The recent surge in Ethereum’s price has captured significant attention, indicating a fascinating yet turbulent period for the cryptocurrency. Following its breach of the 2021 all-time high, a wave of excitement mixed with caution has enveloped the market. As ETH pulled back, essential support levels were tested, prompting bullish investors to step in, defended by a strong demand backdrop. Analysts are highlighting the potential for Ethereum to soar past $5,000 shortly, sparking conversations around future price trajectories and market stability.

However, as optimism grows, concerns about possible corrections remain a pressing factor. The current market sentiment is tinged with trepidation, as traders grapple with the sustainability of recent gains and the potential for upcoming pullbacks.

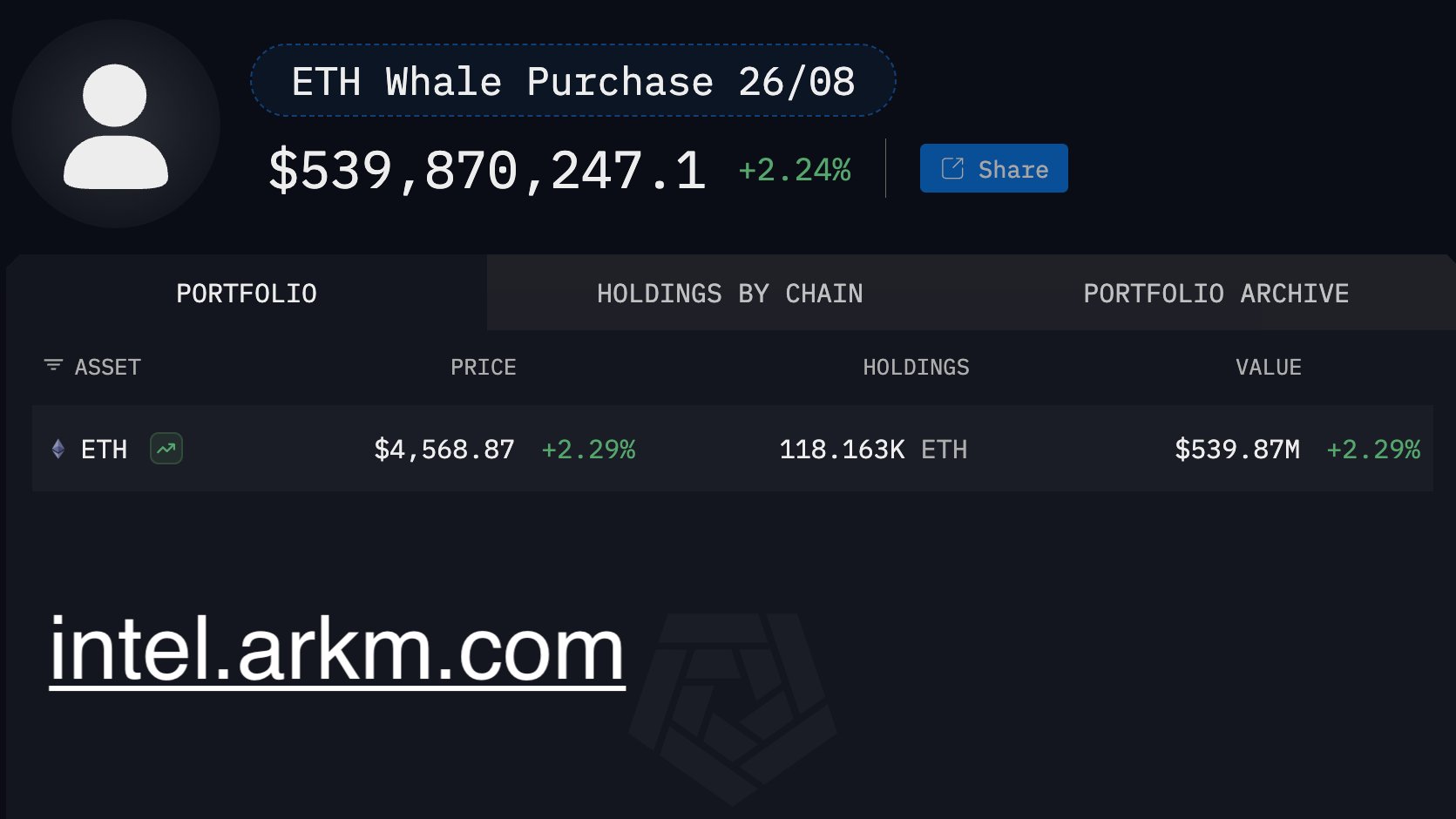

Amid this volatility, an intriguing trend has emerged: the accumulation activities of large investors, commonly known as whales. According to recent data from Arkham Intelligence, several whale addresses consolidated a massive total of approximately $450 million in Ethereum in just one day. This trend not only signals confidence among major players but also suggests strategic positioning for subsequent price advancements.

