Recent analyses from Cryptocurrency Insights indicate that a notable shift is occurring in the investment landscape, particularly with firms heavily invested in digital currencies. One key player, previously known as MicroStrategy, is now facing critical challenges that could reshape its future engagement with major market indices.

Despite a relatively optimistic start to the year for cryptocurrencies, the tides have turned dramatically. Bitcoin (BTC) is currently experiencing a downturn, with prices having decreased significantly from their peak levels. This volatility is prompting a closer examination of how companies tied to Bitcoin are classified and how this affects their investment strategies.

Examining the Current Strategy

As a pioneer in Bitcoin acquisition, this company has amassed a portfolio exceeding 650,000 BTC. However, the threat of being excluded from key market indices is looming. These indices play an essential role in enhancing visibility and aiding fund allocation for investors.

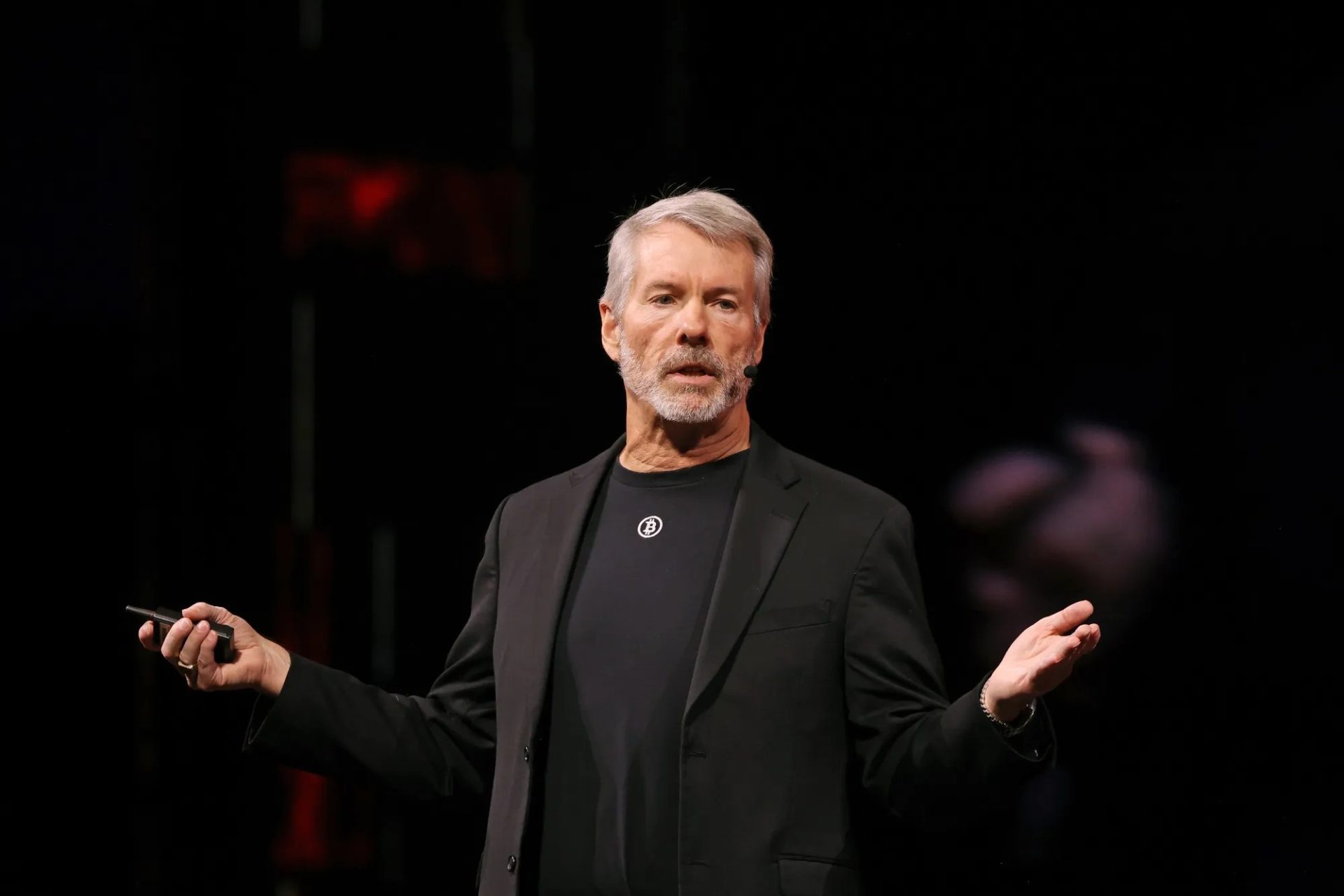

In light of these challenges, the firm’s leader took to social media to clarify its operational model. It is important to note that this organization is fundamentally different from typical investment funds or trusts.

The entrepreneur emphasized that his firm functions as a dynamic entity engaged in the software sector worth approximately $500 million. Its unique treasury approach is designed to utilize Bitcoin not just as a store of value but as an innovative source of capital.

Throughout this year, the firm has rolled out a series of digital credit instruments, achieving significant transaction volumes. Noteworthy offerings include various Bitcoin-backed securities totaling billions in notional value.

These offerings illustrate a proactive approach; instead of merely holding assets, the company aims to create and manage financial products actively. This strategy underlines its vision of integrating Bitcoin into structured finance, potentially laying the groundwork for novel advancements.

The leader maintains that the company’s identity should not be dictated solely by index classifications. He reassured investors that their long-term aims remain steadfast:

…Our belief in the transformative power of Bitcoin is unshakeable, and we remain committed to establishing a groundbreaking financial institution rooted in integrity and innovation.

Impacts of MSCI’s Proposal

Recent discussions among analysts highlight potential fallout from MSCI’s forthcoming decision, scheduled for January 15, 2026. Estimates suggest that if the firm is excluded, it could face outflows between $2.8 billion and $8.8 billion, which would certainly raise eyebrows.

While it is true that active portfolio managers are not bound to adhere to index changes, the sentiment in the market could sour. Being omitted from crucial indices would likely signal a lack of confidence from investors, impacting liquidity conditions and elevating capital costs for the firm.

MSCI’s deliberations indicate a growing consensus that digital asset firms may share characteristics with traditional investment funds, which could lead to further classification issues. To accommodate these views, MSCI is proposing stringent criteria that could exclude entities with significant digital asset holdings from its main global investment indices.

Image source: Bloomberg, data visualizations by TradingView.com