As Bitcoin (BTC) continues its upward trajectory, there is a notable surge in its acceptance and utilization across various sectors. With analysts like Vetle Lunde from K33 Research shedding light on recent developments, it becomes clear that institutions are increasingly recognizing the potential of cryptocurrency investments.

Norwegian Sovereign Wealth Fund Bolsters Bitcoin Holdings

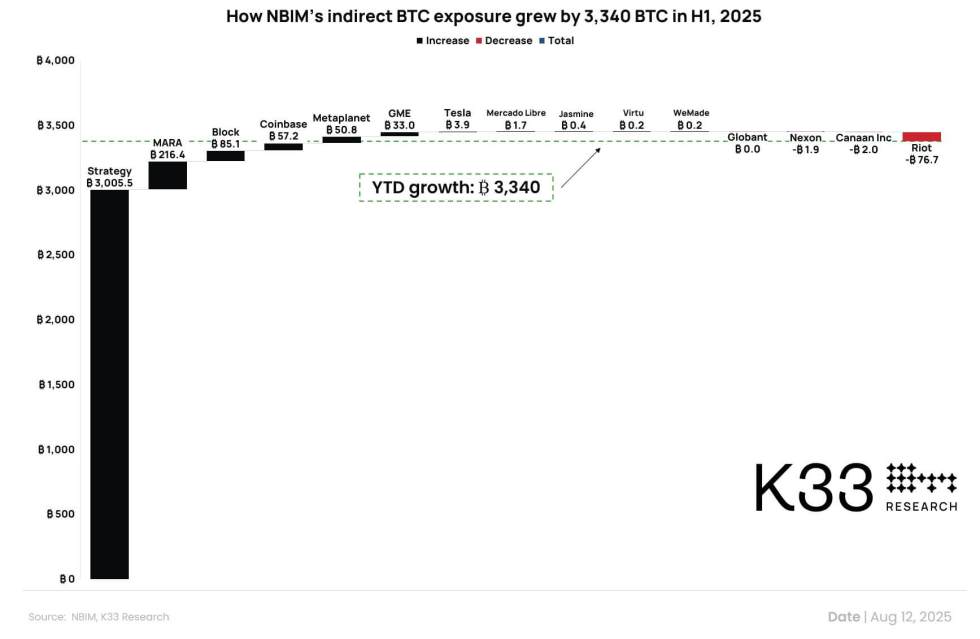

Lunde has reported that Norway’s premier investment entity, Norges Bank Investment Management (NBIM), has dramatically increased its Bitcoin holdings throughout 2025. He insights:

This chart is one of my favorites, as it showcases how the world’s largest sovereign wealth fund is adapting to current market dynamics, which highlights Bitcoin’s integration into diversified investment strategies.

The NBIM has now acquired a total of 7,161 BTC, equating to an impressive $844 million at recent market values.

This marks a striking increase from the end of 2024, when the fund held merely 3,821 BTC, representing a remarkable rise of 3,340 BTC in just the initial half of 2025. This translates to a staggering year-on-year increase of 192%.

According to Lunde, this spike in exposure can largely be attributed to the fund’s significant investments in reputable treasury avenues such as Strategy and Marathon Digital. The ongoing accumulation of Bitcoin by additional corporate treasury players further propels this trend.

Both Strategy and Marathon Digital stand out as key public entities controlling substantial reserves of Bitcoin. Data from CoinGecko highlights that Strategy has amassed 628,946 BTC, while Marathon Digital boasts 50,000 BTC. These firms, collectively owning over 3% of Bitcoin’s overall supply, are valued at over $81 billion at current market rates. For NBIM, Strategy contributed 3,005.5 BTC, whereas Marathon Digital added 216.4 BTC to its indirect stakes.

Additional assets in the Sovereign Wealth Fund’s Bitcoin exposure come from firms like Block (85.1 BTC), Coinbase (57.2 BTC), Metaplanet (50.8 BTC), and GameStop (33 BTC). Noteworthy is Riot Platforms, which reduced its holdings by 76.7 BTC.

2025: A Milestone Year for Bitcoin Adoption

Bitcoin’s incorporation into corporate financial strategies has accelerated even further in 2025. A wave of companies are unveiling initiatives designed to bolster their BTC inventories.

For instance, Marti Technologies from Turkey recently disclosed its intention to allocate 20% of its cash reserves into Bitcoin. Similarly, UK entity Satsuma Technology expressed ambitions to amplify its BTC position.

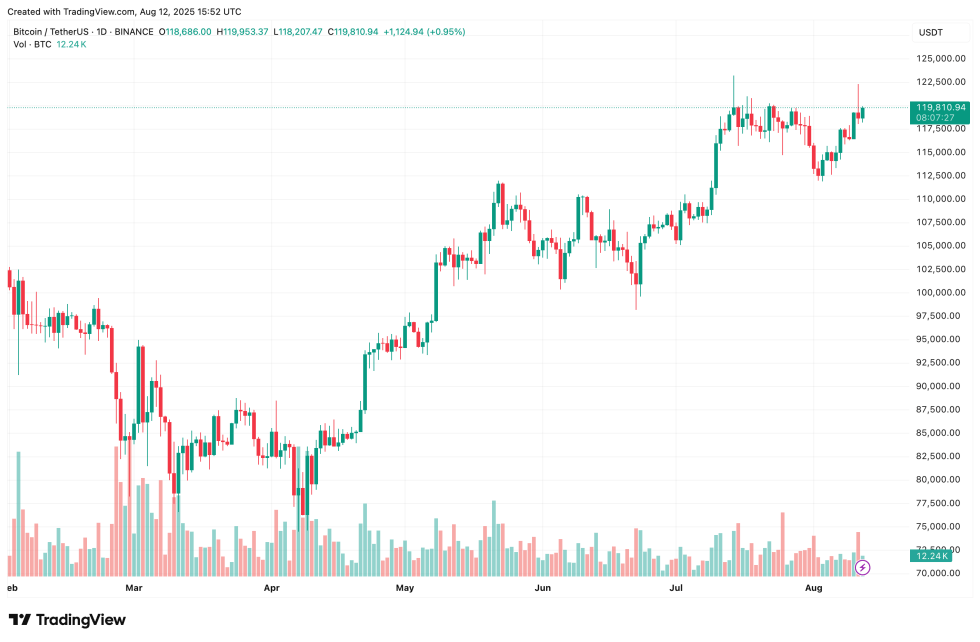

Galaxy Digital has also made headlines by augmenting its Bitcoin assets by 4,272 BTC while scaling back its Ethereum (ETH) investments. As of the latest figures, Bitcoin is trading at $119,810, reflecting a slight decline of 0.5% over the past 24 hours.