Whale Activity: A Sign of Market Confidence

Arkham Intelligence has provided compelling insights into the whales’ movements and their potential impact on the market. On a recent day, a total of nine significant addresses collectively acquired over $456 million worth of ETH. Of these, five wallets directly sourced funds from Bitgo, an elite institutional custodian. The remaining four utilized Galaxy Digital’s OTC services for their transactions. Such strategic maneuvers showcase not only a robust confidence among whales but also highlight the role of established financial infrastructures in facilitating substantial acquisitions.

This uptick in whale purchases indicates a calculative game plan among affluent investors aiming to maximize profits in Ethereum’s potential bullish cycle. Historically, periods of heightened whale activity have often preceded major upward price movements, signaling to retail investors that now is a critical time to consider market positions. With Ethereum probing essential demand areas after its recent highs, these substantial inflows can play a pivotal role in defining the asset’s near-term price stability and potential for growth.

Moreover, public corporations are increasingly joining the Ethereum conversation. Entities like Bitmine and Sharplink Gaming are publicly revealing their Ethereum acquisitions, further solidifying the asset’s reputation as a viable institutional investment. This is reminiscent of Bitcoin’s early institutional embrace when companies began incorporating it into their balance sheets, propelling market confidence to new heights.

The synergy between whale activities, institutional investments, and corporate partnerships crafts a compelling narrative of strengthened confidence in Ethereum’s long-term growth. While immediate risks pose challenges, these developments support a bullish outlook, emphasizing the likelihood of Ethereum continuing toward new price benchmarks and possibly exceeding $5,000.

Can Ethereum Sustain Its Momentum Toward $5,000?

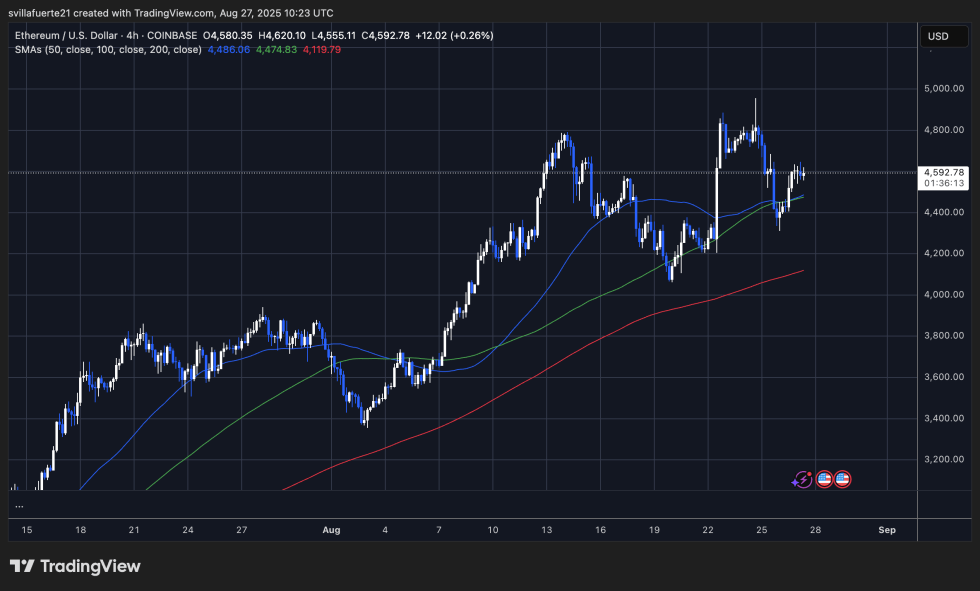

Currently, Ethereum is trading around $4,592 following a corrective dip from near-term highs of $4,850. Analyzing the 4-hour charts reveals that Ethereum is regaining traction, rising above the 50-day and 100-day moving averages. This movement signals a resurgence in buying activity that is re-establishing critical support levels, vital for the ongoing upward trend amidst market fluctuations.

Evaluating the broader context, the 200-day moving average residing at $4,119 offers substantial resilience, underscoring Ethereum’s ability to withstand recent price adjustments. Maintaining levels above these averages not only reinforces current momentum but also creates opportunities for surpassing critical resistance points. Traders are particularly focused on the $4,800 barrier, which must be broken decisively to foster more bullish sentiments and set the stage for the much-anticipated $5,000 milestone.

Despite this momentum, the specter of a reversal still looms. A fall below $4,400 could lead Ethereum back toward the $4,200 support area, where buying interest may re-emerge. For now, the sentiment remains cautiously optimistic. With whale acquisition trends, positive technical indicators, and an overall bullish atmosphere, Ethereum seems primed for higher price levels, assuming the current momentum persists.

Image credits: Featured image from Dall-E, chart from TradingView.