Key Highlights:

- 1️⃣ The tokenization market has surpassed $8.3 billion, reflecting exponential growth.

- 2️⃣ Major financial institutions are engaging with blockchain technologies to enhance asset management.

- 3️⃣ Promising cryptocurrencies include $HYPER, $BEST, and $LINK as adoption increases.

- 4️⃣ The convergence of DeFi and TradFi is reshaping the entire financial landscape.

The evolution of cryptocurrency has been remarkable over the past two decades. As the landscape matures, new dynamics are emerging in the realm of finance.

Initially, DeFi (decentralized finance) and TradFi (traditional finance) were perceived as opposing forces.

DeFi was seen as a revolutionary system offering radical advantages like enhanced transparency and accountability, unlike its traditional counterpart.

However, a shift has occurred, where traditional institutions have found value in the innovations that DeFi provides.

Today, established banks and financial services are embracing digital assets, with tokenization emerging as a key driver—particularly in the case of tokenized US treasuries.

Recent reports suggest that approximately $8.3 billion worth of Treasuries have been successfully tokenized on-chain, with estimates reaching up to $30 billion.

For years, institutions like Goldman Sachs and BNY Mellon avoided cryptocurrency custody due to concerns over regulations and accounting challenges. However, they are now actively tokenizing various assets, especially those that fit seamlessly into the blockchain paradigm.

This operational shift is not merely speculative; it enables companies to manage cash flow more effectively, collateralize assets, and execute trades outside traditional time constraints.

The appeal is unmistakable, especially for large corporations navigating substantial cash and securities movement.

However, tokenization necessitates a secure custody solution—this includes safeguarding both the underlying assets and their corresponding tokens. Herein lies the escalating competition for custody services.

Crypto-native organizations like Coinbase and Fidelity Investments currently lead the custodial space, with assets under management amounting to impressive figures. They charge competitive fees, typically ranging from 0.05% to 0.15% of the asset’s value.

As the sector grows, custodial revenues from tokenized assets could escalate significantly; projections suggest they might soar to $300-$600 million annually as the tokenization of assets continues to expand.

While Coinbase offers specialized crypto knowledge, traditional banks come equipped with established customer relationships and the necessary regulatory frameworks, positioning them well to capture value in this evolving ecosystem.

Tokenization exhibits phenomenal growth potential. In 2024 alone:

- The market capitalization of tokenized assets experienced a 32% increase.

- Tokenized treasuries alone surged by an astounding 179%.

- Private credit saw a robust growth of 40%.

- Commodities reflected a solid 5% rise.

All of these segments are anticipated to grow at an even faster rate into 2025.

As tokenization becomes mainstream and banks increasingly adopt digital currencies, what are the best cryptocurrencies to consider today? Analysts suggest looking into $HYPER, $BEST, and $LINK as potential contenders for significant appreciation as tokenization flourishes.

1. Bitcoin Hyper ($HYPER) – Innovative Connection to Bitcoin’s Future

$HYPER represents an advanced Layer-2 scaling solution that combines the robustness of Bitcoin with the efficiency of advanced blockchain architectures.

This innovative structure makes it possible to utilize Bitcoin in a high-speed, transaction-friendly environment while offering seamless DeFi integration and sophisticated smart contract capabilities.

What is $HYPER exactly? It addresses key limitations of traditional Bitcoin operations, such as slow transaction times and scalability challenges.

Implementing ZK-based validation along with cross-chain consensus, it unlocks the ability to handle thousands of transactions per second while maintaining a verified connection to Bitcoin’s mainnet.

Holders of $HYPER can benefit from yield generation through staking, governance participation, and leveraging Bitcoin in diverse DeFi ecosystems.

With over $24 million already secured in its presale, Bitcoin Hyper stands out as one of the anticipated projects for 2025, with projections suggesting a price increase to $0.20 by the end of 2026, offering investors a potential gain of 1,425% from its current valuation.

Explore how to acquire Bitcoin Hyper and visit their presale page for comprehensive details.

2. Best Wallet Token ($BEST) – A Cutting-Edge Non-Custodial Tool

$BEST serves as a non-custodial, multi-chain Web3 wallet designed to accommodate the rising tide of cryptocurrency adoption and tokenization.

