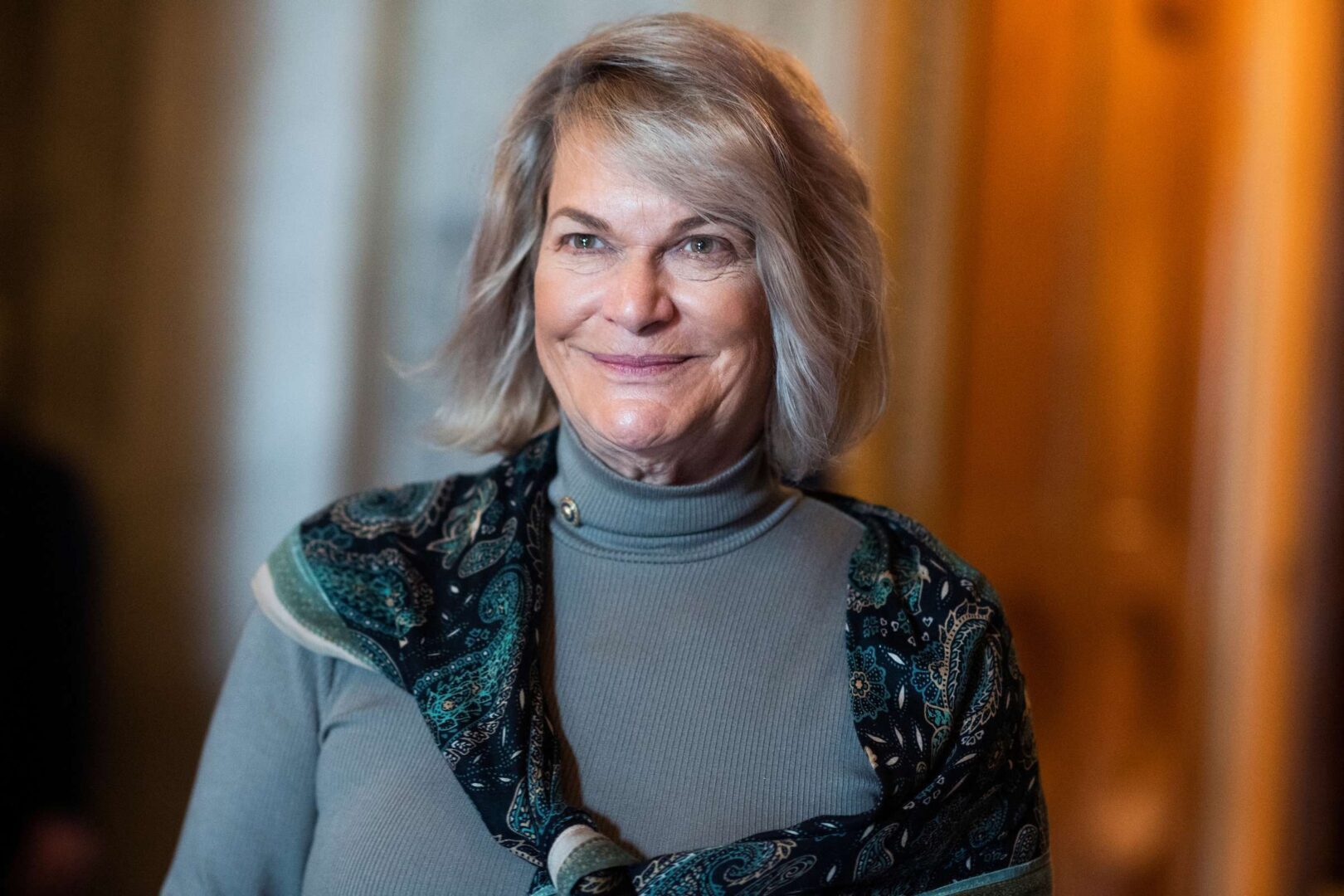

Senator Cynthia Lummis (R-WY) has introduced a groundbreaking idea aimed at revolutionizing the United States’ fiscal policy by advocating for the creation of a strategic Bitcoin reserve. Her proposal, set to be enacted into law shortly, suggests that the US government should acquire one million Bitcoin over the next five years, equivalent to approximately 5% of the total Bitcoin supply.

Strategic Approach for Debt Reduction

The primary objective of establishing a strategic Bitcoin reserve is to aid in reducing the nation’s soaring debt, which presently stands at a staggering $34.99 trillion. Lummis argues that by holding Bitcoin, the US could potentially possess an asset that could cut the national debt in half by 2045.

Speaking at the Bitcoin 2024 conference, Lummis stressed that establishing such a reserve would solidify the dollar’s status as the leading global reserve currency in the 21st century and ensure the country’s continued prominence in financial innovation.

Financial Backing and Security Measures

The proposed legislation outlines the creation of a decentralized network of secure Bitcoin vaults managed by the Treasury Department, adhering to top-tier physical and cybersecurity standards. Funding for the acquisition of Bitcoin would involve reallocating existing funds within the Federal Reserve System and the Treasury Department.

This is the solution.

This is the answer.

This is our Louisiana Purchase moment!#Bitcoin2024 pic.twitter.com/RNEiLaB16U

— Senator Cynthia Lummis (@SenLummis) July 27, 2024

Lummis emphasized that the strategic reserve would not only benefit the US economy but also ensure the dollar’s competitiveness amidst evolving global financial landscapes. She likened the initiative to a transformative event comparable to the “Louisiana Purchase,” suggesting it could reshape the country’s fiscal outlook without necessitating tax hikes.

Preserving Financial Autonomy

The proposal guarantees that the strategic reserve would respect the self-custody rights of private Bitcoin holders, safeguarding personal financial freedoms. This measure aligns with former President Donald Trump’s vision of positioning the US as the “crypto capital of the world,” contingent upon his re-election in November.

Senator Lummis has also criticized the government’s proposed 30% excise tax on the energy consumption of Bitcoin miners, advocating for a more conducive regulatory environment for cryptocurrencies.

By actively participating in significant Senate committees focusing on land, energy, natural resources, and digital assets, Lummis is pushing for the integration of cryptocurrencies into the national budgetary framework, ushering in a new era in American economic policy.

“Instead of holding devaluing US dollars and assets that lose at least 2% value annually, we have the opportunity today to hold assets that appreciate,” remarked Lummis, drawing parallels to past financial milestones.

Lummis’s enthusiastic address at the Bitcoin 2024 conference, concluding with a call to action reminiscent of influential historical decisions, struck a chord with attendees, reinforcing the potential impact of the strategic Bitcoin reserve.

Featured image from Roll Call, chart from TradingView