In recent months, a noteworthy change in corporate finance has emerged, pivoting around digital currencies, particularly Bitcoin. Japan’s Metaplanet, a major player in the hotel industry, is leading this charge by substantially expanding its cryptocurrency portfolio.

Recently, the company made headlines with the acquisition of 103 additional Bitcoin, costing approximately $11.8 million. This strategic move has raised its total Bitcoin holdings to an impressive 18,991 $BTC, with an estimated market value exceeding $2.14 billion.

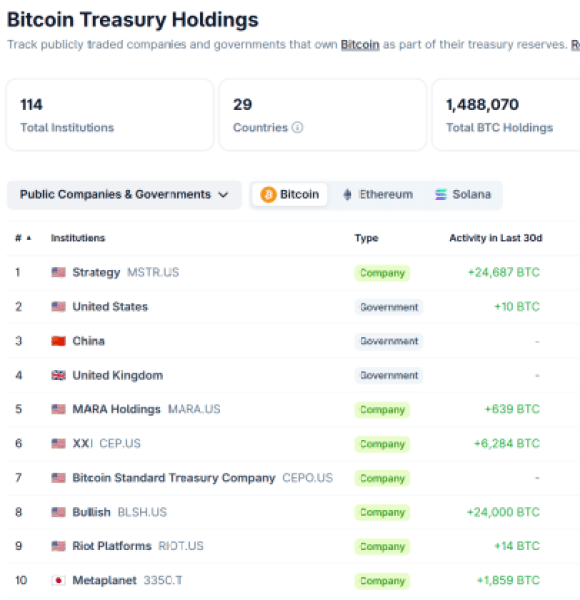

With this massive accumulation, Metaplanet is now among the top seven public companies worldwide holding Bitcoin, marking a significant advancement since the launch of their Bitcoin Treasury Operations last year.

Metaplanet’s approach is both bold and pragmatic: the company is raising capital through stock offerings and bond issuances, channeling proceeds straight into Bitcoin. This initiative underscores a clear commitment to integrating digital assets into their financial framework.

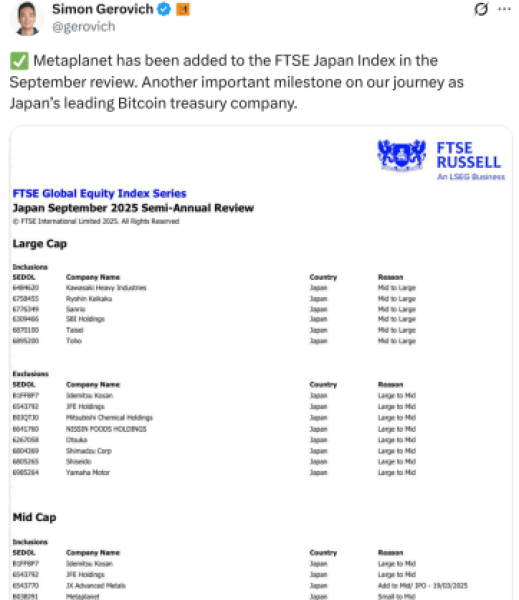

President Simon Gerovich regards this venture as strategically long-term, especially as the upcoming inclusion in the FTSE Japan Index ties Bitcoin closer to mainstream economic frameworks in Japan.

In a recent semi-annual review, confirmed as of September 2025, FTSE Russell upgraded Metaplanet from small-cap to mid-cap status, with inclusion active from September 19.

Despite some fluctuations in stock performance, Metaplanet’s shares have demonstrated remarkable growth throughout the year, reflecting a strong investor belief in its unconventional, forward-looking financial strategy.

The Wider Implications: Metaplanet’s Influence

Metaplanet’s bold Bitcoin investment signals a significant shift in corporate perception of cryptocurrencies as viable financial assets.

By securing the 10th position on CoinGecko, Metaplanet is establishing itself as a prominent player in the global Bitcoin treasury ecosystem—a reflection of their successful strategy in attracting interest from both traditional finance and cryptocurrency markets.

