The ongoing saga of bitcoins linked to the notorious Mt. Gox collapse continues to capture the attention of the cryptocurrency community, as transactions associated with Aleksey Bilyuchenko surface on various exchanges.

Recent Developments in the Mt. Gox Conspiracy

According to blockchain analyst Emmett Gallic, over the past week, approximately 1,300 BTC (valued at around $114 million) have been moved to different, unidentified exchanges by Bilyuchenko-linked entities. Reports indicate that these wallets still manage to hold around 4,100 BTC, equivalent to about $360 million, with sales totaling 2,300 BTC.

Gallic took to social media to share these findings while noting the significance of such transactions on market dynamics. “The movement of these funds hints at an ongoing strategy rather than a haphazard liquidation,” he pointed out, emphasizing the methodical nature of these deposits.

The implications of these transactions are profound, particularly as Bilyuchenko faces serious legal actions in the United States related to the Mt. Gox breach. His financial maneuvers are under close scrutiny from both regulators and the crypto community.

In prior assessments, Gallic had pointed out that earlier transactions suggested a sustained effort to offload these assets rather than a single, large sale. As of November 9, it was reported that transactions originating from Bilyuchenko’s wallets were occurring gradually, further fueling speculation about their long-term strategy.

Such “unknown exchanges” complicate matters for investors attempting to forecast market moves. While large withdrawals can often indicate looming sell-offs, the opacity of the transaction paths makes it difficult to draw firm conclusions, potentially leading to market volatility.

Aleksey Bilyuchenko: The Man Behind the Transactions

In Russia, Bilyuchenko has been embroiled in a separate legal battle concerning the WEX exchange, which resulted in a conviction earlier this year. Reports indicate that he has been sentenced to a total of 3.5 years in prison for embezzling a staggering 3.1 billion rubles from WEX assets. The Moscow City Court recently upheld this sentence, solidifying his legal troubles.

Conversely, in the U.S., Bilyuchenko faces serious allegations of money laundering and conspiracy related to the Mt. Gox hack that occurred in 2011. The indictment includes charges linked to over 647,000 bitcoin, enhancing the severity of his legal battles. If found guilty, he could face decades behind bars for his alleged activities.

Furthermore, he is also under scrutiny in the Northern District of California regarding additional charges related to operating an unlicensed money service business, intertwined with allegations about his involvement with BTC-e during its operational years. The potential penalties for these charges could add up to an additional 25 years in prison.

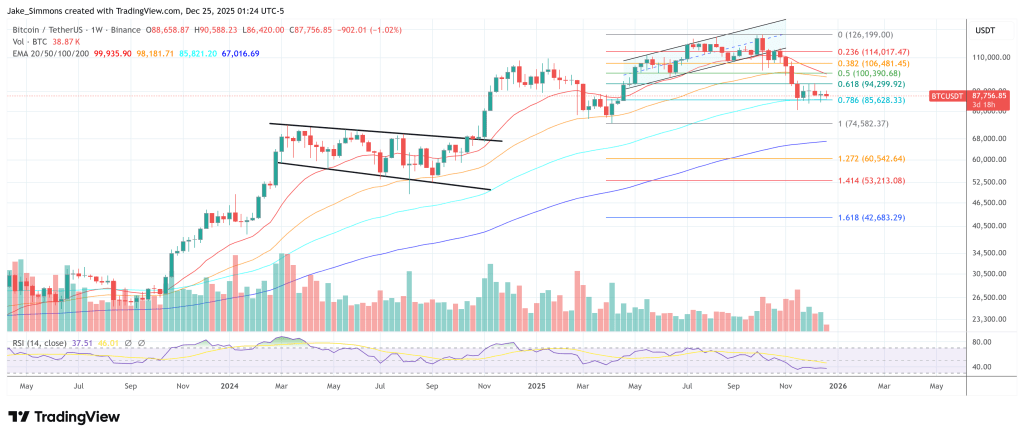

As of now, the importance of these developments on the wider cryptocurrency market cannot be overstated, especially as BTC trades hover around $87,756.