The cryptocurrency sector continues to evolve with new players making significant moves. Recently, Metaplanet, a prominent Bitcoin treasury firm based in Japan, has made headlines with its substantial acquisitions.

Metaplanet Strengthens Its Position with New Bitcoin Holdings

According to a statement from Metaplanet’s President, Simon Gerovich, the company has successfully purchased an impressive amount of 5,268 BTC. This strategic purchase, completed at an average price of $116,870 per Bitcoin, totals approximately $615.67 million.

This acquisition follows closely on the heels of another record purchase just days prior, where Metaplanet acquired 5,419 BTC. Such rapid accumulation signals an assertive approach to enhancing their Bitcoin treasury.

In a notable shift, while firms like Strategy (formerly Microstrategy) have reduced their buying activity, Metaplanet’s vigorous acquisitions place it in a prime position within the cryptocurrency market.

As this aggressive purchasing strategy unfolds, Metaplanet has now ascended to the fourth position in corporate Bitcoin rankings, overtaking notable competitors in the sector. The latest standings can be visualized through a comparative analysis sourced from BitcoinTreasuries.net.

Before these purchases, Metaplanet was ranked below both Bitcoin Standard Treasury Company and Bullish. With its total holdings now reaching 30,823 BTC, it showcases a clear upward trajectory.

Having invested approximately $3.33 billion in their Bitcoin strategy, the current market valuation of their holdings stands at around $3.61 billion. This reflects an unrealized gain of approximately 8.4%, highlighting the profitability of their investments.

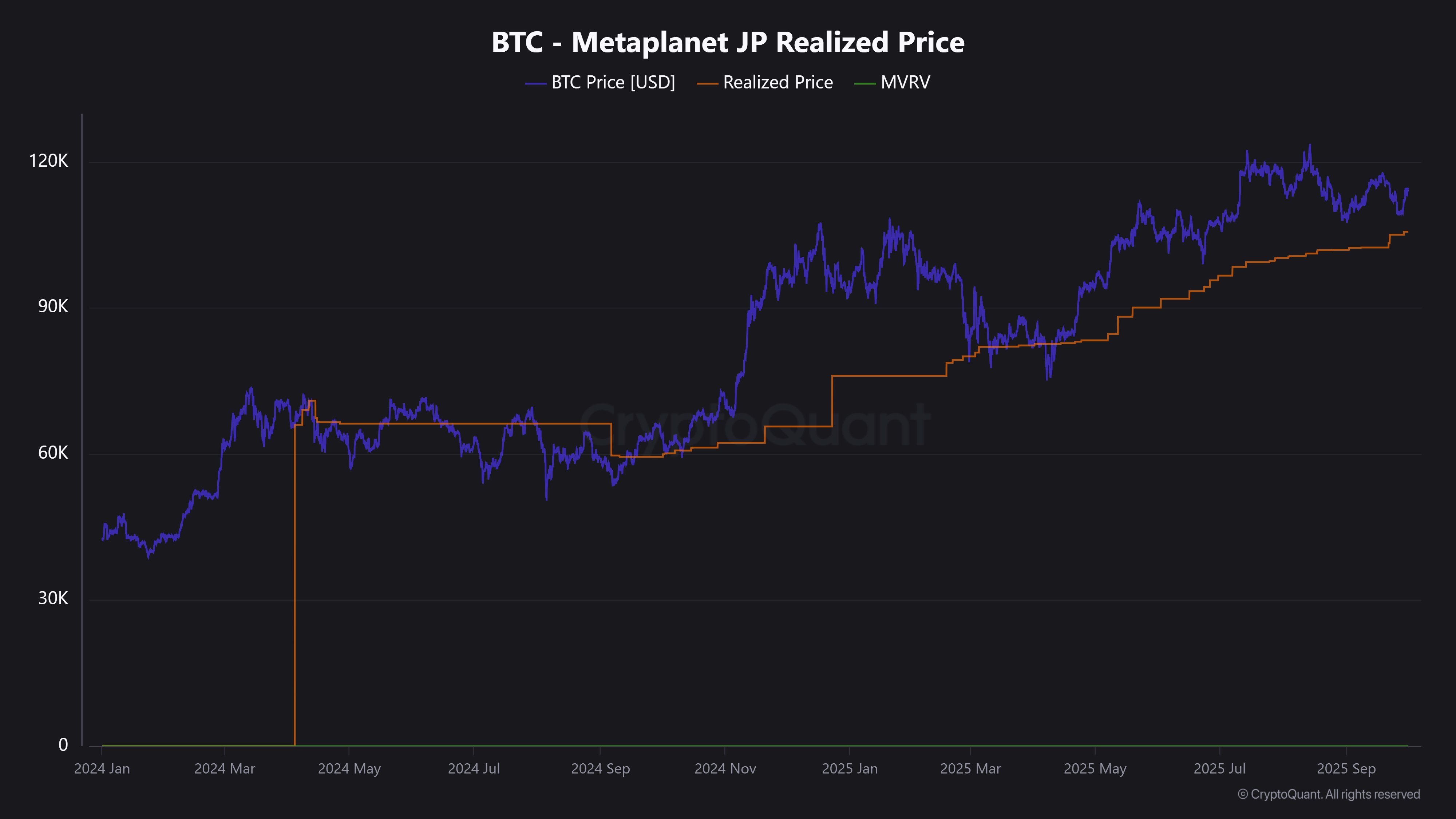

Analysis from the CryptoQuant community shows how effectively Metaplanet has managed its investments since initiating its Bitcoin treasury strategy, adapting to market fluctuations.

Recent trends indicate that while Bitcoin has experienced bearish phases, Metaplanet’s strategic positioning aims to mitigate potential losses by maintaining a solid cost basis.

Another insightful chart reveals critical break-even points for the firm, showcasing where the threshold for profitability lies.

Currently, Metaplanet operates with a cost basis around $107,912. Recent market fluctuations have tested this level, yet prices have rebounded, creating a favorable gap above it.

Moreover, the company has set ambitious targets, surpassing its 2025 goal of holding 30,000 BTC. It plans to achieve a stunning target of 210,000 BTC by 2027, which would represent a full 1% of Bitcoin’s total circulating supply, as part of their strategic “Phase II”.

Current Bitcoin Pricing Trends

In recent market activity, Bitcoin has surged by nearly 4% within the last 24 hours, successfully climbing back to the $117,600 price point.