Ethereum continues to display a remarkable upward trend, recently surpassing the significant threshold of $2,650. The stability above the $2,600 mark is contributing to a renewed sense of optimism among investors in the cryptocurrency landscape. As ETH demonstrates consistent strength, there is a notable increase in interest from institutional investors. Recently, SharpLink Gaming (Nasdaq: SBET) has made waves by enhancing its focus on Ethereum. The company’s latest updates filed with the US Securities and Exchange Commission (SEC) indicate a significant increase in the potential amount of common stock it can offer, rising from $1 billion to an impressive $5 billion.

This strategic initiative is part of SharpLink’s ambitious treasury management plan that aims to bolster its Ethereum holdings, positioning itself as a leader among Nasdaq-listed firms to openly embrace an Ethereum-centric financial strategy. This news emerges as ETH is on track to dominate the altcoin market, outshining key competitors with increasing trading volume and formidable technical momentum.

The combination of Ethereum’s robust network fundamentals and price trends aligns with a growing narrative of institutional interest. As corporations like SharpLink integrate ETH into their financial frameworks, this could signal a broader momentum towards corporate cryptocurrency adoption, especially if Ethereum maintains its upward trajectory and solidifies a positive macro trend.

SharpLink’s Strategic Ethereum Accumulation

In a landmark move, SharpLink Gaming has become recognized as the largest corporate holder of Ethereum. In its recent filing with the SEC dated July 17, 2025, the company declared its authorization to increase the total common stock available for sale to $6 billion. This new figure integrates the initial $1 billion authorized in May, along with an additional $5 billion from the latest supplement.

The funds generated from these sales are targeted for Ethereum acquisition as part of SharpLink’s innovative cryptocurrency strategy. Currently, the company holds around 280,706 ETH, translating to an approximate valuation of $1 billion on its balance sheet.

This bold commitment not only sets SharpLink apart as a frontrunner in institutional Ethereum adoption but also increases the long-term scarcity of ETH. Given the current issuance rates, the Ethereum network would require roughly 2.5 years to generate 1,436,000 ETH—the same amount SharpLink could potentially secure should it fully convert the $6 billion into ETH based on prevailing market prices.

This robust strategy exemplifies a growing conviction in Ethereum’s potential for serving as both a long-term store of value and a foundational layer for Web3 applications. It may also herald a significant shift in corporate accumulation strategies, extending beyond just Bitcoin.

ETH Performance Insights: Watch for These Key Indicators

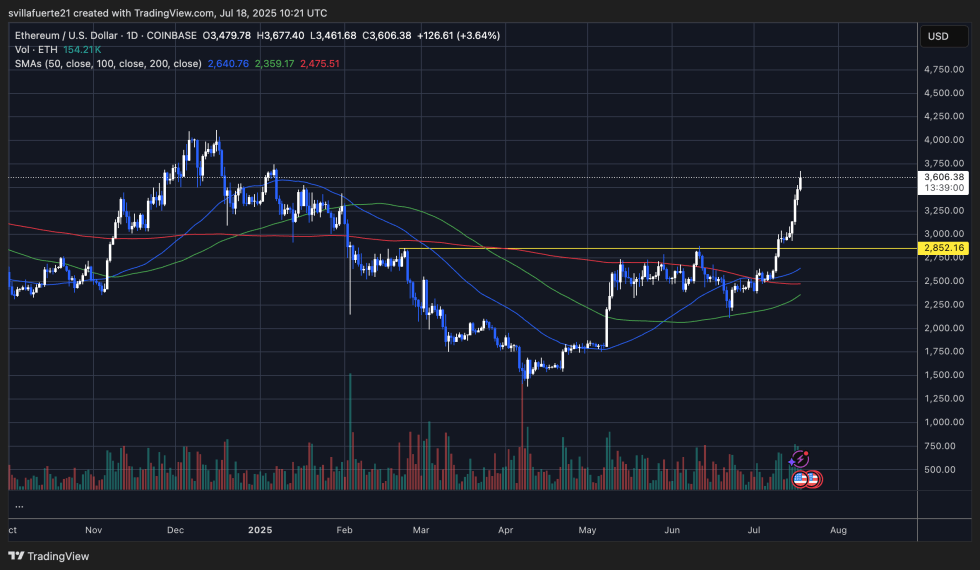

Ethereum (ETH) is demonstrating a strong bullish pattern on its daily chart, recently reaching $3,606.38 with a 3.64% increase for the day. Following a breakout from a longstanding resistance level of approximately $2,850, ETH confirmed its upward movement with substantial volume, indicating strong investor confidence. Current prices are notably above the key moving averages—50, 100, and 200-day averages are positioned at $2,640, $2,359, and $2,475, respectively—suggesting a clear bullish trend across various timelines.

The recent chart analysis reveals a definitive breakout from a prolonged phase of consolidation. Once ETH reclaimed the pivotal $2,850 level and secured it as support, momentum escalated significantly. In the weeks that followed, ETH produced several large-bodied candles with small wicks, indicative of aggressive buyer behavior.

The rise in trading volume supports the strength of this bullish trend. Current price movements seem to be shaped by increasing participation from institutional investors, likely driven by macroeconomic factors such as ETF adoption and enhanced regulatory clarity within the United States.

Image sourced from Dall-E, chart data from TradingView.