In an unprecedented move, the public token sale for Pump.fun recently concluded within just 12 minutes, demonstrating the immense interest among investors. The event managed to raise a staggering $500 million, as participants quickly acquired 12.5% of the total token supply of 1 trillion PUMP tokens, each priced at $0.004.

Record-Breaking Fundraising in Under 15 Minutes

Setting a new standard in the crypto space, Pump.fun’s Initial Coin Offering (ICO) took only a brief 12 minutes to completely sell out, amassing a phenomenal $500 million. This Solana-based platform, dedicated to memecoins, unveiled an astonishing opportunity for investors by offering 125 billion PUMP tokens at a price point of $0.004 each. This instant sale implies a fully diluted valuation (FDV) of around $4 billion.

Investors could join in the excitement by purchasing tokens directly on the official Pump.fun website or through popular exchanges like Bybit, KuCoin, and Kraken. The breakdown of purchases revealed that the website facilitated approximately $448.5 million in transactions, while Kraken and KuCoin accounted for $30 million and $16.5 million, respectively.

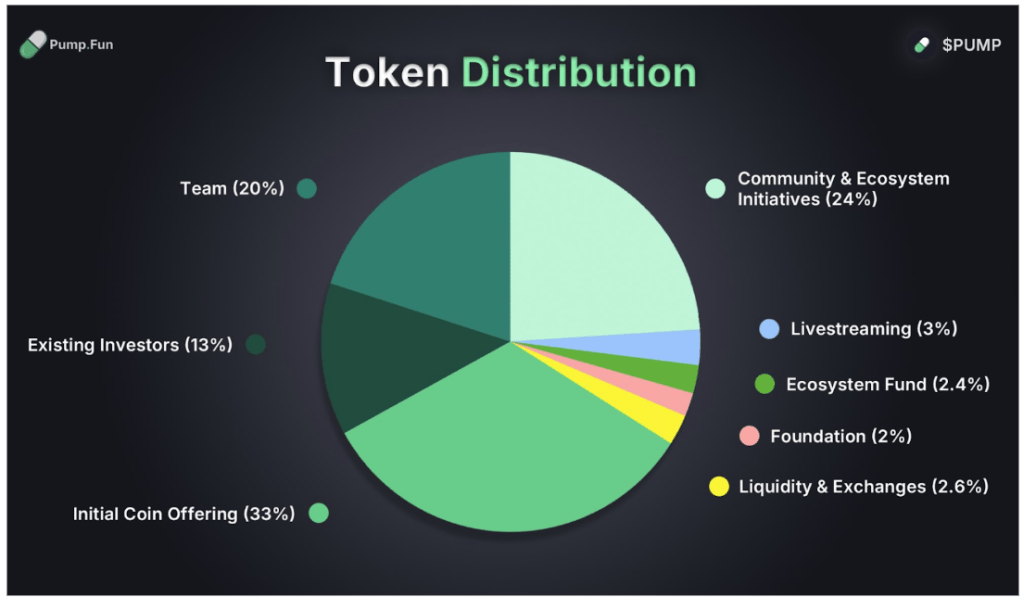

Image From Pump.fun

Following the sale, buyers can anticipate receiving their PUMP tokens within 48 to 72 hours, during which transfers will be disabled. Once distributions are completed, trading is expected to react strongly to bullish market sentiments, reflecting the significant interest generated by the sale.

Reactions to the Rapid Sale

The eagerly awaited trading window for PUMP is projected to open as early as July 14, with preliminary listing prices experiencing a volatile range of up to $0.006989 on Hyperliquid. Although there were minor fluctuations, it has shown signs of resilience, hovering around the $0.006 level.

The social media response to the sellout announcement on platform X was mixed, with some users expressing excitement, while others conveyed dissatisfaction related to exchange issues that hindered their participation. A notable concern emerged about the change in token distribution, given the initial expectation of a 33% supply allocation versus the 12.5% that was ultimately offered.

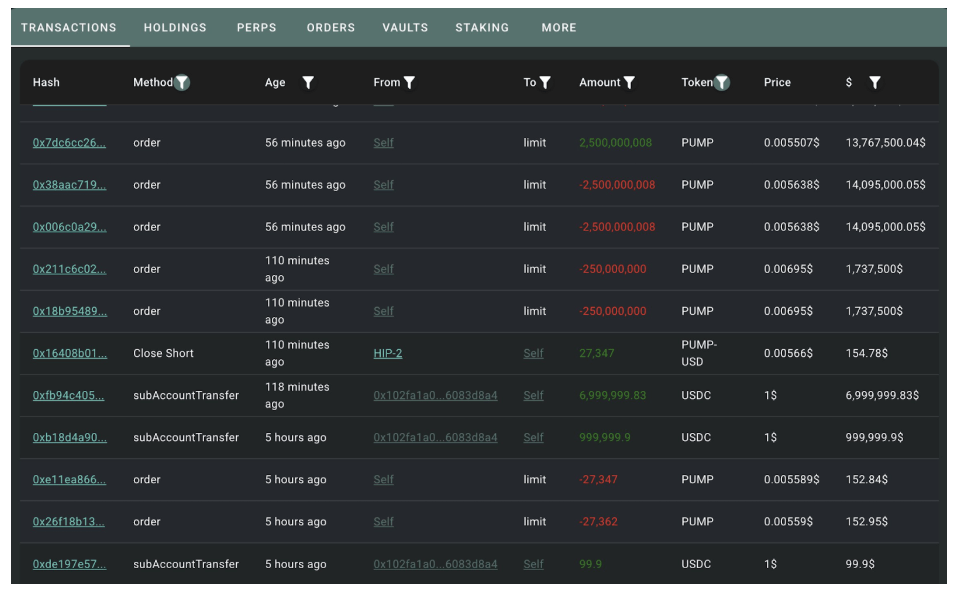

Image From Pump.fun

In a surprising twist, one trader took a noteworthy risk by opening a significant short position amounting to $8 million USD on Hyperliquid, despite facing potential losses nearing $800,000. Such maneuvers indicate both the thrill and the tension surrounding this new venture.

Featured image from Unsplash, chart from TradingView