The cryptocurrency market is currently navigating through turbulent waters, with XRP facing notable challenges in its quest to regain significant price levels. This persistent selling pressure across the sector has resulted in a cautious trading environment, where market participants are hesitant to engage without clearer signals of direction. Recent trends have shown an inability to maintain upward momentum, illustrating a landscape still grappling with uncertainty.

Insights from a recent report highlight significant shifts in XRP futures open interest over the last month, particularly as measured in XRP units. The analysis suggests a trend of negative sentiment on major exchanges, indicating that traders are opting for deleveraging over speculative endeavors. Essentially, this means that many are choosing to shut down their positions and minimize risks, rather than piling into high-leverage bets as they await a more stable market.

This reduction in open interest often coincides with pivotal moments in the market, as participants prioritize capital conservation during uncertain times. Depending on the overall liquidity scenarios and investor mood, this can herald either a phase of renewed accumulation or additional downturns.

Currently, XRP’s market environment indicates that traders are exercising caution with derivatives, making price movements particularly sensitive to variations in demand, macroeconomic developments, and the overall investment climate in cryptocurrency.

XRP’s Deleveraging Environment: Key Observations from the Derivatives Market

A recent analysis from CryptoQuant shed light on changes in futures open interest, demonstrating a significant withdrawal of investments across major derivatives exchanges. In the last month, Binance reported a reduction of an estimated 1.6 billion XRP in open interest, while Bybit experienced an even larger decrease of approximately 1.8 billion XRP.

Other platforms like Kraken recorded significant drops nearing 1.5 billion XRP, whereas OKX noted a milder decline of about 446 million XRP. BitMEX had the smallest reduction, with only 36 million XRP. This data underscores the trend of position unwinding primarily occurring on the largest exchanges, underscoring their critical role in shaping overall market dynamics and short-term investor sentiment.

From a behavioral finance perspective, a decline in open interest usually signifies a collective preference among traders to reduce risk rather than engage in aggressive speculation. This behavioral pattern often occurs during transitional market phases, paving the way for the establishment of a new trend or a local bottom. The focus appears to be on capital preservation, leading to a derivatives environment characterized by lower leverage and reduced speculative fervor.

Current Price Action: XRP Testing Crucial Support Levels

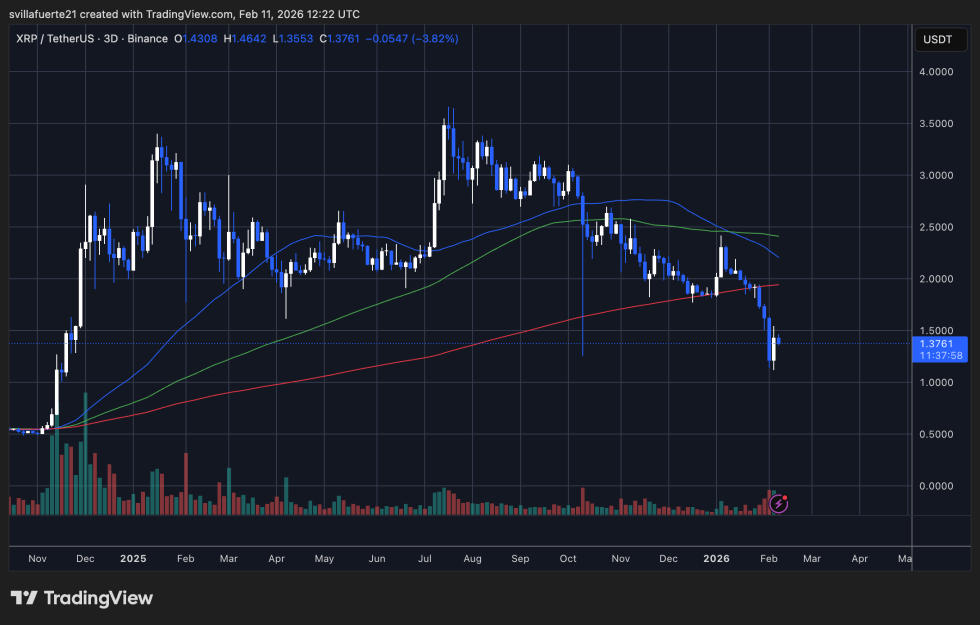

On the higher timeframes, XRP finds itself under sustained pressure, having recently dipped toward the $1.30 to $1.40 range after failing to hold above previous support zones. A discernible pattern of lower highs has emerged since the peak, indicating a decline in bullish momentum and a shift towards a more defensive market outlook.

Technically speaking, XRP is trading beneath key moving averages, which now serve as dynamic resistance levels. This scenario often highlights continuous bearish sentiment, particularly when matched with reduced upward momentum during recovery attempts. The latest price decline appears to be connected with heightened trading volumes, pointing more towards position unwinding than genuine accumulation.

Structurally, the current price range aligns closely with a historical liquidity zone that had previously supported consolidation. Maintaining stability within this area could provide XRP with the opportunity to transition into a sideways price pattern. However, a significant breakdown could signal a deeper retracement toward earlier support levels.

The outlook for XRP hinges on broader market sentiment, derivatives positioning, and overarching liquidity trends. A sustained move above critical moving averages would be essential to signal potential bullish momentum and restore market participants’ confidence.

Image from ChatGPT, chart sourced from TradingView.com.