The stablecoin landscape is experiencing a robust resurgence, marked by significant growth and adoption. As of the third quarter of 2025, the market achieved a remarkable milestone of $41 billion in net inflows, showcasing a vibrant ecosystem.

According to research from Orbital, we are now witnessing the retail sector embracing stablecoins more than ever. This transition is attributed to a monumental shift in the crypto market’s focus, moving from speculative trading to practical everyday applications, especially in developing regions worldwide.

Retail Engagement Stabilizes as the Crypto Ecosystem Matures

The uptick in stablecoin usage saw a staggering 69% rise in user participation from mid-2024 to mid-2025. The latest reports indicate an average of 3.6 million daily active users during Q3, signaling a phase of maturation within the market.

Interestingly, despite a slight dip in transaction frequency from 1.33 billion to 1.21 billion, the overall retail payment volume grew by 4% to reach a remarkable $1.77 trillion. This shift indicates a growing trend of larger transactions, surpassing the previously common smaller amounts below $10,000.

Leading the charge is Tether’s USDT, possessing an impressive 83% share of total transactions. Meanwhile, USDC is emerging as the go-to choice among decentralized finance (DeFi) users, capturing over 50% of the market in that sector. Binance continues to be a dominant exchange, facilitating significant liquidity for these tokens and enhancing retail-based payment solutions in growing markets.

Stablecoins: A Strategic Tool Against Inflation in Emerging Markets

As unstable economies grapple with inflation, stablecoins are proving to be essential and innovative solutions. Financial leaders like Ark Invest’s CEO Cathie Wood have noted this upward trend, adjusting forecasts due to the increasing reliance on stablecoins over cryptocurrencies.

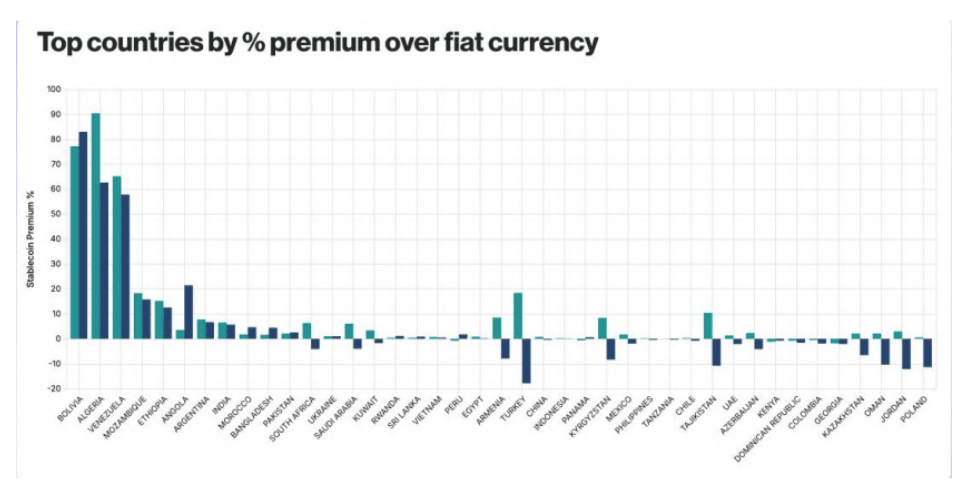

Orbital’s report highlights the alarming premiums consumers must pay in countries like Algeria, Bolivia, and Venezuela, where the costs to access dollar-pegged assets can reach as high as 90%. This underscores the reliance on stablecoins as digital representations of the U.S. dollar in these particular markets. Conversely, nations such as Türkiye and Ethiopia see more moderate premiums ranging from 8% to 18%.

Regions like India, Saudi Arabia, and South Africa benefit from better financial frameworks that allow users to engage with stablecoins at more favorable rates, with some places even trading below market parity, signaling improved liquidity and market dynamics.

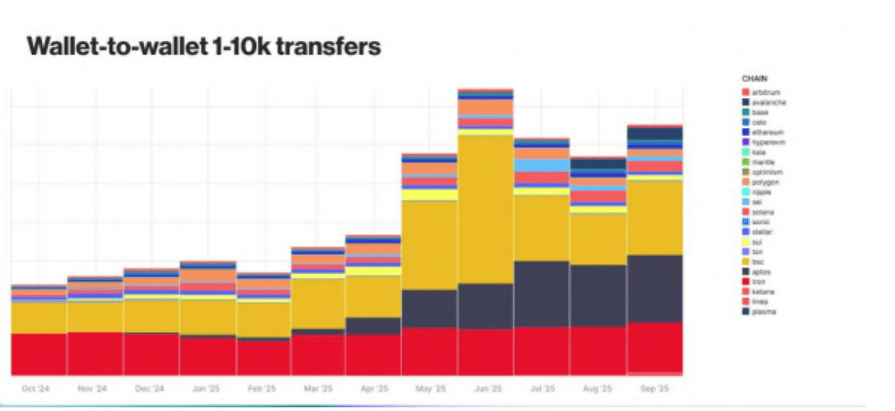

Moreover, an array of new blockchain technologies is emerging, competing fiercely for the stablecoin market. While the Binance Smart Chain dominates retail transactions, its growth rate has stabilized. New contenders like Aptos and Plasma are gaining traction, with Plasma recording $7 billion in deposits shortly after launching its native token, XPL. Tron remains consistent due to substantial USDT transactions, while Ethereum has expanded its stablecoin availability by $35 billion.

Stablecoin Wallet-to-Wallet Transfers

Current estimates by CoinGecko reveal that the stablecoin market cap stands at approximately $311 billion.

Image sourced from Unsplash, chart credited to TradingView