In the ever-evolving landscape of cryptocurrency, few traders have made waves quite like James Wynn. Rising to prominence through his bold trading choices, he has leveraged social media to share his strategies and outcomes, attracting a significant following. His audacious moves in the Bitcoin market have influenced both veteran traders and newcomers alike, with spectacular highs and challenging lows.

Strategic Moves in the Bitcoin Market

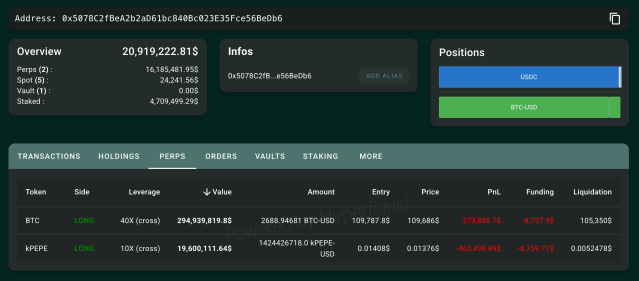

As one of the standout traders on the Hyperliquid platform, James Wynn’s recent trades have been particularly noteworthy. He made headlines when he engaged in a staggering long position worth $1.2 billion, applying 40x leverage. Such aggressive strategies can attract both admiration and scrutiny, especially with a liquidation threshold set at $105,179.

When market fluctuations pushed Bitcoin’s value downward, Wynn confronted a tough decision. Ultimately, he opted to close his long position, resulting in a hefty loss of $13.4 million. Yet, undeterred by this setback, he pivoted to a short position, betting against Bitcoin’s price movement.

However, entering this new position at just above $107 proved problematic as Bitcoin rebounded. James was soon forced to exit this position as well, leading to an additional loss of $15.87 million. In less than a day, Wynn’s total losses surged to nearly $28 million, highlighting the volatile nature of cryptocurrency trading.

The Future Path for James Wynn

After the dust settled from his recent losses, James Wynn took to X (formerly Twitter) to address his followers. He shared insights about his trading experience and mentioned a potential shift in strategy, coupled with a revelation that he still remained $25 million positive overall from an initial investment of around $3-$4 million.

This announcement sparked various theories within the trading community, with many speculating on his next moves. True to his adventurous spirit, just hours later, he re-engaged on Hyperliquid, rolling out new trades.

Initially, he focused on strengthening his position in PEPE, a cryptocurrency that has proven lucrative for him in the past. Following this, he opened another Bitcoin long position at an entry point of $109,733.

As of the latest updates, James has since closed his PEPE position after narrowly avoiding liquidation amidst a market downturn. Meanwhile, his unilateral Bitcoin position has been halved to $439 million, though he has already suffered a $4.4 million loss, leaving him with a fluctuating Bitcoin position currently at a -$4.12 million deficit.