Today, a significant milestone in the cryptocurrency realm was achieved as Top Win International, a company listed on Nasdaq, announced it successfully raised $10 million from various investors, with notable participation from Taiwan’s Wiselink. This investment marks a transformative moment, being the first instance of a publicly-listed Taiwanese entity investing in a Bitcoin treasury.

Top Win International Expands into Bitcoin Investments

As highlighted in a recent press release, Top Win International, which has roots as a luxury watchmaker, is embracing a new direction by investing in Bitcoin. This strategy aligns with the growing trend of traditional companies entering the digital asset space.

Wiselink took the initiative in this funding, contributing $2 million through a three-year convertible note. The remainder of the investment was secured from additional backers, which included United Capital Management based in Kansas.

The capital raised will primarily be allocated towards acquiring Bitcoin, although Top Win may also seek to invest in other public firms that have similar Bitcoin treasury strategies, adhering to relevant regulatory guidelines.

It’s crucial to note that while Top Win is venturing into digital assets, they have affirmed that they do not plan to transition into an investment firm. Following its Nasdaq debut in April 2025, the company rebranded its ticker from TOPW to SORA after collaborating with SORA Ventures in May.

Despite announcements of this major funding round, shares of Top Win experienced a noticeable drop, declining over 15% at market opening. However, they remain up by over 12% within the last week, reflecting a complex market sentiment.

In related news, Sequans Communications, an NYSE-listed company, recently unveiled an ambitious initiative to amass 100,000 BTC by the year 2030, highlighting their confidence in Bitcoin’s potential as a significant asset for long-term financial growth.

Beginning its Bitcoin acquisition strategy on July 8, Sequans allocated $384 million towards convertible debt and equity investments, successfully adding 1,264 BTC to their assets just last month.

Currently, Sequans holds the 21st spot among publicly traded Bitcoin holders worldwide. Major players like Michael Saylor’s Strategy, MARA Holdings, and Twenty One Capital lead the rankings.

Growing Corporate Interest in Bitcoin

Once viewed as a risky venture, corporate adoption of Bitcoin has gained remarkable traction, especially since the 2024 election of US President Donald Trump.

This week, Norway’s Norges Bank Investment Management disclosed a substantial increase in its Bitcoin holdings, pushing its investment to $844 million.

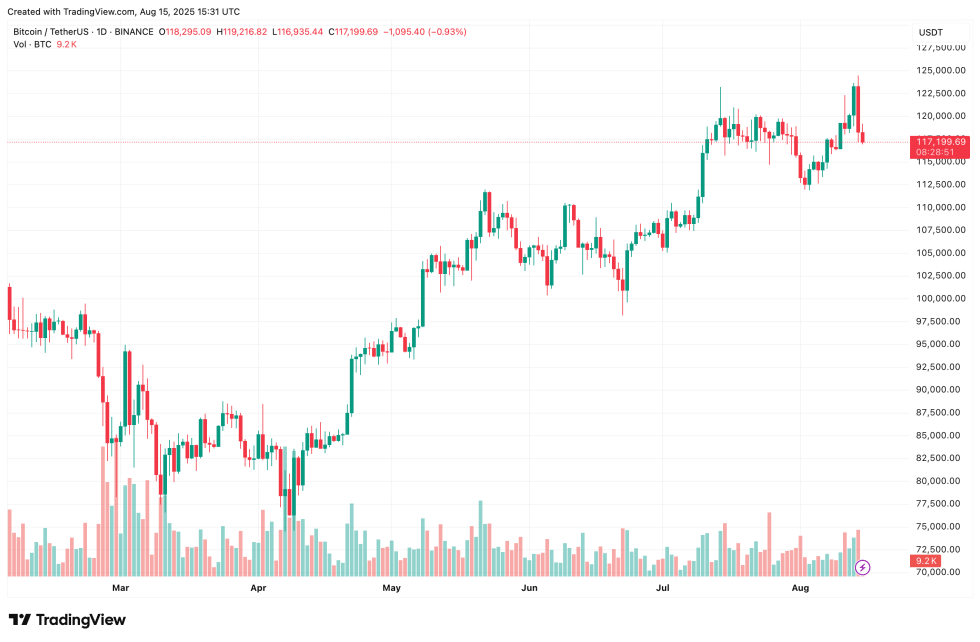

Furthermore, Choreo, a wealth management firm, has revealed an investment of approximately $6.5 million across multiple Bitcoin exchange-traded funds (ETFs). As of now, Bitcoin is trading at $117,199, showing a modest decline of 0.9% in the last 24 hours.