In the dynamic realm of cryptocurrency, the recent enthusiasm surrounding Exchange Traded Funds (ETFs) is palpable. As the market stabilizes, two notable contenders have emerged: XRP and Solana ETFs. Investors are actively tuning into these developments as the competition heats up, particularly with XRP exhibiting robust daily inflows while Solana experiences a notable downturn.

Solana ETFs Face Unprecedented Withdrawals

Solana’s recently introduced US Spot ETF has entered a challenging phase, struggling to retain investor interest following initial success. Recent statistics from Sosovalue highlight a concerning outflow of $32.19 million, the steepest since its inception in late October 2025.

Recorded on December 3, this withdrawal was unexpected, especially since the overall cryptocurrency market has shown signs of recovery. Interestingly, all the outflow appeared to stem from the 21Shares TSOL ETF, which alone reported a withdrawal of $41.79 million in one instance. Smaller inflows from the remaining Solana ETFs helped cushion the overall impact, leading to a total outflow of $32.19 million.

Since its launch, TSOL has been a significant contributor to the negative flow tally, including $13.55 million on December 1 and an additional $8.10 million in late November. Cumulatively, the 21Shares Solana ETF has witnessed a total outflow of $101.51 million.

This downturn is sharply contrasted by Bitwise’s BSOL ETF, which is thriving with substantial total inflows amounting to $580.72 million, making it the frontrunner among Solana ETFs. Following in its wake is Grayscale’s GSOL with $89.01 million. Altogether, the overall net cumulative inflows for Solana ETFs have reached $623.21 million; however, these figures still pale when compared to those of the XRP ETF.

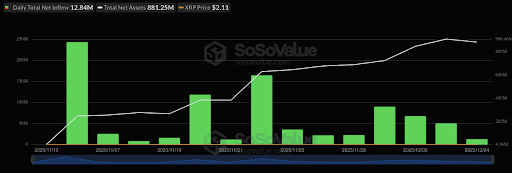

XRP ETF Surges Toward $1 Billion Mark

Recent on-chain analytics demonstrate that XRP ETFs are rapidly advancing past Solana’s offerings in net inflows. Analyst Neil Tolbert pointed out the increasing interest from institutional investors, suggesting that the demand for XRP is poised for further growth. There are expectations of more XRP ETFs entering the market soon, heralding a substantial uptick in demand and inflows as traditional finance begins to engage with digital assets.

Currently, five Spot XRP ETFs boast a combined total of over $984 million in assets, with less than $16 million needed to breach the $1 billion inflow threshold. Leading this charge is Canary Capital’s XRPC with $358.88 million, trailed by Grayscale’s GXRP, Bitwise’s ETF, Franklin Templeton’s XRPZ, and REX-Osprey’s XRPR.

Sosovalue’s data indicates that XRP ETFs, excluding REX-Osprey’s offering, have garnered approximately $887.12 million in net cumulative inflows. Unlike the Solana ETFs, which have struggled with multiple outflows, the XRP ETF has achieved 15 consecutive days of positive inflows since its launch in November.

This scenario is particularly striking given that Solana released seven ETFs starting October 2025, while XRP introduced only four last month. Yet, XRP ETFs have eclipsed Solana’s offerings by nearly 30% in total inflows, establishing XRP as the clear frontrunner among the newest ETF players in 2025.