This platform encompasses DeFi functionalities, token exchanges, NFT management, and exclusive presale access all within an intuitive mobile interface. It perfectly balances user convenience with sophisticated on-chain operations.

The $BEST token incentivizes wallet users with benefits such as staking rewards, governance involvement, and access to innovative launchpads for budding token sales.

The development strategy highlights the increased focus on security, scalability, and user experience, paving the way for seamless engagement with the evolving crypto landscape.

Interoperability among various blockchain networks, including Ethereum, BNB Smart Chain, and Solana, is increasingly becoming a vital factor for the success of decentralized applications (dApps) and user engagement.

As the ecosystem evolves, plans are underway to incorporate additional chains to enhance functionality. Furthermore, users can utilize Best Wallet’s advanced multi-wallet features, enabling them to establish up to five unique wallets within the application for improved asset organization.

With the rising focus on self-custody and digital asset security, the token $BEST is anticipated to serve as a crucial component of the wallet ecosystem. Currently, the presale has raised $16.6 million, with tokens priced at $0.025835.

Experts forecast that the value of $BEST will surge to $0.072 by year’s end, potentially yielding a return of 178% for early investors.

Check the Best Wallet Token presale page for all the latest updates.

3. Chainlink ($LINK) – The Oracle Solution Transforming Finance

Chainlink ($LINK) has shifted from being a prominent blockchain oracle towards a fundamental link between traditional finance (TradFi) and decentralized financial systems (DeFi):

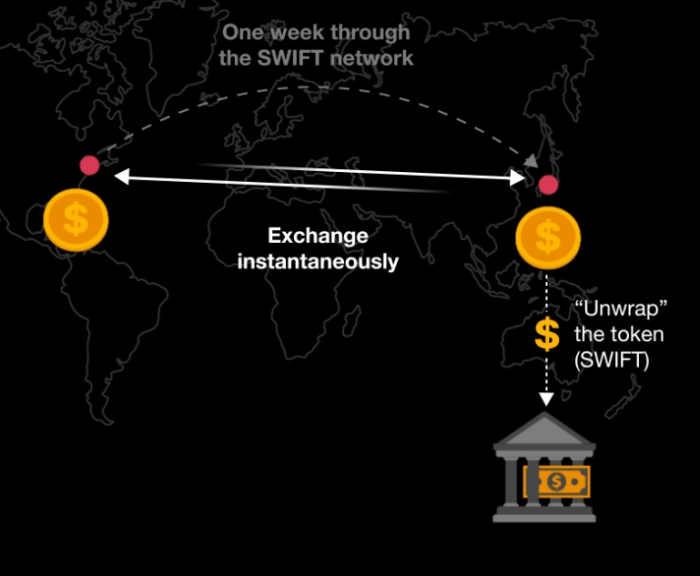

- Chainlink partnered with SWIFT to ensure that banks can utilize the ISO 20022 messaging format while triggering on-chain transactions, allowing seamless integration of traditional and digital financial processes.

- The introduction of the ‘Digital Transfer Agent’ (DTA) standard allows fund administrators to handle tokenized fund operations as they would with conventional methods, but with enhanced efficiency through blockchain.

- Collaborating with 24 major global financial institutions, including DTCC and Euroclear, Chainlink is striving to standardize on-chain corporate actions data and simplify asset servicing practices.

Chainlink’s ongoing developments explicitly connect to the future of asset tokenization. In a recent showcase, founder Sergey Nazarov highlighted the immense market potential:

Markets worth trillions of dollars are becoming accessible, and Chainlink aims to facilitate this transition to the world of cryptocurrency.

Although changes in TradFi and DeFi may seem gradual, the implications are critical. Tokenizing traditional assets signifies that banks could emerge as essential custodians and facilitators in the next wave of financial innovation.

The movement of tokenized assets will define which entities will govern the financial landscapes of tomorrow, making $BEST, $LINK, and $HYPER key players in this evolution.

As always, it’s essential to conduct thorough research. This piece does not constitute financial advice.

Written by Bogdan Patru for Bitrabo –