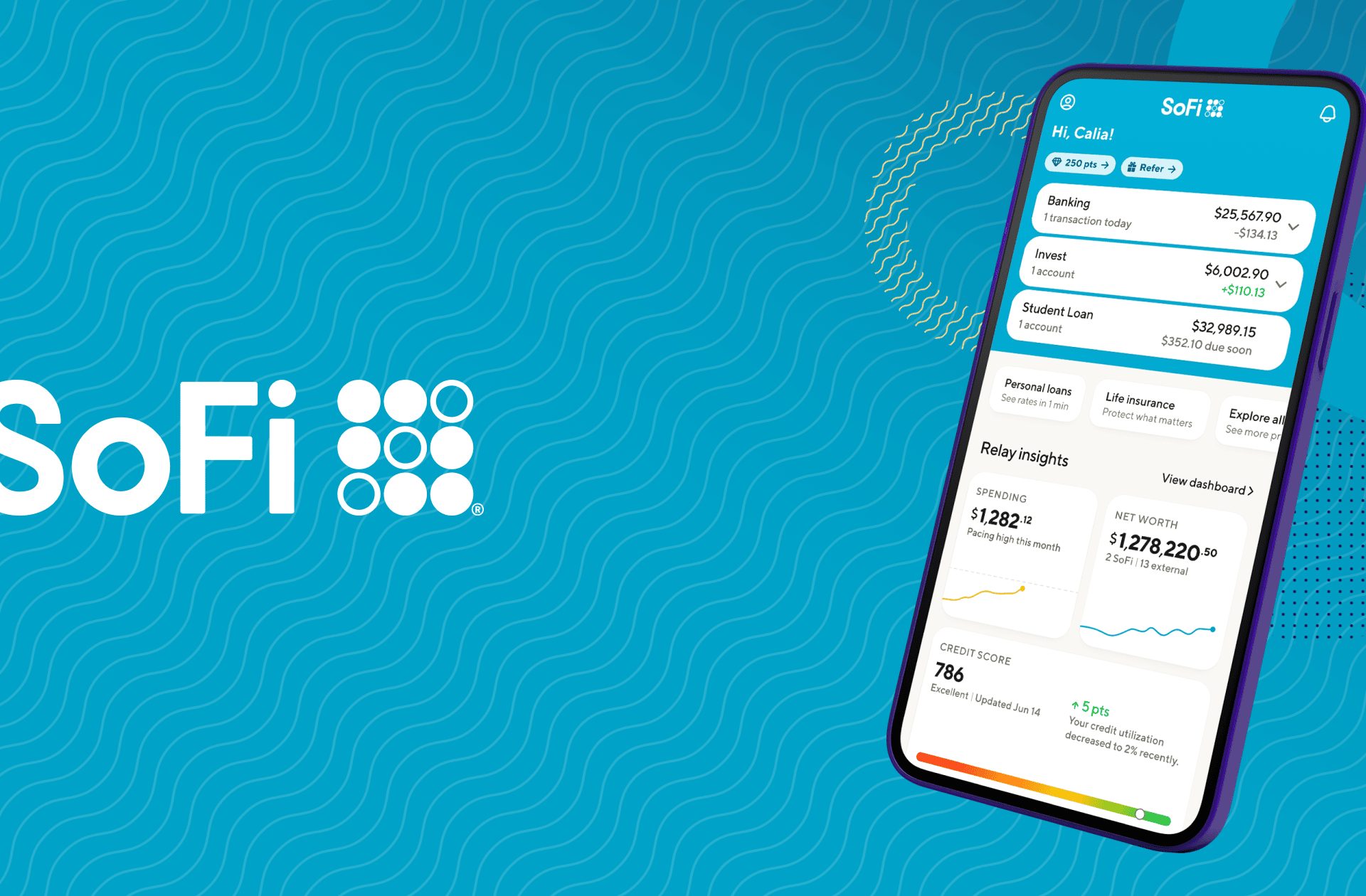

In a groundbreaking development, SoFi has started allowing its US customers to engage in cryptocurrency transactions via its platform. Announced on November 11, 2025, this initiative includes options to buy, sell, and hold various digital assets such as Bitcoin, Ethereum, and Solana.

Integrating Banking and Cryptocurrency

As per the latest investor release, SoFi reports a robust membership base of approximately 12.6 million users. The crypto trading feature will gradually be available to these users in the coming weeks.

Customers will benefit from the convenience of transferring funds from SoFi checking or savings accounts directly into cryptocurrency, eliminating the need for a separate account.

SOFI BANK NOW OFFERS CRYPTO TRADING & XRP CHAINLINK ETF UPDATES!

WATCH

https://t.co/29c7Qf3JwB#crypto #cryptonews #bitcoin #sofi #bank #xrp #chainlink #etf #thinkingcrypto pic.twitter.com/gAPNNyqUx6

— Tony Edward (Thinking Crypto Podcast) (@ThinkingCrypto1) November 12, 2025

“This launch is a significant turning point where banking and cryptocurrency converge in one unified platform,” remarked SoFi CEO Anthony Noto in a statement. He emphasized the importance of providing secure and regulated access for members to navigate the evolving landscape of finance.

Additionally, a waitlist promotion will be in effect until November 30, enticing customers to engage with the platform by meeting specific activity targets for a chance to win one Bitcoin by January 31, 2026.

The Impact of Regulatory Changes

Recent reports indicate that this move aligns with newly clarified regulations issued by federal authorities in 2025. The guidance from the Office of the Comptroller of the Currency earlier this year made it easier for banks with national charters to engage in cryptocurrency and blockchain services, paving the way for initiatives like SoFi’s.

There is also evidence that a substantial percentage—around 60%—of SoFi’s crypto holders prefer keeping their assets with established banks rather than decentralized exchanges. Trust and smoother transaction processes are critical factors influencing this choice.

Future Aspirations Beyond Basic Trading

SoFi has ambitious plans that extend beyond basic trading functionalities. According to Noto, the company envisions launching a USD-backed stablecoin and facilitating crypto-enabled remittances through blockchain technology. The aim is to seamlessly integrate cryptocurrency features into lending products as well.

The positive financial outcomes from the latest quarter have allowed SoFi to increase its profit projections, enabling further exploration into innovative services.

Market analysts are eager to observe how other banks and fintech companies will respond. Some may attempt to replicate SoFi’s integrated app model, while existing crypto exchanges may highlight their competitive features and fee structures to retain customers.

As enticing as these offerings are, the market remains volatile. Notably, assets purchased through SoFi’s platform are not protected by FDIC insurance, a detail SoFi underscores to its users.

Image credit to SoFi; data sourced from TradingView