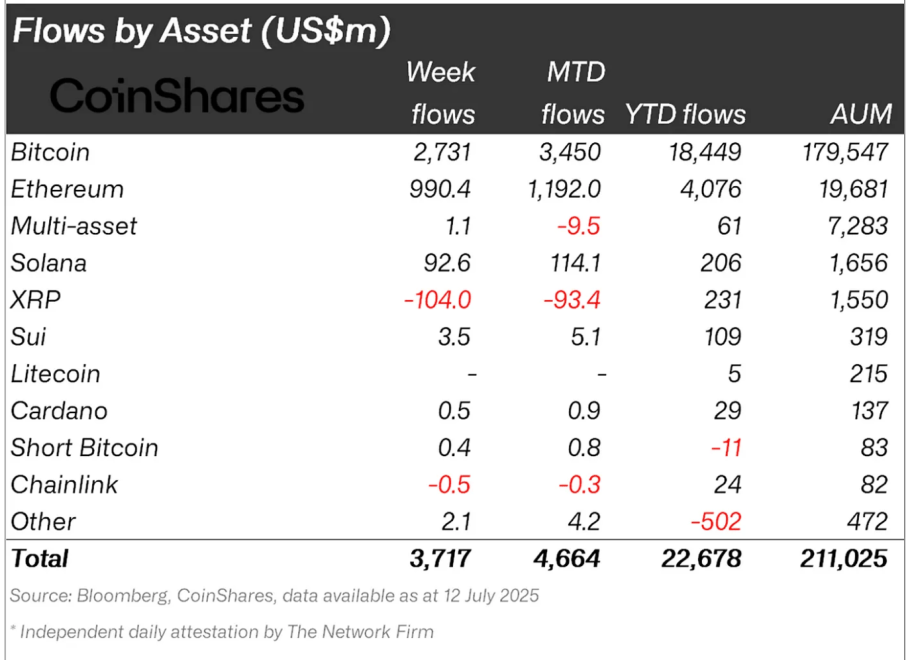

As a result, the total assets under management (AuM) for crypto investment products have surpassed the $200 billion threshold, now sitting at $211 billion.

Additionally, trading volumes for exchange-traded products (ETPs) have seen a considerable rise, doubling this year’s average to an impressive $29 billion. These figures not only underscore the growth potential of digital asset investment vehicles but also emphasize their increasing traction among institutional investors.

Bitcoin and Ethereum Lead the Charge in Fund Inflows

Bitcoin continues to showcase its leadership in the market, attracting $2.7 billion in inflows last week, bringing its total AuM to an impressive $179.5 billion. This sum is now equivalent to 54% of the AuM in gold exchange-traded products, indicating a possible shift in investor mindset towards viewing digital assets as viable alternatives for wealth preservation.

While long Bitcoin products enjoyed remarkable inflows, short Bitcoin ETPs noted minimal activity, reflecting an overwhelmingly bullish sentiment. Ethereum also captured significant interest with inflows of $990 million over the week, marking its twelfth consecutive week of gains.

These inflows constitute 19.5% of Ethereum’s AuM in the last three months, compared to Bitcoin’s 9.8%, pointing towards Ethereum’s relatively stronger growth trajectory. Its momentum may be propelled by prospects surrounding staking improvements and advancements in decentralized finance and tokenization.

Regional Insights and Altcoin Trends

A significant portion of inflows originated from the United States, totaling $3.7 billion, indicative of solid interest from American investors and institutions.

Conversely, Germany reported outflows of $85.7 million, a notable deviation from global trends. Meanwhile, both Switzerland and Canada experienced positive net inflows of $65.8 million and $17.1 million, respectively, signifying a growing investor appetite for digital assets in these regions.

In the altcoin arena, Solana garnered impressive inflows amounting to $92.6 million, fueled by recent advancements in its network and its capabilities in handling high-speed transactions. On the other hand, XRP saw the largest outflow of the week, totaling $104 million, marking a significant shift for the token.

This variance in inflows suggests that investor sentiment remains highly selective within the altcoin market, heavily influenced by project fundamentals and ongoing regulatory discussions.

CoinShares’ findings reaffirm that the digital asset investment landscape is transitioning into a phase characterized by institutional growth, as evidenced by historic inflows and heightened market engagement.

Remarkably, Bitcoin reached a new all-time high earlier today, exceeding $123,000, while ETH, XRP, and SOL surged by more than 10% over the past week, illustrating the dynamic and evolving nature of cryptocurrency investments.

Featured image created with DALL-E, Chart from TradingView