The landscape of digital asset treasury (DAT) companies is undergoing significant changes as we head through 2025. Particularly within the realms of Bitcoin and Ethereum, publicly-traded firms that hold these assets on their balance sheets are offering retail investors an indirect avenue to engage with cryptocurrencies.

Yet, recent analyses indicate that retail investors may have faced substantial losses—estimated at approximately $17 billion—through investments in Bitcoin treasury stocks. This trend suggests that the initial excitement surrounding BTC treasuries is waning, leaving individuals grappling with their financial implications.

Have We Witnessed the Decline of the Bitcoin Treasury Phenomenon?

A recent market assessment by 10x Research has pointed out that the so-called “era of financial magic” for Bitcoin treasury firms appears to be fading. This Singaporean research entity claims that these treasury firms created a facade of immense “paper wealth” by distributing shares that were significantly overvalued.

The firm elaborates that as Bitcoin prices soared, it became strategically advantageous for treasury companies to issue shares at a premium. However, this once-celebrated premium to net asset value (NAV) has been exposed as an illusion, leading to substantial losses for investors while executives profited.

According to 10x Research, participants who invested in these inflated stocks amidst the Bitcoin treasury surge have collectively lost nearly $17 billion. The diminished volatility and shrinking profits are compelling these treasury companies to transition from a marketing-driven approach to one grounded in actual market fundamentals.

10x Research further added:

The forthcoming phase won’t revolve around illusions—it will hinge on those who can consistently create value when investor enthusiasm wavers.

The performance metrics of Bitcoin-associated stocks have reflected this downturn, demonstrating a marked disappointment recently. For instance, the stock of Strategy (formerly MicroStrategy) has plummeted by over 20% since August.

The firm, led by Michael Saylor, announced its latest Bitcoin acquisition, which occurred between October 6 and October 12. The purchase of 220 BTC at an average price of $123,561 raised Strategy’s total holdings to 640,250 BTC, valued at roughly $47.38 billion.

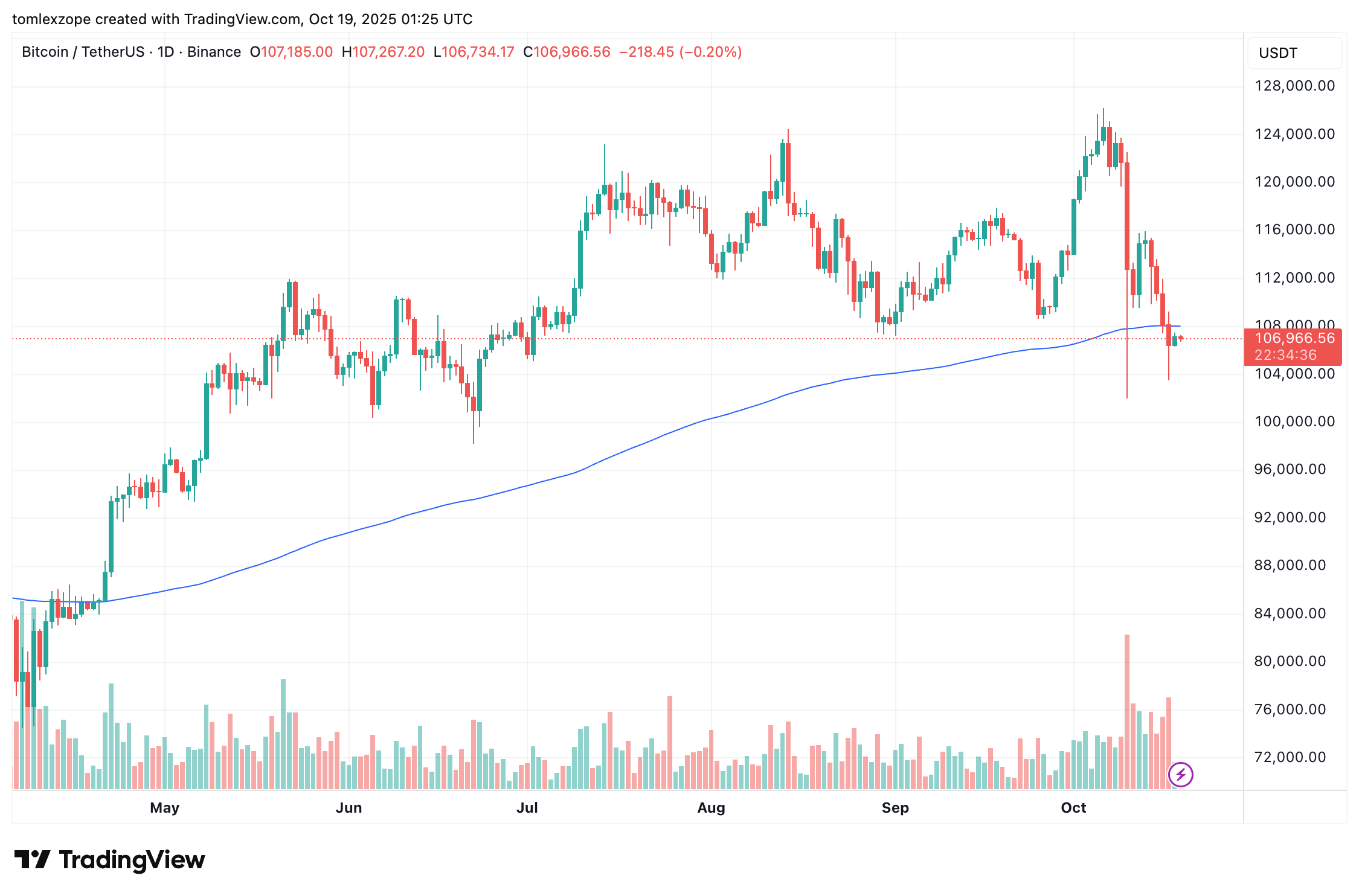

Current Bitcoin Valuation Overview

Presently, Bitcoin is trading around $106,799, exhibiting minimal fluctuation over the past 24 hours. Following the market downturn on October 10, this leading cryptocurrency has struggled to maintain any upward momentum. Reports from CoinGecko reveal a decline exceeding 4% in Bitcoin’s value over the last week.