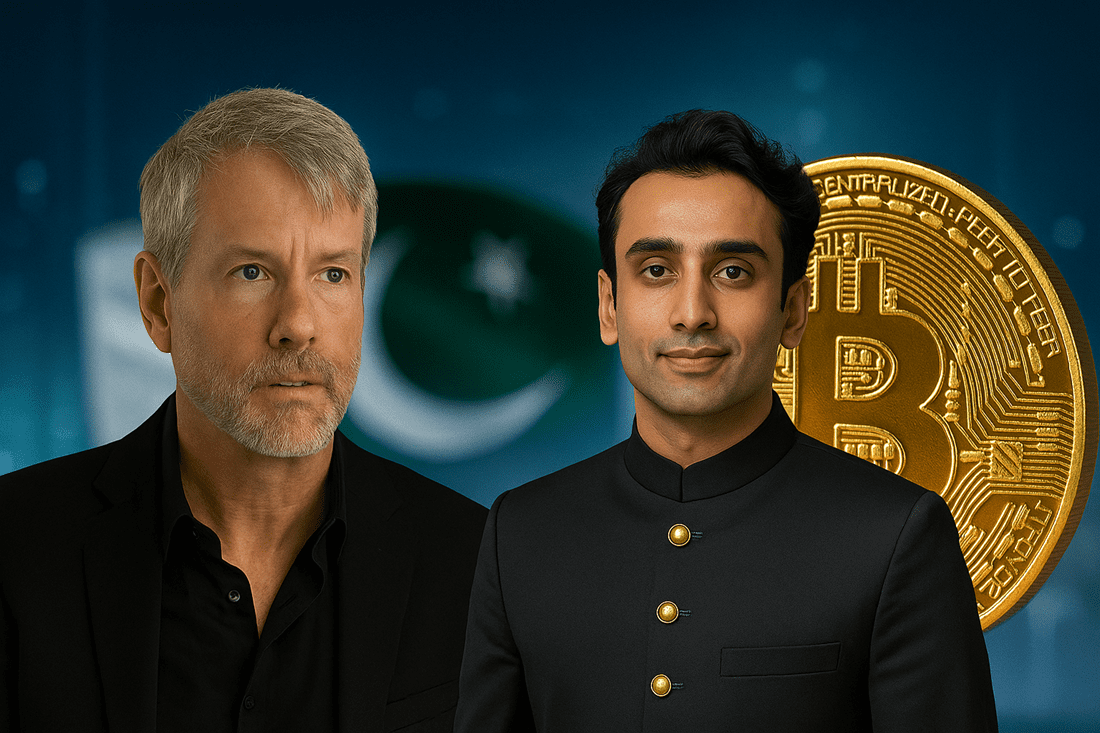

The landscape of digital currencies is transforming, and Pakistan is poised to take a significant leap forward. Recently, a prominent meeting took place where key figures explored the potential of integrating Bitcoin into the country’s financial framework. This initiative highlights Pakistan’s ambition to innovate in the realm of digital assets, evidenced by a conversation involving influential entrepreneur Michael Saylor, Finance Minister Muhammad Aurangzeb, and Minister of State for Blockchain and Crypto Bilal Bin Saqib.

Strategic Collaboration for Bitcoin Integration

Discussions during the meeting emphasized the potential for Bitcoin to enhance monetary stability in a market heavily reliant on traditional fiat systems and international financial support. Saylor, recognized for spearheading a transformative shift in corporate cryptocurrency investment, heralded Bitcoin as a pivotal asset for national financial resilience. He urged Pakistan to consider this a critical opportunity for modernization in a globally competitive financial landscape.

A recorded video of this meeting circulated widely on social media platforms, showcasing Saylor’s vision. He articulated that intellectual leadership and global trust are essential components for attracting investment. “Building credibility is key,” Saylor noted, reinforcing the idea that the investment community is ready to respond positively if trust is established.

Minister Aurangzeb echoed this sentiment, stating that Pakistan aims to be the frontrunner in the Global South in terms of digital asset adoption. This ambition reflects a broader strategy to position Pakistan as a hub for innovation and regulatory excellence in cryptocurrencies. Saqib emphasized that with the right framework, Pakistan could emulate the success seen in other nations with burgeoning digital economies.

Michael Saylor’s company holds a substantial reserve of Bitcoin, further lending credibility to this initiative. The conversation came at a critical time as Pakistan is working to legislate frameworks governing digital assets. The establishment of the Pakistan Crypto Council and its initiatives to collaborate with various regulatory bodies signify a concerted effort to craft a robust legal landscape for cryptocurrencies.

Nevertheless, challenges persist. Recently, government officials reiterated that current regulations still classify cryptocurrency as banned, contributing to a complex compliance environment. This dichotomy between promoting a Bitcoin reserve and maintaining a prohibition creates a confusing policy dynamic, necessitating urgent clarification and alignment among regulators.

Pakistan’s leadership is not merely reactive; they are actively seeking to harness potential benefits from digital currencies. Recent revelations include plans for a state-controlled Bitcoin wallet and leveraging surplus energy for Bitcoin mining and related operations, showcasing a proactive stance on energy use and economic diversification through cryptocurrency.

Although formal agreements regarding Saylor’s advisory role are still pending, the implications of this collaborative effort are significant. Pakistan’s aspirations to lead in digital finance are being publicly championed, signaling that the nation is serious about positioning itself at the forefront of the cryptocurrency revolution.

Ultimately, the capacity for this vision to translate into lasting policy will depend on creating a regulatory framework satisfactory to both local authorities and international institutions such as the IMF. As the cryptocurrency market continues to evolve, Pakistan’s next steps will be critical in determining its role on the global stage.

As of the latest updates, Bitcoin’s market value remains at $106,613.