Ethereum remains an asset of considerable interest, with ongoing developments indicating a promising outlook. While the current market shows a level of consolidation, several indicators suggest that the next rally could be just around the corner. Investors are keeping a close watch on the intertwining paths of both Ethereum and Bitcoin, as market dynamics evolve.

Recent information released by Lookonchain reveals that SharpLink has made a significant transfer of $379 million USDC to Galaxy Digital. This move could signify a strategic investment in additional ETH, highlighting a trend wherein institutional interest in Ethereum shows no signs of waning despite prevailing market volatility. Such actions may very well prepare the ground for a breakout from the ongoing price consolidation.

SharpLink Gaming is making waves as one of the first publicly listed companies on Nasdaq to adopt Ethereum as part of its treasury strategy. This approach reflects a growing acceptance of ETH as a key component in institutional portfolios, moving beyond the confines of speculative trading.

In light of recent market movements, the coming weeks are set to be pivotal. Observers believe that the current consolidation phase could herald a robust surge for Ethereum as market conditions evolve and institutional investments continue to flow.

SharpLink’s Ethereum Holdings Surge

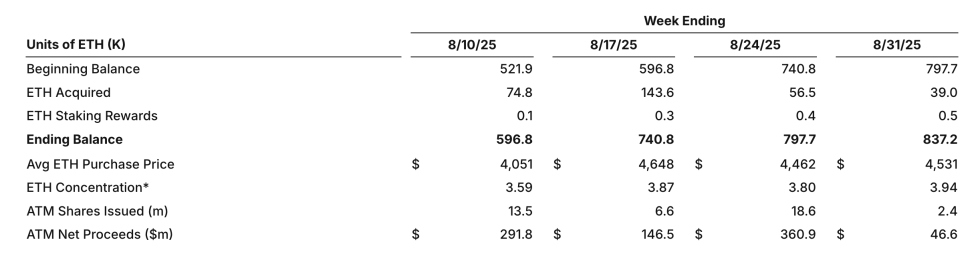

As of August 31, 2025, SharpLink has officially disclosed that its Ethereum holdings have reached an impressive total of 837,200 ETH. This expansion solidifies the organization’s standing as one of the largest corporate holders of Ethereum. The firm remains committed to its ETH-centric treasury strategy, evidenced by its recent purchase activity.

In just one week, SharpLink acquired an impressive 39,008 ETH, funded by $46.6 million in net proceeds from its at-the-market (ATM) facility. The average price per ETH purchased during this period was $4,531, showcasing the company’s confidence in the asset as it nears all-time highs.

This accumulation elevates SharpLink to the status of the second-largest ETH treasury holding company, just behind BitMine, which holds over 2 million ETH valued at around $9.2 billion. Such treasury allocations underscore a significant trend where major institutions increasingly recognize Ethereum not merely as a speculative asset but as a viable long-term investment.

By boosting its ETH holdings, SharpLink is sending a robust message to the market: Ethereum’s position within corporate treasuries is evolving into an essential component of financial strategy, signaling broader acceptance and utilization in the digital economy.

Current ETH Market Analysis

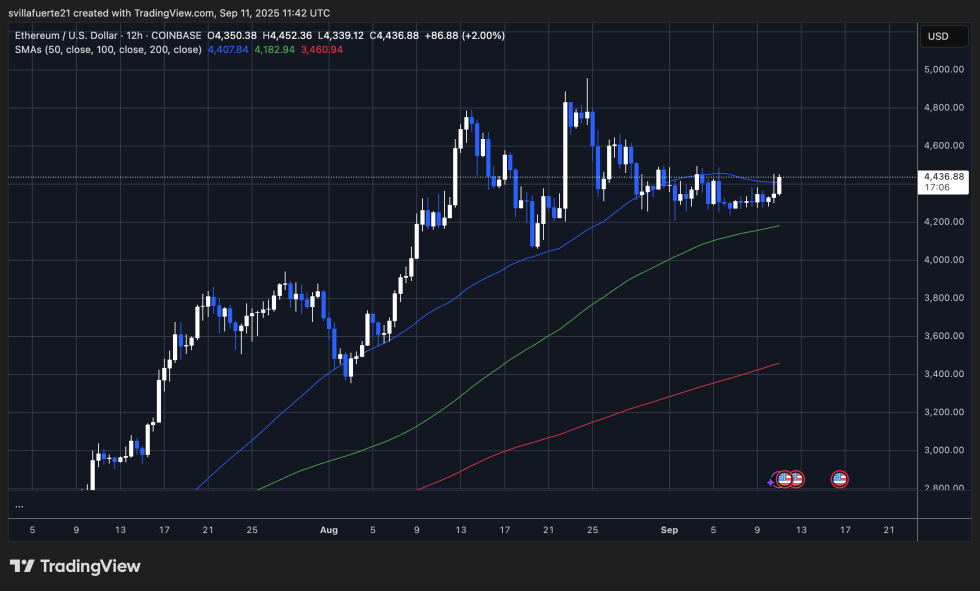

Currently trading at $4,436, Ethereum showcases a 2% daily increase as it begins to navigate out of extended sideways trading. The 12-hour chart reveals a steady performance throughout September, consistently holding support above $4,200. Momentum appears to be on the rise as Ethereum nears its resistance level around $4,450.

The 50-day Simple Moving Average (SMA) at $4,407 currently serves as an immediate support level, while the 100 SMA at $4,182 provides a robust cushion beneath. The broader bullish trend remains intact, underscored by the 200 SMA situated at $3,460, well below current price levels. Maintaining above the $4,200 threshold favors further upward movement for ETH.

For bullish investors, the next significant milestone is reclaiming the $4,600 resistance. Should this barrier be surpassed decisively, Ethereum may venture towards the $4,800 to $5,000 range, potentially igniting a more substantial bullish trend.

Image sourced from Dall-E, chart from TradingView.