The rise of Ethereum is capturing attention as institutional investors ramp up their interest, driving up the demand significantly.

Just in August, the influx of capital into Ethereum has soared by an impressive 44%, with the total now showing $13.7B. Notably, August 11th marked a record-setting day with $ETH witnessing a single-day inflow exceeding $1B.

This surge appears to be largely attributed to corporations and institutional players accumulating $ETH as bullish sentiment gains traction.

- Currently, approximately 3.7% of the total $ETH supply is in corporate treasuries.

- Leading this trend is Bitmine Immersion Tech, holding an estimated $7.81B in $ETH, closely followed by SharpLink Gaming with $3.48B.

With $ETH having surged over 80% in the last two months and trading around $4,378, the critical question arises: are these institutional players merely chasing a rising price, or do they possess deeper insights?

This begs the inquiry: Is Ethereum positioned to become as significant as Bitcoin? Let’s delve into the reasons behind Ethereum’s rapid growth.

Furthermore, we will highlight three promising cryptocurrencies to consider during this anticipated ‘digital silver’ bull run.

What Are the Pillars of Ethereum’s Growth?

Several influential factors are propelling Ethereum, one of the primary being the introduction of the GENIUS Act.

This legislation aims to establish regulations surrounding the issuance of dollar-pegged stablecoins, offering essential clarity within the cryptocurrency landscape.

Another significant catalyst is the recent 401(k) reform, enabling crypto inclusion in retirement funds.

This shift is a tremendous boost for $ETH, as it invites both institutional and retail investors to view it as a viable diversification tool.

Additionally, Ethereum’s upgrade plans are progressing, with the aim of enhancing accessibility and utility.

The recent Pectra upgrade introduced 11 essential EIPs designed to improve operational speed and user experience, while also increasing the validator staking cap from 32 $ETH to 2,048 $ETH for more efficient management and faster rewards.

What’s more, $ETH has additional upgrades in the pipeline.

- Fusaka (projected for November 2025) aims to enhance block times and overall infrastructure.

- Glamsterdam (2026) is expected to focus on broader performance enhancements.

Such continuous improvements will position Ethereum as a leading player in the DeFi and Web3 sectors.

For those looking to construct a crypto portfolio, there hasn’t been a more opportune moment. With $ETH appearing strong based on both fundamental and technical assessments, a significant increase could herald a broader crypto rally.

Here are three noteworthy altcoins to consider now for capitalizing on this market momentum.

1. Bitcoin Hyper ($HYPER) – Revolutionizing Bitcoin With Layer 2 Capabilities

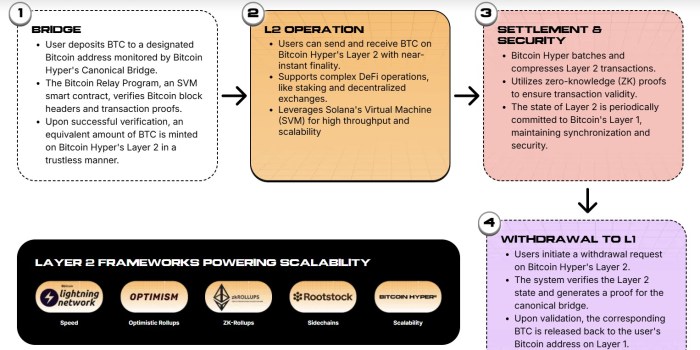

Bitcoin Hyper ($HYPER) is set to transform the Bitcoin ecosystem by integrating Layer 2 features and enhancing compatibility.

Commonly recognized as the ‘digital gold,’ Bitcoin trails behind other competitors like Solana and Ethereum in the realms of Web3 and DeFi—an issue $HYPER seeks to address.

Utilizing the Solana Virtual Machine (SVM), $HYPER introduces improved speed and scalability to the Bitcoin blockchain.

Presently, Bitcoin can only handle around 7 transactions per second, processing them sequentially.

With the integration of SVM, multiple transactions can be executed in parallel, significantly increasing throughput and enhancing speed.

Additionally, the SVM capability allows developers to deploy smart contracts and develop decentralized applications directly on Bitcoin.

