Tether is set to expand its ecosystem by launching USDT on Bitcoin’s RGB protocol, enabling users to hold Bitcoin (BTC) alongside the stablecoin in one unified wallet experience.

Accessing USDT Natively on Bitcoin Through RGB

The announcement from Tether highlights a significant milestone in cryptocurrency integration, as USDT will soon be available on the RGB protocol. This groundbreaking technology facilitates the creation, management, and transfer of smart contracts directly on the Bitcoin blockchain.

Initially launched on Bitcoin’s mainnet in July, the RGB protocol version 0.11.1 brings numerous functionalities, including support for stablecoins, NFTs, and community tokens—all native to the Bitcoin network. This positions Bitcoin in competition with platforms like Ethereum, which already supports these features.

Importantly, RGB operates differently from traditional network layers; it utilizes client-side validation to confirm transactions. According to RGB Hub, “RGB functions without the need for trusted third parties, federations, or validators,” reinforcing its decentralized ethos.

As the leading stablecoin within the cryptocurrency market, USDT’s approach to tap into Bitcoin’s vast user base underscores its growing importance and adaptability. With this innovation, Tether aims not only to expand USDT’s reach but also to cement Bitcoin’s role as a foundational element in the digital currency landscape.

In a press release, Tether elaborated:

This development showcases Tether’s commitment to enhancing the utility of stablecoins and its belief in Bitcoin as the cornerstone of modern financial systems.

While a specific launch date has yet to be confirmed, this integration promises a seamless experience for users to manage BTC and USDT together. Tether’s CEO, Paolo Ardoino, remarked:

Bitcoin merits a stablecoin that is authentic and efficient. With RGB, USDT secures a powerful route on Bitcoin, reaffirming our vision of a liberated financial era.

In related news, Bitcoin ETF markets have recently experienced significant fluctuations, as highlighted by analyst Maartunn from the CryptoQuant community. The current holdings of spot ETFs have decreased markedly, showing a decline from April’s all-time highs.

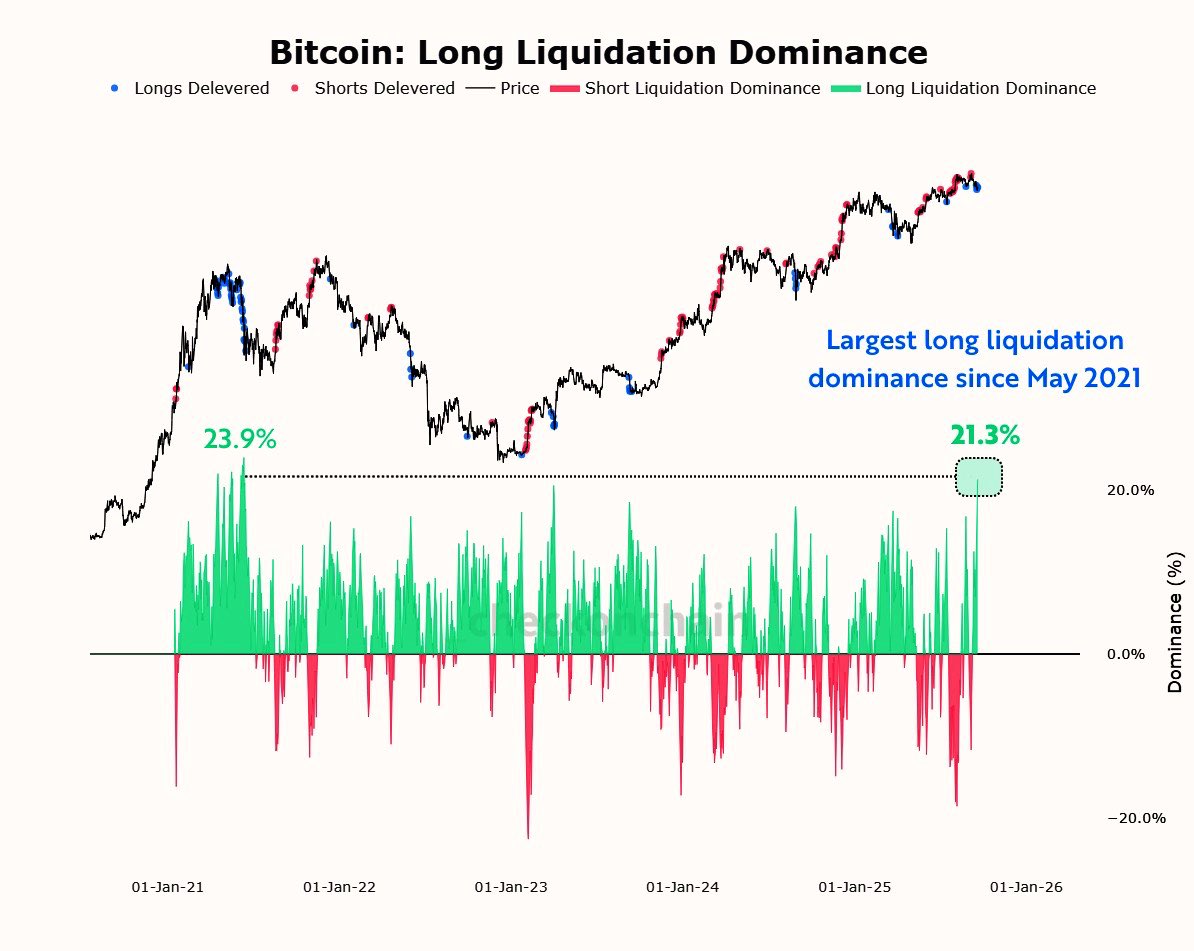

As illustrated, the net holdings of spot ETFs are now around $813.9 million below their peak, coinciding with a downward trend in Bitcoin’s price. This drop has contributed to an increase in long liquidations, a situation noted by quant analyst Frank, who reports a peak in long dominance not seen in four years.

The last significant long liquidation surge transpired in May 2021, during which the Bitcoin market faced severe price corrections that temporarily halted bullish trends.

Current Bitcoin Pricing Trends

This week has shown a slight upward trend in Bitcoin’s price, which has recently climbed to approximately $112,400, indicating a potential recovery from earlier lows.