TRON (TRX) has garnered significant attention recently as it navigates the volatile crypto landscape, following a surge to multi-year highs. Despite frequent price fluctuations, the underlying fundamentals illustrate a robust performance, which bolsters investor faith in its future. Analysts note that TRON’s impressive resilience is not solely attributed to technical aspects; it also benefits from heightened on-chain activity that distinguishes it from other blockchains in the ecosystem.

Highlighting this momentous shift, analyst Darkfost has brought to light compelling statistics: TRC-20 USDT flows from major exchanges have soared to unprecedented levels, emphasizing a strong demand for stablecoin transactions on the TRON network. This growth accentuates TRON’s emerging position as a primary blockchain for USDT, fueled by its diverse array of services and products, along with its renowned capability of maintaining low transaction fees and swift processing times.

This appealing combination has attracted a wave of retail and institutional investors, carving out TRON’s niche as a pivotal component in the stablecoin market. As price volatility threatens overall market perception, the increasing dependence on TRON for USDT transactions highlights a broader story—adoption is on the rise, and many believe that TRON’s capabilities extend far beyond immediate price fluctuations.

TRON’s Emergence as a Preferred Blockchain for USDT Transactions

In the view of top analyst Darkfost, one of the most telling indicators of TRON’s growing influence is the accelerating adoption of TRC-20 USDT among various centralized exchanges. More platforms are integrating TRON-based stablecoin transactions, indicating a noticeable investor appetite. This development has been particularly marked since late 2024, as on-chain activity originating from exchanges has observed a significant uptick, reinforcing the reliance on TRON’s robust infrastructure.

The magnitude of this surge became apparent on August 22 when a remarkable $13 billion in USDT transacted on-chain from centralized exchanges in a single day. This remarkable figure marked the third-largest daily USDT volume ever recorded on TRON, reinforcing its crucial role in global stablecoin transactions.

Upon closely examining the statistics, it is clear that Binance leads this charge, encompassing more than 65% of TRC-20 USDT transfers among prominent exchanges. Following behind is HTX at 18%, with Bybit contributing an additional 5%. These figures reflect how the main players in the industry are increasingly relying on TRON’s network to handle substantial volumes of stablecoin liquidity.

TRX Maintains Critical Support Amid Market Fluctuations

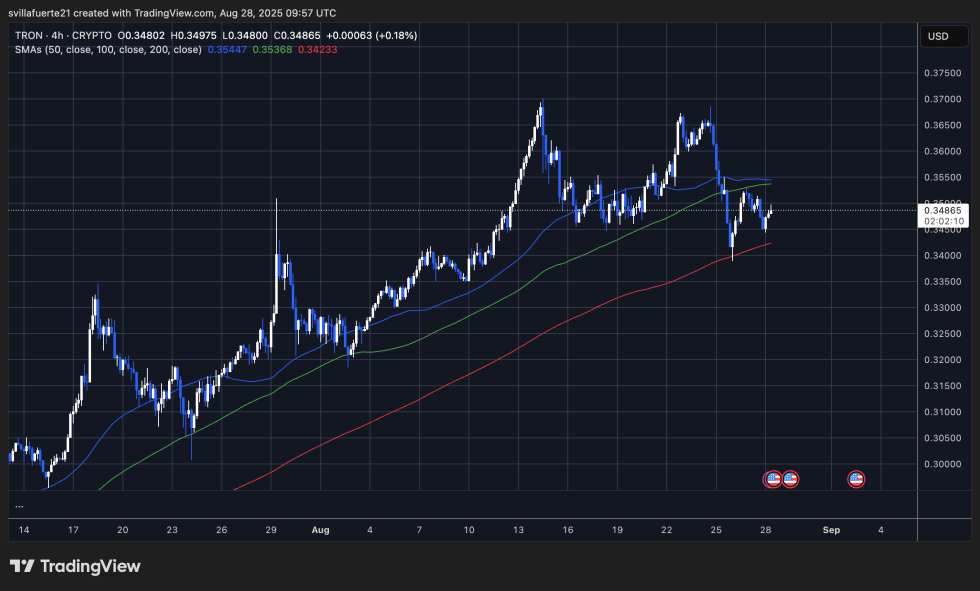

Currently, TRX trades around $0.348 following a volatile retreat from highs of approximately $0.37. Analyzing the 4-hour chart, one can see a sharp price drop, yet the asset found robust support at the 200-day moving average around $0.342, indicating bullish buy pressure that aims to uphold the prevailing trend. This resilience suggests that even with a cooling momentum, the overarching uptrend remains valid as long as TRX stays above this vital threshold.

At present, TRX is consolidating between the 50-day moving average at $0.354 and the 200-day support level, creating a tight price range that indicates market indecision. For the bulls, reclaiming the 50-day and 100-day averages, clustered around $0.354–$0.356, will be crucial to shifting momentum back in their direction. A successful breach above this resistance may pave the way for a potential retest of the $0.36 zone and the significant resistance of $0.37, which previously capped bullish rallies.

On the flip side, failing to hold above the 200-day moving average would jeopardize the upward trajectory of TRX, exposing it to possible declines with subsequent support likely found around $0.335. At this moment, the chart reveals cautious yet hopeful sentiment: buyers remain eager to defend higher lows, but the recapturing of short-term moving averages is essential for TRX to regain bullish momentum and target fresh all-time highs.

Featured image from Dall-E, chart from TradingView