Following an intense several-week rally, Bitcoin has hit a halt at the $105K mark, now pulling back to identify support within the $101K–$100K range. This adjustment comes after a vigorous buying spree that drove BTC past significant resistance levels, including $90K and $100K, sparking widespread optimism throughout the cryptocurrency space. While this retreat may seem like a deceleration, numerous analysts consider it a healthy phase of consolidation before a possible upward surge.

In a bullish development, data from CryptoQuant indicates that over the last 20 days, more than $6 billion in liquidity has flowed into the market via newly minted USDT. This substantial influx raises Tether’s overall market capitalization to a remarkable $150 billion, underscoring increasing investor enthusiasm. With such liquidity entering the ecosystem, focus is now directed at Bitcoin’s ability to maintain its current support level and push towards new all-time highs.

This consolidation period may prove crucial. If BTC succeeds in staying above $100K, the bullish trend will remain strong. Conversely, failing to hold this level could lead to a more significant correction as the market absorbs recent gains. Attention is primarily on how price movements behave around this pivotal range.

Shift in Focus to Altcoins as Bitcoin Consolidates

Bitcoin finds itself at a crucial crossroads, with bulls attempting to protect the $100K mark while striving to regain $103K to facilitate a breakout above the all-time high of $109K. Although BTC remains structurally bullish, it has struggled to rise further after surpassing $105K last week, prompting a pullback that tests essential support zones. Maintaining the integrity of the $100K range is vital to prevent a sharper correction and sustain momentum from what has been an extraordinary rally.

However, market interest appears to be migrating. Analyst Axel Adler highlighted on X that an influx of $6 billion in fresh capital has permeated the crypto sector over the past 20 days through newly issued USDT, elevating Tether’s total market cap to $150 billion. While this liquidity initially buttressed Bitcoin’s ascent, trends are increasingly favoring altcoins.

As Bitcoin’s dominance wanes, assets like Ethereum and other leading altcoins are taking in a significant portion of the capital influx. This shift reflects a growing confidence among investors in higher-risk opportunities, with ETH reclaiming crucial levels and altcoins showing promising breakout potential. Should Bitcoin continue its consolidation, the momentum for an altcoin season could accelerate in the weeks ahead.

Bitcoin Testing Resistance as Buyers Support Key Levels

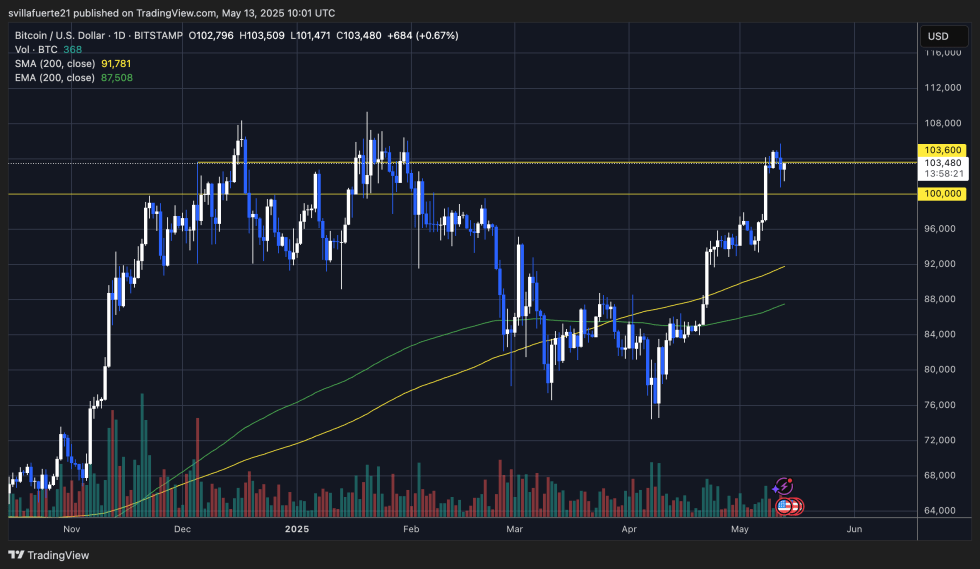

Currently, Bitcoin is consolidating just beneath the $103,600 resistance after a rapid increase that saw its price jump from below $90K to above $105K in under two weeks. The daily chart illustrates how BTC has consistently tested the $103,600 mark—an area that served as a resistance during peaks in January and March. Despite multiple attempts to break through, the price has yet to achieve a confirmed daily close above this level, signaling strong selling pressure.

Support is currently positioned in the $100K–$101K range, aligned with the vital psychological level and prior breakout zone. Thus far, bulls have shown resilience in defending this key area, highlighting strength in the ongoing market structure. The 200-day SMA at $91,781 and the 200-day EMA at $87,508 remain significantly below current price levels, reinforcing Bitcoin’s established uptrend but also indicating a potentially overheated short-term situation.

A successful breakout above $103,600 would pave the way for a test of the all-time high at $109K. However, failure to maintain support above $100K could instigate a deeper retracement towards lower demand zones. For now, Bitcoin is poised in a bullish stance, but the market awaits further validation through volume and price behaviors to confirm the next direction.

Featured image from Dall-E, chart from TradingView