The distribution of wealth within the XRP ecosystem has become a focal point of discussion lately. Recent insights reveal a significant concentration of XRP among a small percentage of holders, highlighting potential implications for market dynamics. This analysis offers a fresh perspective on the distribution patterns and their potential effects on liquidity and price movements.

Understanding XRP Wallet Distribution

Key findings revealed by market analyst KKapon illustrate surprising trends in the distribution of XRP among various wallets. The data indicates that the top tier of wallets possesses a staggering amount of XRP, shifting the conversation toward who maintains liquidity rather than just market value. This shift underscores the notion that the control of XRP can significantly impact overall network operations.

KKapon’s examination points out that misconceptions surrounding XRP distribution are common due to a lack of detailed analysis. He emphasizes that the real issue lies in understanding who possesses liquidity rather than merely focusing on market pricing. Such an understanding can influence trading strategies and investment decisions within the XRP community.

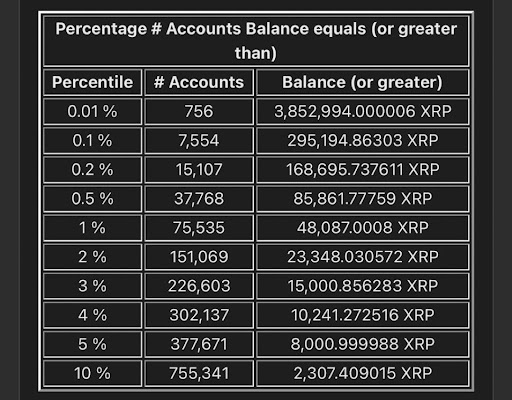

The table presented sheds light on the distribution tiers, showing how few wallets control vast amounts of XRP. For instance, the top 0.01% of wallets, numbering around 756, hold at least 3,852,994 XRP, demonstrating the high degree of concentration at the top of the distribution curve. This concentration raises important questions regarding market accessibility and liquidity, especially during market fluctuations.

If we delve deeper into the tier structure, the top 0.1% of wallets control at least 295,194 XRP across over 7,500 accounts. The 0.5% mark is set at 85,861 XRP, encompassing nearly 38,000 wallets. This reveals that a relatively small number of accounts hold a great share of the total supply, which could create challenges for new investors trying to enter the market or for existing holders looking to liquidate their positions during sudden price surges.

According to analytics, the 1% tier starts at 48,087 XRP, effectively covering 75,535 wallets. Notably, as we proceed down the distribution, the balance required to be among the top 5% is merely 8,000 XRP, spanning about 377,671 accounts. This suggests a notable layer of accessibility for smaller investors, even though the highest percentages are dominated by larger wallets.

The Ownership of XRP Wallets: Individual vs. Institutional

KKapon’s analysis reveals that the majority of wallets identified in the rich list correspond mostly to retail holders and may not accurately represent institutional ownership. Unlike individuals who often use personal wallets, institutions typically engage with XRP through custodial accounts or derivative instruments. This distinction is crucial as it indicates that many large quantities of XRP might not be actively traded but are instead held securely for future strategic maneuvers.

Understanding the difference in ownership between retail and institutional investors can provide deeper insights into market behavior and potential price volatility. As these institutional players gain exposure to XRP, the impact on liquidity and price fluctuations could be substantial.

Overall, the analysis of XRP’s wealth distribution encourages a closer examination of where liquidity resides within the ecosystem. As more investors become aware of these dynamics, it could lead to informed trading strategies, better market forecasting, and enhanced engagement within the XRP community.