The Financial Services Agency (FSA) of Japan is set to evaluate the regulations surrounding cryptocurrencies, which may result in reduced taxation for crypto gains and the introduction of a digital assets exchange-traded fund (ETF).

Japan’s Urgent Need for Crypto Regulation Review

According to an anonymous insider who spoke with Bloomberg, the FSA plans to undertake a thorough assessment of the current framework governing digital currencies in the near future.

The main goal of this review is to analyze whether the existing regulations under the Payments Act adequately protect investors. The source highlighted that digital currencies are primarily used for investment and speculation, rather than as everyday transaction mediums.

One proposal under consideration is to redefine digital tokens as financial instruments in accordance with Japan’s investment law. Market analyst Yuya Hasegawa from the crypto exchange bitbank Inc. stated:

Reclassifying digital assets through the Financial Instruments and Exchange Act would enhance investor protections and bring about significant changes.

When discussing these “significant changes,” Hasegawa mentioned that this redefinition could lead to a reduction in tax rates on crypto profits from 55% to 20%, aligning them with those applicable to stocks and other financial assets.

This reclassification could also facilitate the launch of token-based ETFs, promoting further incorporation of digital assets into Japan’s financial landscape.

Japan’s Commitment to Balanced Crypto Regulation Despite Historical Issues

Japan’s careful stance on cryptocurrency regulation is understandable, especially after the 2014 incident involving the Mt. Gox hack, which severely impacted the market. More recently, in May 2024, the DMM Bitcoin exchange suffered a hack that resulted in a loss of $305 million in digital assets.

Nevertheless, the Japanese regulatory body has consistently indicated that it will not impose overly strict regulations on cryptocurrencies, unlike the stringent measures seen in neighboring China.

A recent survey revealed that a majority of institutional investors in Japan are eager to explore opportunities in the digital asset sector within the next three years. However, industry leaders are advocating for less stringent regulations to lower operational costs and foster growth.

There has been a noticeable recovery in crypto trading in Japan after a decline in 2022, with average monthly trading volumes in centralized exchanges reaching nearly $10 billion by August 2024, up from $6.2 billion in 2023.

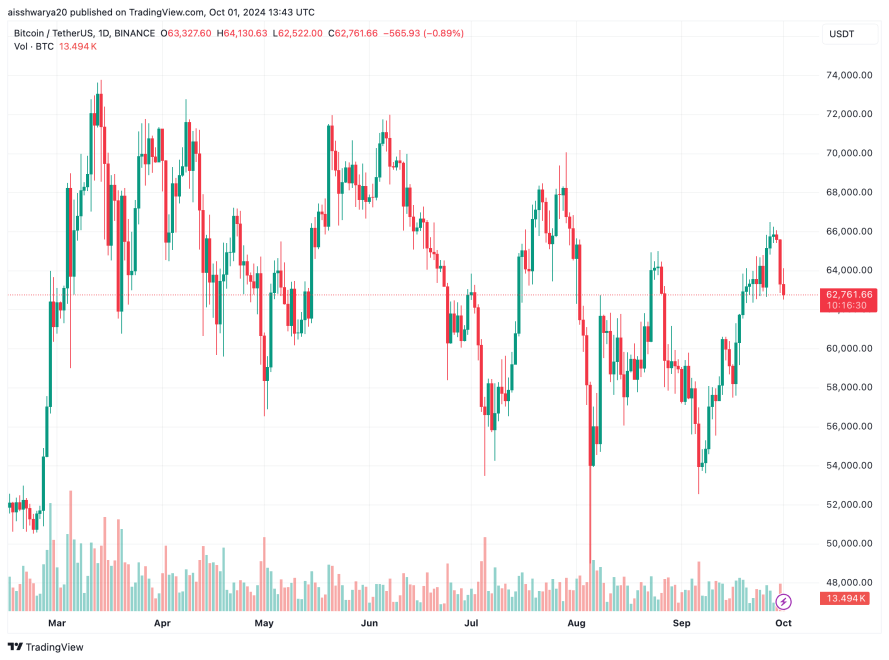

In a significant move, Metaplanet Inc., a publicly traded company in Japan, recently announced that it has included Bitcoin (BTC) in its balance sheet. As of the latest updates, BTC is trading at $62,761, reflecting a 2.1% decrease over the past day.