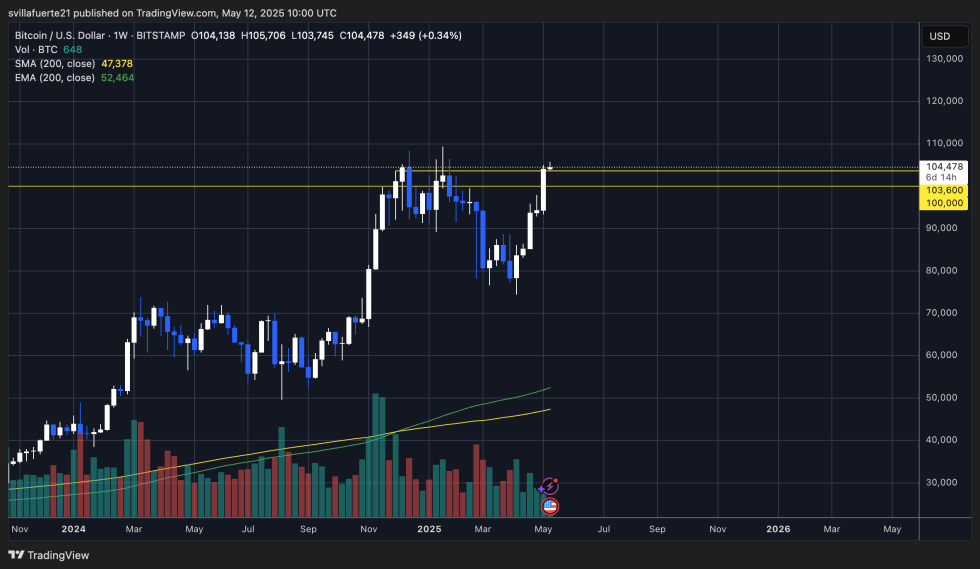

Bitcoin has recently achieved a significant milestone, trading just above the $104,000 mark, marking its second-highest weekly close in history. This development underscores the strengthening of its ongoing bullish trend. The price movement has been remarkably vigorous in recent weeks, following the reclaiming of both the $90,000 and $100,000 psychological barriers. This shift in price action signifies a notable change in market sentiment after a period of extensive consolidation.

Data analytics from various crypto platforms indicate that the Fear and Greed Index has seen a noteworthy uptick, highlighting a resurgence of optimism among Bitcoin investors. Despite this positive sentiment, the index remains well below extreme “greed” levels, suggesting that there’s still potential for further price gains without hitting an unsustainable peak.

This blend of strong market performance and measured sentiment could be indicative of a durable rally rather than a fleeting speculative surge. As Bitcoin maintains its position above critical resistance levels, market analysts are increasingly eyeing the all-time high of approximately $109,000 as the next major target. This recent price surge has also invigorated the broader cryptocurrency market, spurring altcoin growth. As confidence builds, the market is poised for an exciting new phase of expansion, likely fueled by fresh capital influxes.

Bitcoin Approaches Critical All-Time Highs

This week is pivotal for Bitcoin as bullish investors target the historic high of $109,000. After facing significant selling pressure and widespread skepticism, the flagship cryptocurrency is drawing attention once again, trading just under $105,000. This threshold now represents immediate resistance, and breaking through it could signal a foray into previously uncharted territory. Conversely, if selling resumes around this point, Bitcoin may undergo another consolidation phase or a price correction.

Analyst insights suggest a marked improvement in market sentiment. According to expert views, the average readings of the Fear and Greed Index are on the rise, reflecting increasing investor confidence. Notably, this optimism is far from extreme levels, indicating a healthy bullish environment that supports the sustainability of the current upward trend.

Additionally, positive macroeconomic factors are lending support to the bullish outlook. Recent negotiations between major global powers have alleviated some of the geopolitical tensions, adding to the upward momentum in markets. With Bitcoin stabilizing near multi-month highs, conditions are ripe for another significant upward shift.

BTC’s Critical Moment Near Historical Highs

Trading above $104,000 and following a historic close, Bitcoin has reclaimed a key price level. Having reached the $90,000 mark in late April, the recent price surge brings Bitcoin close to its all-time high zone. This upward trend is evident in weekly charts showing clear momentum, characterized by BTC’s ability to breach crucial resistance levels with vigor. The current price is now testing the same range that previously represented the peak earlier this year—between $104,000 and $105,700.

This price range is pivotal. If buyers can push past this resistance and close out the week near or above the all-time high, it would likely affirm the long-term uptrend. A successful breakout would likely trigger significant buying momentum and attract institutional investments. However, should Bitcoin falter or retreat, it could signal short-term exhaustion, potentially diverting the price towards the $100,000 to $103,000 support area.

Overall, favorable volume trends and better market sentiment persist, supported by decreasing exchange balances and a growing sense of investor confidence. Nevertheless, achieving a confirmed weekly breakout above the all-time high remains the ultimate test for Bitcoin, with all eyes keenly focused on whether the cryptocurrency can set a new milestone in the near future.

Image sourced from recent market analysis and data; analytics derived from TradingView.