The world of cryptocurrency is witnessing a significant moment as Bitcoin is currently hovering around the $105,000 mark following a notable retracement from its peak of $112,000. This recent volatility has led BTC to a phase of consolidation, where it seems to have found solid footing within a critical demand zone. As global markets face challenges with rising US Treasury yields and persistent inflationary pressures, investor sentiment has been heavily influenced, creating a complex backdrop for cryptocurrency trading.

Nevertheless, Bitcoin has demonstrated remarkable resilience. Data from CryptoQuant highlights that large Bitcoin holders, or “whales,” who possess between 1,000 and 10,000 BTC, have progressively expanded their holdings. Since a dip below $78,000 on March 11, these whales have collectively acquired around 200,000 BTC, increasing their total holdings from 3.3 million BTC to an impressive 3.5 million BTC. This trend highlights a strong underlying belief in Bitcoin’s long-term potential, despite market fluctuations.

The ongoing consolidation phase, combined with rising demand from influential players, has analysts eagerly anticipating Bitcoin’s next significant movement. Whether BTC will break through resistance levels or dip lower, the trends in accumulation convey an unwavering strength that cannot be overlooked.

Market Dynamics: Bitcoin Tests Waters Amidst Whale Accumulation

Bitcoin is at a crucial juncture, having experienced a notable decline of over 7% from its record high of $112,000. Currently stabilizing around $105,000, market participants are evaluating its behavior amid intensifying economic uncertainties. Global disputes, particularly trade tensions between the US and China, are influencing market stability and driving volatility across various risky assets. Despite these turbulent times, Bitcoin has significantly outperformed most altcoins since 2021, marking its position as a preferred choice for many investors.

What stands out during this period of price correction is the unwavering confidence from large BTC holders. An analysis by leading experts reveals a significant uptick in Bitcoin ownership among addresses holding between 1,000 to 10,000 BTC. These whales have added 200,000 BTC to their portfolios since mid-March, with their total now reaching 3.5 million BTC in less than three months.

Over the last 30 days, another 78,000 BTC was aggregated, with a notable 6,000 BTC purchased in just the past week. Although the rate of accumulation has slowed, the prevailing trend remains bullish. The ongoing interest from large holders even post the all-time high reinforces the notion that significant players are preparing for future price advancements.

Analyzing Bitcoin’s Price: Navigating Support Levels During Consolidation

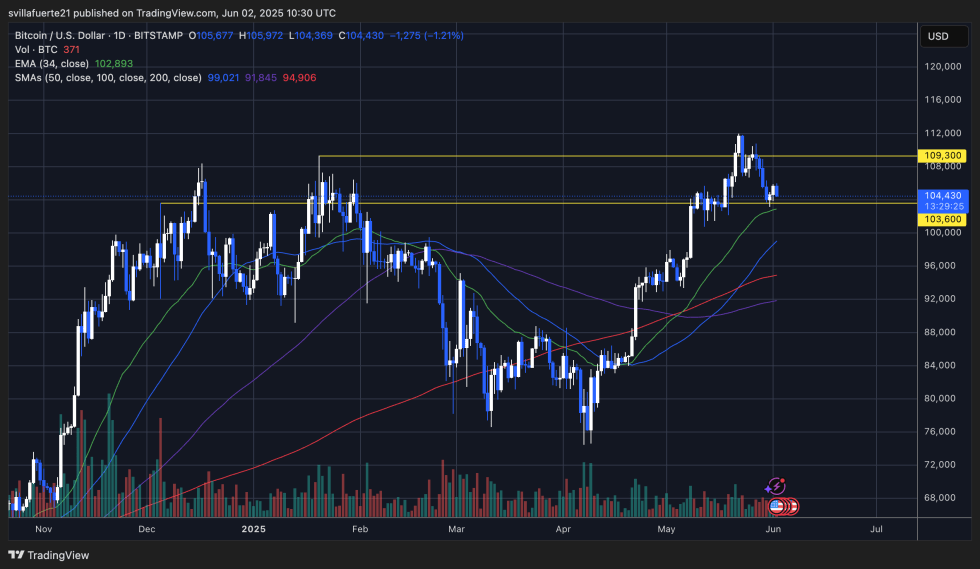

As of now, Bitcoin trades at approximately $104,430, showing signs of consolidation just above a key support level at $103,600 following a decline from its recent all-time high of $112,000. Technical analysis points to a rejection around the $109,300 resistance, which has been tested multiple times, yet a breakout has not materialized. Regardless of this, the price action remains bullish as long as Bitcoin holds the $103,600 support level, aligning with a rising 34-day EMA positioned at about $102,893.

During this retracement, trading volume has experienced a slight decline, suggesting that the current pullback could be more of a correcting phase rather than a significant downward trend. The ongoing upward trajectory of both the 50-day and 100-day SMAs reinforces a mid-term bullish outlook. If Bitcoin can maintain its position above the $103,600 support, a renewed effort toward $109,300 could be on the horizon.

Conversely, a drop below the $103,600 threshold could indicate deeper sell-off risks, with potential targets hovering around the $99,000 to $100,000 mark, where the 50-day SMA offers additional support. Investors are urged to keep a close eye on Bitcoin’s ability to hold this consolidation range, particularly as macroeconomic uncertainties, rising US Treasury yields, and geopolitical tensions continue to impact the broader market. Successfully maintaining these levels would indicate resilience and potentially pave the way for a breakout in the near future.

Image courtesy of Dall-E, chart sourced from TradingView.