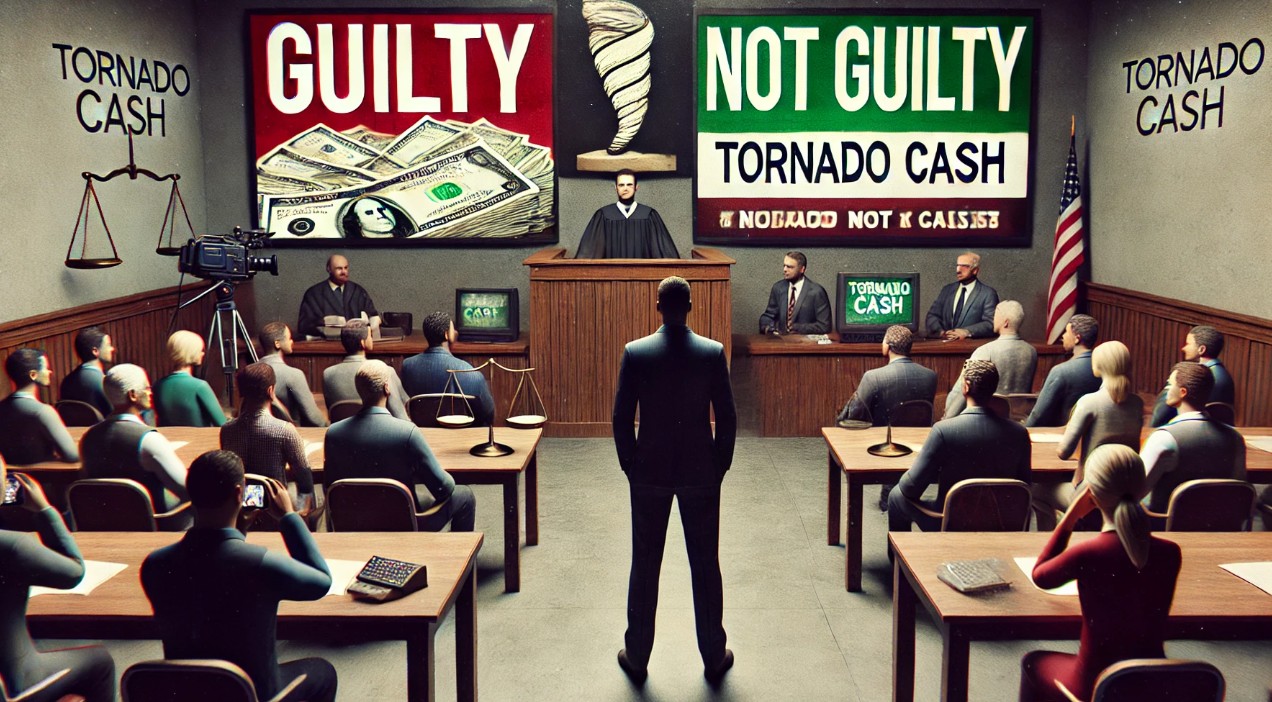

A recent jury trial has shed light on the intricate relationship between cryptocurrency and regulatory compliance, particularly concerning Roman Storm, founder of Tornado Cash. On Wednesday, the jury was unable to reach a consensus on major charges, including money laundering and evading sanctions, which have been at the center of a high-stakes legal battle initiated by the U.S. Department of Justice (DOJ) two years prior.

Nevertheless, the jury did issue a decision, convicting Storm of a lesser offense: operating an unlicensed money transmitting business. This verdict has sparked discussions within the financial and legal communities about the implications for cryptocurrency regulation.

Key Issues in the Tornado Cash Case

As reported by Inner City Press, Storm was found guilty on just one of three charges. The more severe allegations involving conspiracy to launder money and violating North Korean sanctions remain unresolved. The complexities of the case underscore the challenges regulators face in an evolving cryptocurrency landscape.

The allegations against Storm and co-founder Roman Semenov center around Tornado Cash, a service implicated in laundering more than $1 billion in funds derived from illegal activities. The DOJ asserts that the platform enabled users, including those purportedly financed by North Korea, to carry out anonymous transactions that obscured the origin of their illicit gains.

Legal Implications of KYC and AML Regulations

The indictment also highlighted that the founders sidestepped critical frameworks such as “know your customer” (KYC) and anti-money laundering (AML) protocols. This decision is viewed as a significant violation of established legal structures designed to combat financial crimes.

The DOJ’s charges suggest that this intentional oversight not only violated existing financial laws but also contributed to the very money laundering operations they were accused of facilitating. As cryptocurrency continues to grow in popularity, the need for clear regulations becomes ever more pressing.

The Broader Impact on Cryptocurrency Regulation

The conflicting verdicts from the jury exhibit the ongoing struggle between law enforcement and the cryptocurrency sector. Regulators are attempting to find a balance between encouraging innovation in financial technologies while ensuring that robust safeguards are in place to prevent misuse.

This case also serves as a crucial reminder that while cryptocurrency can offer enhanced privacy, it is not immune to legal scrutiny. As regulatory frameworks evolve, those participating in this burgeoning industry must remain vigilant and informed about their obligations.

Image credit: DALL-E, chart provided by TradingView.com