The landscape of cryptocurrency ownership is evolving rapidly, and the latest analysis from financial services firm River provides a detailed view of Bitcoin holdings as of July 14, 2025. This exploration reveals how the total supply of 21 million bitcoins is distributed across different holder categories. With a firm statement that “the people had 15 years to front-run Wall Street on Bitcoin,” River signals a shift as large institutions gradually enter the market, emphasizing that acquiring their stake will come at a premium.

The Breakdown of Bitcoin Ownership

In River’s insightful visualization, individual investors dominate the scene, possessing a striking 14.06 million BTC, which equates to an impressive 67% of the total Bitcoin supply. In stark contrast, institutional ownership remains relatively limited: businesses hold approximately 1.15 million BTC (5.5%), while exchange-traded funds and other investment vehicles collectively manage around 1.43 million BTC (6.8%). Furthermore, governmental agencies account for just 314,000 BTC (1.5%), totaling a mere 13.8% among these prominent classes, often referred to collectively as “Wall Street, governments, and corporations.”

River has delved deeper into this data, categorizing additional segments of the Bitcoin ownership landscape. There exists a “Satoshi/Patoshi” group comprising 968,000 BTC (4.6%) resulting from early mining efforts, a number derived from rigorous hashing analysis. Additionally, “Other Entities” encompass 379,000 BTC (1.8%), which includes bitcoins tied up in smart contracts or held within bankrupt estates. River’s assessment also points to approximately 1.57 million BTC (7.5%) as “Lost Bitcoin”—an estimate defined through UTXO age cohorts—as well as 1.11 million BTC (5.3%) labeled as “To Be Mined,” reflecting the yet-to-be-issued part of Bitcoin’s capped supply.

This detailed segmentation of Bitcoin ownership highlights the scarcity of readily available bitcoins for institutional investors, reinforcing River’s assertion that “big business” will need to invest heavily to gain substantial exposure. The recent uptick in mutual funds and corporate treasury strategies dedicated to Bitcoin further underscores the urgency of this allocation.

The surge in institutional interest in Bitcoin is evident in 2025, marked by the introduction of innovative “Bitcoin treasury” solutions and a proliferation of US spot exchange-traded products crafted to facilitate strategic asset management. These developments indicate a growing acceptance and integration of Bitcoin within traditional financial systems.

Despite the relatively small percentage of Bitcoin held by governments – a figure reported at 314,000 BTC – the active engagement of state actors is primarily led by the United States. Notable holdings also emerge from China, the United Kingdom, Ukraine, and Bhutan. Independent sources like Bitbo/Arkham indicate that the US alone possesses around 198,000 BTC, while China reportedly holds approximately 194,000 BTC. The discrepancy in government ownership numbers can be attributed to differing classification criteria, with some datasets capturing a wider net of assets.

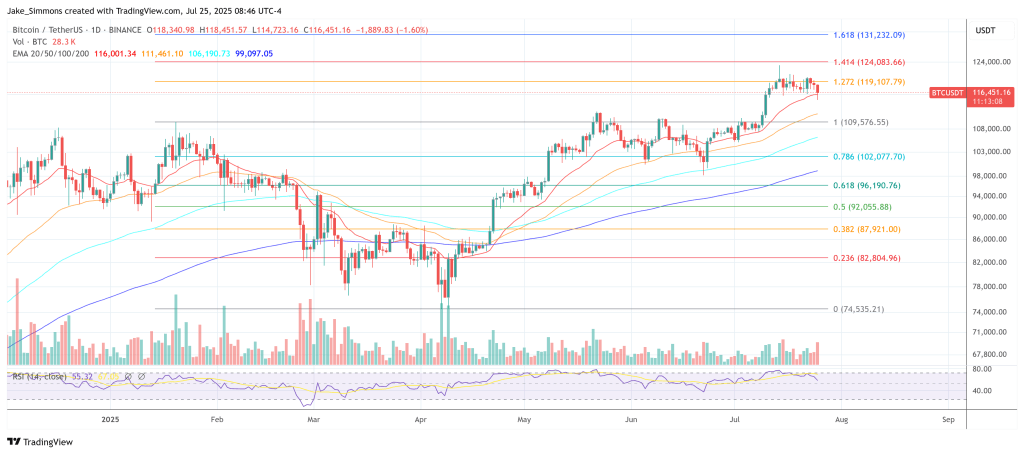

As of the latest data, Bitcoin is trading at an impressive $116,451, highlighting its significant market position as interest continues to grow among both individual and institutional investors.