The latest Bitcoin acquisition coincided with the asset trading at a trough of $111,484, showcasing the company’s ‘buy the dip’ mentality in practice.

This proactive stance, amplified by a reported 8% rise in their stock price following the news, indicates that investors are increasingly valuing a sustained, Bitcoin-centric business model. CEO Simon Gerovich has indicated continued exploration of various funding methods to increase their Bitcoin holdings.

With its recent elevation to mid-cap status within a significant index, Metaplanet is solidifying its role as a pioneering figure in the evolving dialogue between traditional finance and digital currencies.

Exploring New Dimensions: The Emergence of Bitcoin Hyper

While firms like Metaplanet continue their Bitcoin accumulation, a fresh wave of innovation is enhancing Bitcoin’s usability.

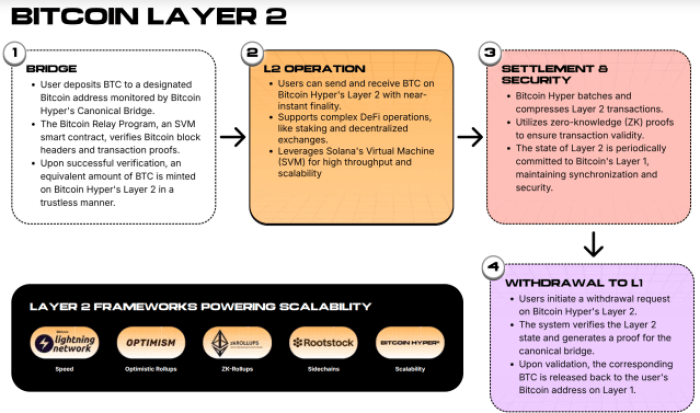

Introducing Bitcoin Hyper ($HYPER), a next-gen Layer-2 solution tackling Bitcoin’s inherent challenges, including slow processing times, high transaction fees, and the absence of smart contract capabilities.

Bitcoin remains a robust asset, but it needs modernization; Bitcoin Hyper aims to act as a catalyst for the Bitcoin network.

By integrating Solana Virtual Machine (SVM) technology, it brings unparalleled speed and minimal costs to Bitcoin transactions. This additional layer allows for the development of dApps, DeFi platforms, and even NFTs on a secure Bitcoin foundation.

Thanks to the Canonical Bridge, seamless transitions between this innovative layer and Bitcoin are made achievable.

If you recognize Bitcoin’s long-term value and seek to make it more functional, Bitcoin Hyper ($HYPER) offers a promising opportunity.

Secure your $HYPER today at $0.012805 and join the movement ushering Bitcoin into its next era of functionality.

Why Bitcoin Hyper Deserves Your Attention

The enthusiasm surrounding Bitcoin Hyper is substantial and well-founded; it’s rooted in genuine utility. In a cryptocurrency market riddled with temporary fads, Bitcoin Hyper distinguishes itself by addressing real-world concerns.

This is not just another speculative asset; it represents a vital infrastructure piece that could elevate Bitcoin from a mere store of value to a programmable asset. The combination of Bitcoin’s established reputation with Solana’s swift transactions could emerge as a compelling market narrative.

$HYPER’s presale has already secured over $12M, signaling strong investor belief that it could unlock Bitcoin’s full potential.

With the mainnet launch approaching and the presale nearing completion, don’t delay your opportunity to participate, especially with the potential for 91% staking rewards.

Investing now, with our projected price of $0.32 for $HYPER by the end of 2025, could lead to exceptional returns—up to 2,399%.

Bitcoin’s Evolution: From Digital Gold to Dynamic Utility

As corporations like Metaplanet increasingly invest in Bitcoin, it’s a clear indication of a transformative shift within the financial landscape.

Bitcoin is evolving beyond merely being viewed as digital gold; it is also the foundation for pioneering innovations such as Bitcoin Hyper ($HYPER).

$HYPER represents a bridge to a future where Bitcoin becomes an active, practical asset. The fusion of corporate acceptance and technological advancement is set to create a wave of sustainable change.

Always perform thorough research and make informed decisions in this rapidly changing market. Please note that this information does not constitute financial advice.