Gemini, a prominent creditor of Genesis, has revealed that DCG, Genesis’ parent company, will not be able to fulfill the $630 million debt payment to its creditors. Whether the creditors will receive any consideration will depend on whether they believe DCG will engage in good faith negotiations for a consensual deal.

Genesis’ Debt to Top 50 Creditors Exceeds $3.5 Billion

According to a court filing, Genesis owes over $3.5 billion to its top 50 creditors, including Cumberland, Gemini, Mirana, MoonAlpha Finance, and VanEck’s New Finance Income Fund. The settlement process of Genesis has been shrouded in controversy since its inception.

In February, a settlement agreement was reached between Genesis and DCG to provide creditors with 80% of the funds they lost due to the bankruptcy, but the agreement later fell apart due to the creditors’ increased demands. By May 22, Gemini intends to file a new claim, called the “Gemini Master Claim,” to recover over $1.1 billion of digital assets.

The proposed plan is aimed at recovering the digital assets that Genesis did not return to around 232,000 active loan holders of Gemini Earn as of January 19, 2023. This proposal is separate from DCG’s consent or participation, emphasizing its independence and lack of reliance on DCG’s approval or active engagement.

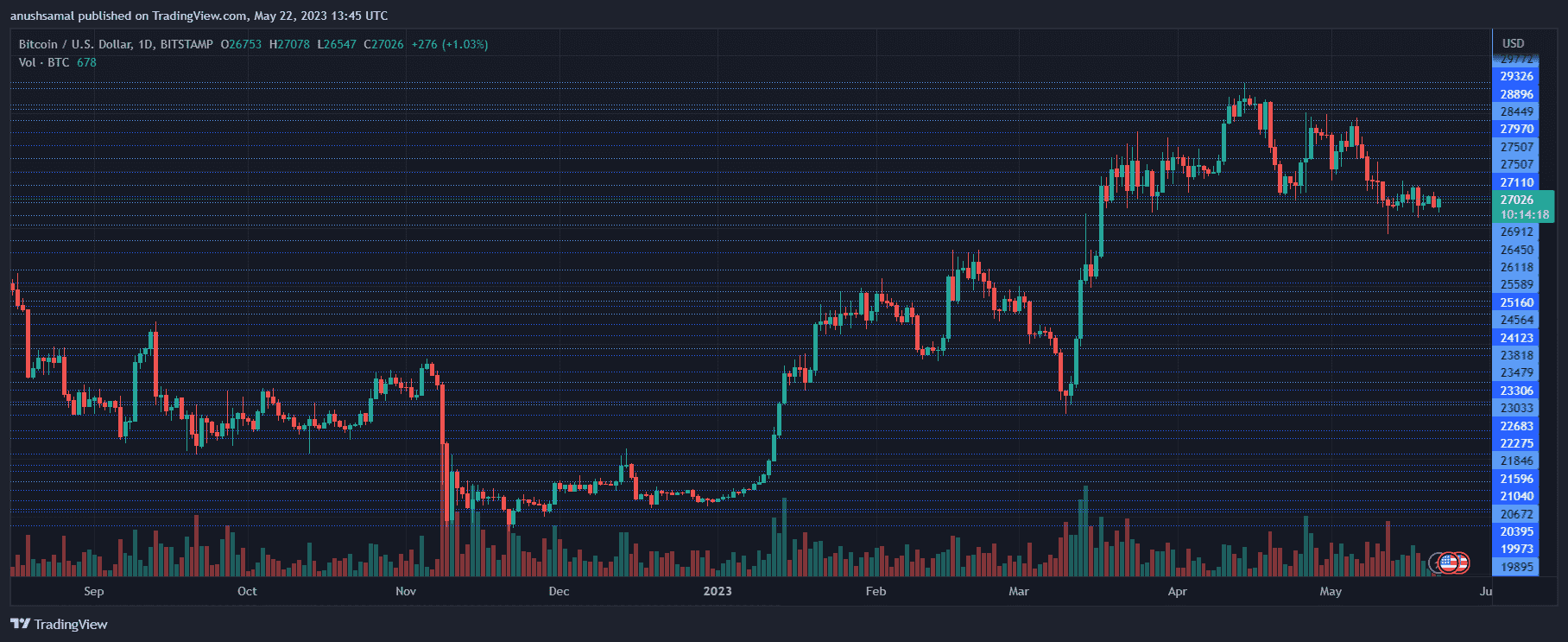

Featured Image From Business Insider, Chart From TradingView.com