As cryptocurrency markets evolve, Bitcoin recently reached a milestone at $124,500 before encountering resistance at the $115,000 mark. The enthusiasm that fueled its rise is now tempered as market participants eagerly watch how the leading digital asset will maintain this critical support level. Despite strong fundamentals, including growing institutional interest and a robust base of holders, new trends in capital flow are unfolding.

Market analysts have observed a significant shift as some capital appears to be flowing from Bitcoin towards altcoins, indicating a transitional phase in the market cycle. Notably, Ethereum has emerged as a central player in this evolving landscape, attracting the attention of investors.

In an intriguing development, the on-chain analytics firm Lookonchain has reported concerning a once-dormant Bitcoin whale that has re-entered the market with remarkable activity. Last Friday, this individual transferred 300 BTC (valued at approximately $34 million) into Hyperliquid, aiming to exchange it for Ethereum. This bold strategic move is already yielding impressive returns, with the whale’s unrealized profits exceeding $100 million.

Presently, the whale’s holdings include a substantial 135,265 ETH (valued at around $581 million) with an average purchase price of $4,295, leading to an increase of $58 million in profits. Additionally, he has acquired 122,226 ETH (totaling $535 million) at an average price of $4,377, up by $42 million. Such a significant rotation indicates a critical juncture—while Bitcoin stabilizes, Ethereum and other altcoins might capture increased investor interest.

Strategic Moves: Bitcoin Whale Transitioning to Ethereum

According to Lookonchain’s latest findings, the enigmatic Bitcoin whale is creating waves in market discussions through a series of bold moves. Recently, this individual transferred an additional 4,000 BTC (approximately $460 million) into exchanges to convert into Ethereum. This considerable repositioning demonstrates a strong signal to both analysts and investors.

To date, this whale has gathered a striking total of 179,448 ETH (around $806 million) at an average price of $4,490. Alongside this, the long position of 135,265 ETH ($581 million) remains active. These assertive adjustments reflect a calculated approach favoring Ethereum over Bitcoin, signaling a prediction that ETH may outperform in the market’s next phase.

The ramifications of this shift are substantial. On one side, such a large capital transition indicates a burgeoning confidence in Ethereum as it challenges Bitcoin’s market position. Conversely, it raises the possibility of increased volatility in the short term.

Financial experts caution that while the outlook appears bullish, a market correction could occur before sustained gains emerge. The heightened leverage in derivatives markets coupled with reduced liquidity in spot trading could potentially result in sharp downturns, impacting over-leveraged positions.

Comparative Analysis: Bitcoin vs. Ethereum

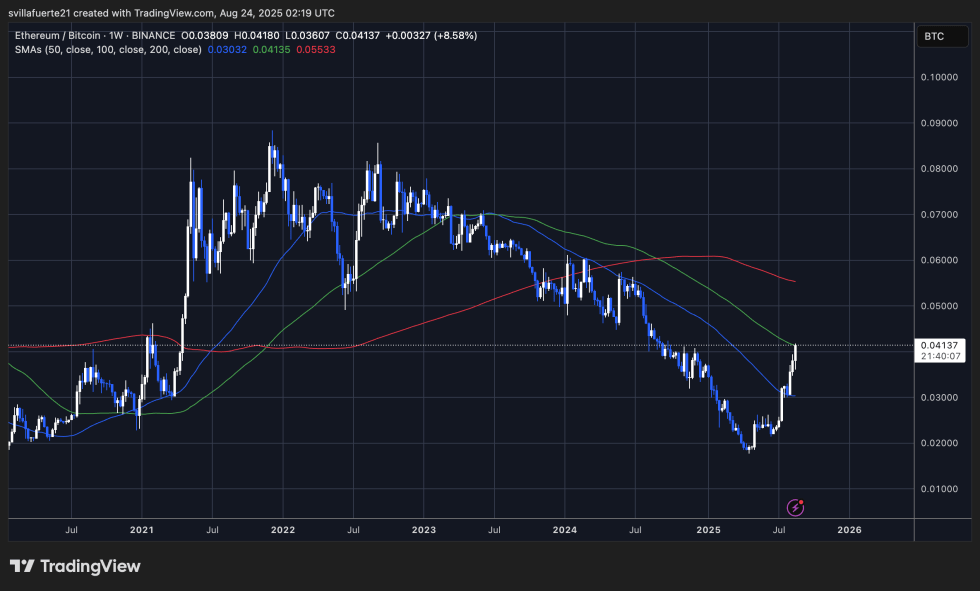

The chart comparing ETH/BTC demonstrates a notable resurgence of Ethereum against Bitcoin after an extended downtrend observed from mid-2022 to early 2025. Ethereum has recently ascended to the 0.041 BTC level, marked by bullish momentum, breaking previous resistance on key moving averages. The 50-week simple moving average (SMA) has been surpassed, with prices now testing the 100-week SMA, creating a crucial resistance zone. Should Ethereum maintain upward momentum past this level, the next substantial target would approach the 200-week SMA situated around 0.055 BTC.

This rotation is particularly noteworthy as Ethereum had lagged behind Bitcoin for an extended period. The recent price movement indicates potential for further capital rotation from Bitcoin into Ethereum, driven by substantial institutional investments and whale activity.

However, should the ETH/BTC ratio face resistance at the present level, a retracement towards support around 0.035 BTC may be anticipated, correlating with previous consolidation areas. Nevertheless, current momentum indicators favor Ethereum, suggesting a prevailing strength in this asset.

Featured image from Dall-E, chart from TradingView.