The implementation of a decentralized canonical bridge enables users to exchange their Layer 1 Bitcoin tokens for utility-driven Layer 2 BTC on a 1:1 basis.

These L2 tokens can be utilized for a multitude of DeFi functions, such as staking, lending, DAOs, gaming, and more.

This utility has attracted a whopping $12.8M from early-stage investors during the $HYPER presale.

Current prices sit at $0.012825, with forecasts predicting an increase to $0.32 by late 2025—indicative of a staggering potential gain of 2,400%.

If you’d like to explore investing in $HYPER, here’s a detailed guide to purchasing $HYPER.

Learn more about Bitcoin Hyper on its official website.

2. Best Wallet Token ($BEST) – Empowering a Top-Tier Non-Custodial Wallet

Best Wallet Token ($BEST) is the native cryptocurrency for Best Wallet, a multi-chain, non-custodial wallet that champions security.

- The wallet employs Fireblocks’ MPC security protocols to bolster its defenses.

- As a non-custodial solution, users maintain control over their private keys, thus mitigating the risks associated with third parties.

- Additional layers of security are available, allowing for multi-factor authentication, including biometric access.

A remarkable feature of Best Wallet is its Presale Aggregator, enabling users to discover lucrative crypto presale opportunities before they gain mainstream traction.

When it comes to selecting the right crypto wallet, user experience is paramount. Users can handle everything, from token purchasing to transactions, directly within the wallet interface, streamlining the entire process.

The innovative approach of this wallet ensures that all tokens undergo a thorough verification process, reducing risks associated with fraudulent offerings.

As the crypto landscape evolves, Best Wallet has set an ambitious goal of acquiring 40% of the non-custodial wallet market share by 2027. By investing in $BEST tokens, you can contribute to this vision.

Holding $BEST not only grants you exclusive access to presale tokens and staking rewards (currently at an impressive 87%), but it also lowers your transaction fees and gives you a voice in platform governance.

Currently, 1 $BEST token is priced at approximately $0.025555, with its presale already attracting over $15.2 million in investments.

Visit the official website for further details about $BEST.

3. Solana ($SOL) – Rapid Adoption and Institutional Interest

Solana ($SOL) has emerged as a prominent player, drawing significant interest from institutional investors alongside Ethereum. This surge in attention indicates a promising trajectory for the asset.

This month, major firms like Bit Mining and DeFi Development Corp made substantial acquisitions of $SOL tokens, highlighting the token’s growing appeal.

Furthermore, Pantera Capital’s initiative to raise $1.25 billion for a Solana-focused treasury company reflects the increasing confidence in the project’s future.

$SOL has experienced remarkable growth, rallying over 114% since early April and breaking past the $200 mark.

Market sentiment is particularly optimistic regarding the potential for Solana ETFs, with Polymarket indicating a greater than 99% chance of approval. According to Bloomberg analyst James Seyffart, a live SOL ETF could be realized before year-end with a 95% likelihood.

From a technical standpoint, $SOL currently appears to be consolidating around the $200 mark. A minor price dip to $180 could pave the way for further gains, potentially skyrocketing the token above $250 shortly.

If you’re eyeing a reputable large-cap cryptocurrency with substantial growth potential, now is an opportune moment to consider $SOL.

Conclusion

With a rising tide of institutional investment and ETF proposals, Ethereum is inching closer to the $5,000 threshold. For those eager to construct a robust crypto portfolio, now represents a favorable opportunity.

Start your investment journey with Bitcoin Hyper ($HYPER), which integrates new levels of scalability and speed into the Bitcoin ecosystem.

Next, you might want to accumulate Best Wallet Token ($BEST), powering the Best Wallet, known for secure crypto storage and transactions.

Lastly, incorporating Solana ($SOL) can enhance the diversity of your portfolio while benefiting from $SOL’s mainstream acceptance, institutional interest, and impending ETF developments.

Bear in mind that crypto investments carry inherent risks, affected by both micro and macroeconomic trends. This article does not serve as financial advice. Always conduct thorough research before proceeding with investments.