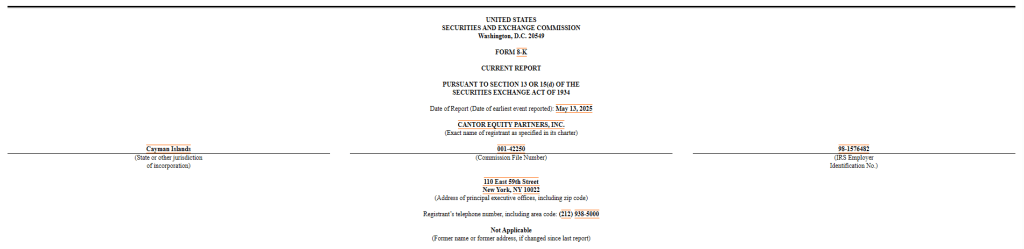

In a surprising move, a prominent stablecoin issuer has invested close to $500 million in Bitcoin. According to a recent report filed with the U.S. Securities and Exchange Commission, Tether acquired 4,812 BTC at an average price of $95,319 each on May 9. This substantial purchase brings approximately $460 million in Bitcoin into an escrow account managed by Twenty-One Capital, a company supported by Tether that is pursuing a SPAC merger with Cantor Equity Partners.

Tether’s Strategic Shift

Tether appears to be moving beyond just creating tokens; it is engaging directly with market volatility. By investing nearly $460 million into Twenty-One’s expanding Bitcoin cache, Tether is positioning itself alongside major corporate holders. This recent acquisition raises Twenty-One’s Bitcoin holdings to a total of 36,312 BTC, with Cantor Equity Partners holding 31,500 BTC on its behalf, the remaining BTC originating directly from Tether’s reserves.

Market Dynamics and Investor Reactions

Once the SPAC deal is finalized, Twenty-One’s shares will be listed under the ticker XXI. According to CEO Jack Mallers, the merger approvals are underway, but no specific timeline has been provided. The market has already experienced significant fluctuations: XXI shares surged from $10.65 to $59.73 on May 2, only to retract to $29.84 before recovering by 5.2% in after-hours trading following this latest Bitcoin acquisition.

Major Partnerships Fueling Growth

Tether is not the only major investor in Twenty-One. SoftBank has committed a substantial $900 million, while Bitfinex will transform approximately 7,000 BTC into equity at $10 per share. Furthermore, Cantor Fitzgerald is spearheading the SPAC initiative and has arranged for an additional $585 million to support further Bitcoin investments. Each of these high-profile backers introduces both strength and potential risks, depending on market movements and strategic pivots.

Positioning in the Bitcoin Landscape

With 36,312 BTC secured, Twenty-One Capital is poised to become the third-largest corporate Bitcoin holder. Strategy (formerly MicroStrategy) dominates with 568,840 BTC, while BMO-backed Marathon Digital has 48,237 BTC. Twenty-One is aggressively positioning itself for investors seeking pure Bitcoin exposure in their portfolios.

A Unique Business Proposition

The overarching philosophy for Twenty-One is straightforward: enhance Bitcoin per share. According to their SEC documentation, profitability is not the primary goal. Instead, every dollar raised will be reinvested into acquiring more BTC, marking a departure from conventional public companies, which typically aim for earnings per share growth. Their focus on increasing Bitcoin holdings is aimed at attracting a specific investor demographic.

Future Considerations for Investors

The SPAC route presents its challenges. Delays in SEC reviews are possible, and investors will be keen on monitoring any adjustments to capital-raising strategies. A surge in Bitcoin could lead to significant gains for Twenty-One; however, a downturn could pose risks due to the absence of operational profit to mitigate losses. This presents a compelling opportunity for those eager for direct Bitcoin investments, while others seeking consistent revenue streams may find alternative options more favorable.

As developments unfold, market analysts will closely observe the SEC’s actions and how Twenty-One manages its growing BTC assets. The outcomes could significantly impact the role of stablecoin issuers in the Bitcoin investment landscape.

Image sourced from Gemini Imagen, with data visualization courtesy of TradingView