A recent analysis conducted by Bybit in collaboration with BlockScholes reveals a notable shift in market sentiment, with investors showing a preference for Ethereum (ETH) over Bitcoin (BTC).

The analysis points to a growing level of optimism surrounding ETH compared to BTC, citing significant market indicators and anticipated regulatory changes as contributing factors to this shift.

Positive Signals Despite Market Volatility

The upcoming launch of Ether Spot ETFs in the US is anticipated to offer substantial support to the leading altcoin globally in terms of adoption and potential price growth.

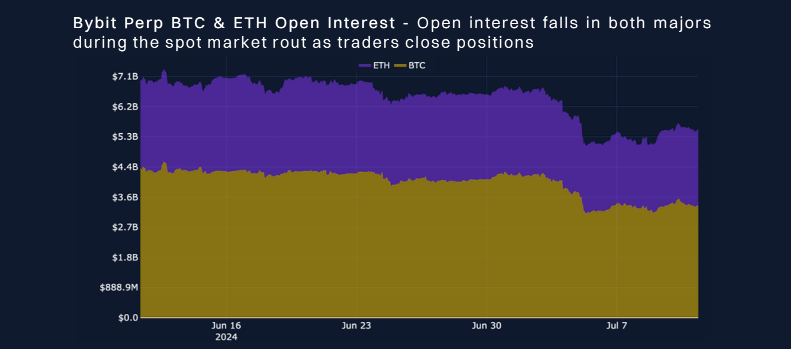

Furthermore, Ethereum futures have shown signs of outperforming BTC in terms of recovering open interest, reflecting a prevailing market narrative that favors Ethereum’s long-term outlook.

The surge in ETH perpetual contract trading volumes indicates investors taking calculated risks in anticipation of anticipated market shifts, such as the launch of an ETF.

Rising Price Momentum and Options Activity

ETH options market continues to exhibit high volatility, particularly as investors await ETF approvals, showcasing a more optimistic stance compared to BTC options.

Stable premium levels in the volatility of ETH options across various term structure points suggest strong market expectations for future price dynamics.

Over the past 24 hours, Ethereum’s price has climbed by 4% to reach $3,472. Several spot ETH ETFs are set to debut on July 23 following preliminary approval from the US SEC, with projections indicating potential financial inflows into Ethereum, potentially propelling its price beyond $4,000.

Ethereum Price Overview

In recent days, Ethereum has exhibited significant price movements, initially dropping to $2,811 during a market downturn but recovering as Bitcoin surged. The latest peak for ETH stands at $3,484 following a “double bottom” formation on the 4-hour chart.

Forecasts suggest possible resistance levels at $3,570 and $3,800, with potential support at $3,350 aligned with the 21-day and 50-day Simple Moving Averages (SMAs) should bearish momentum prevail.

ETF Approval Drives Investor Enthusiasm

Preliminary approval granted to three issuers by the SEC has invigorated Ethereum’s market dynamics ahead of the anticipated launch of Spot ETH ETFs. Analysts anticipate substantial trading volumes and institutional interest post ETF certification, with investor confidence and market positioning benefiting from anticipated liquidity and institutional engagement.

Featured image from Techopedia, chart from TradingView