The growing interest in digital currencies has made headlines in various sectors, and the scrutiny from US authorities on foreign regimes is more intense than ever. Recently, significant attention has been focused on how different governments utilize cryptocurrencies, particularly in relation to financing operations under controversial leadership. This has raised questions about the transparency and legality of such practices.

U.S. Government Investigates Cryptocurrency Sources

During an enlightening discussion, a senior adviser revealed ongoing investigations into the use of cryptocurrencies by foreign parties. Although specific details were withheld, the official confirmed that a multi-agency task force is actively examining financial ties that may be linked to less-than-legitimate operations and their use of digital assets.

“This is a complex and evolving scenario,” the adviser noted. “There are many national security implications. Our teams are analyzing potential funding routes related to specific regimes and their access to digital currencies, as well as other commodities.”

The important aspect for stakeholders to note is the procedural angle: while no concrete actions like asset seizures have been acknowledged, the categorization of crypto assets in these discussions underscores their growing relevance in global finance.

The caution from authorities follows viral assertions that certain nations might be in possession of vast quantities of Bitcoin. A recent report by notable journalists highlighted the possibility that these regimes could control substantial Bitcoin reserves, raising eyebrows among analysts and the financial community. However, this claim was based more on circumstantial evidence and intelligence reports than verified blockchain data.

Several blockchain investigations have revealed a noticeable disparity between speculative numbers and verifiable holdings. Reports from forensic firms have indicated challenges in tracking significant amounts of Bitcoin associated with the regime in question, pointing to the difficulties in confirming their actual reserves.

Moreover, the skepticism regarding these claims extends to the lack of identifiable blockchain addresses, making it even harder for analysts to substantiate these huge assessments. The ambiguity surrounding these claims has resulted in calls for thorough investigation and transparency.

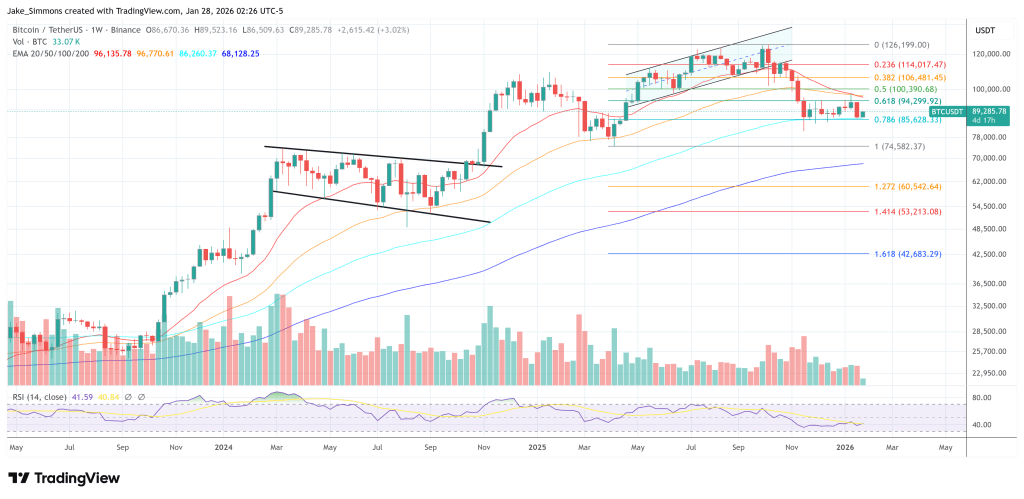

As the cryptocurrency market continues to evolve, the implications for valuation and regulatory measures could be immense, especially with Bitcoin currently priced at $89,285. Stakeholders will need to monitor these developments closely to understand their potential impact on global finance.