The recent report from the US President’s Working Group on Digital Assets has stirred significant interest among crypto enthusiasts and investors alike.

This new framework aims to enhance accessibility and regulation surrounding cryptocurrencies, focusing on pivotal recommendations for stablecoins, regulatory frameworks, banking access, and tax policies.

Such clarity in regulation is likely to catalyze growth for Bitcoin ($BTC), the dominant cryptocurrency in the market. However, despite potential surges in demand, the Bitcoin network still grapples with challenges such as transaction delays and high fees.

To mitigate these issues, the forthcoming Layer 2 solution, Bitcoin Hyper, is anticipated to launch soon.

The Emerging US Crypto Strategy: SEC vs. CFTC

Dubbed ‘Strengthening American Leadership in Digital Financial Technology’, this report marks a decisive change in the regulatory landscape for digital assets, prompted by Executive Order 14178 signed by Donald Trump on January 23, 2025.

Key to this new initiative is the establishment of a clear categorization for digital currencies, which will dictate their classification as either securities or commodities.

Previously, the SEC imposed stringent regulations on securities, while the CFTC adopted a more lenient approach for commodities, sparking legal ambiguity and disputes. A notable case involved Ripple, which faced the SEC over the classification of $XRP as an unregistered security, resulting in a settlement that included a hefty $125M fine.

Under the leadership of Gary Gensler, the SEC adopted an aggressive stance on enforcement, leaving many crypto projects uncertain about compliance. However, the appointment of Paul Atkins as the new SEC chair signals a shift towards more progressive and inclusive regulatory practices.

With the new report, oversight responsibilities are delineated between the SEC and CFTC: the SEC focuses on securities, while the CFTC governs spot markets for cryptocurrencies.

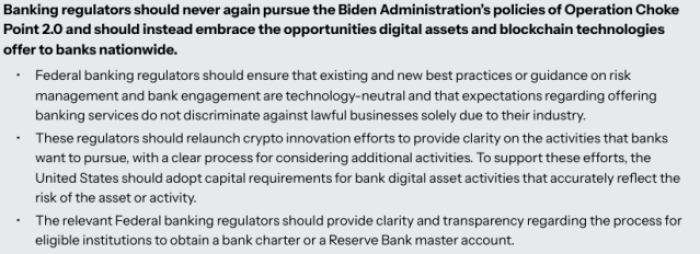

Banking reform is another priority, with the Working Group advocating for a streamlined chartering process and enhanced transparency to facilitate banking services for crypto ventures.

Moreover, the report calls for federal banking agencies to implement technology-neutral risk assessments, promote innovation-focused initiatives, and eliminate biases against legitimate crypto businesses.

Stablecoins are also a significant focus, as lawmakers are urged to support the CBDC Anti-Surveillance State Act, opposing a US central bank digital currency. The report acknowledges, however, that stablecoins wield functionalities that can mimic certain aspects of CBDCs.

Furthermore, a revamped tax framework for crypto assets is recommended to classify them distinctly, aligning existing tax regulations with digital currency operations and illuminating complex areas like staking to improve compliance.

The Future of Bitcoin Amid New Regulations

This regulatory overhaul bodes well for Bitcoin, currently valued over $118K, signaling a positive trajectory bolstered by institutional support and clearer guidelines.

Historically, $BTC surged past its previous all-time high of $93K following Trump’s election victory in November 2024, as anticipations for favorable crypto policies surged.

With unambiguous regulations on the horizon, interest from institutional players is expected to escalate.

To illustrate the significant acquisition power in the market, Strategy (formerly MicroStrategy) stands as the largest holder of $BTC, amassing approximately 628,791 $BTC, a valuation exceeding $73B, closely followed by Marathon Digital’s substantial holdings valued at $5.87B.

As the appetite for $BTC continues to rise amidst favorable industry conditions, the pressure on the Bitcoin network will inevitably intensify. This is precisely where Bitcoin Hyper enters the spotlight.

Empowering Bitcoin Through Bitcoin Hyper

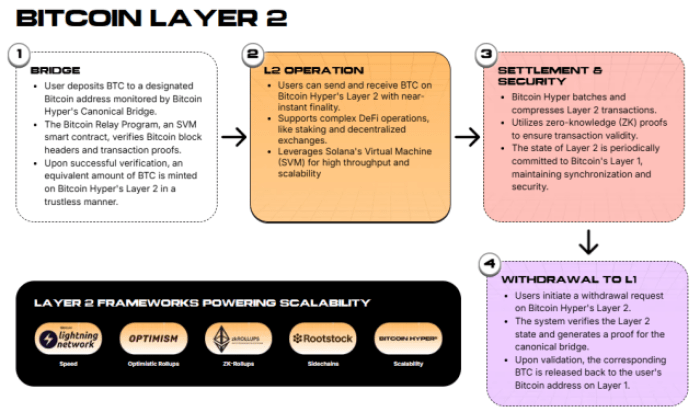

Scheduled for release in Q3 2025, Bitcoin Hyper ($HYPER) promises to bestow essential upgrades upon the Bitcoin infrastructure.

This advanced Layer 2 solution is engineered to accelerate transaction speeds, reduce costs, and integrate smart contract capabilities—essential for Bitcoin’s ongoing evolution.

Harnessing the power of the Solana Virtual Machine (SVM), Bitcoin Hyper aims to infuse rapid transaction capabilities into the Bitcoin blockchain. This evolution serves not only the payment sector but paves the way for decentralized applications, innovative meme coin launches, and the tokenization of real-world assets.

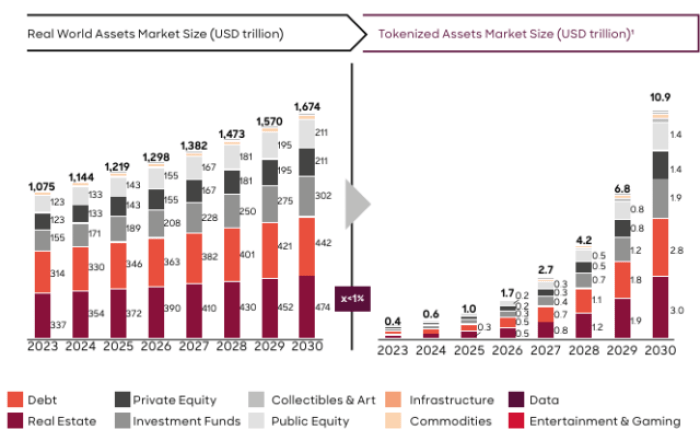

With experts predicting that the market for tokenized assets will soar to $10.9T by 2030, Bitcoin Hyper is strategically positioned at the frontline of this burgeoning industry.

The landscape of cryptocurrency is constantly evolving, and exciting advancements are paving the way for significant growth in Bitcoin’s ecosystem. Among these advancements is the innovative use of a Canonical Bridge. This powerful tool enhances interoperability in the blockchain space, similar to those employed by leading Layer 2 solutions such as Arbitrum and Linea.

This mechanism allows for the seamless transfer of $BTC across different layers, increasing efficiency while retaining the robust security that Bitcoin is known for.

If you’re keen on maximizing your experience within this burgeoning ecosystem, acquiring some $HYPER tokens is highly advisable. Investors will benefit from reduced transaction costs, participation in governance, and an appealing staking yield of up to 169% APY.

The overwhelming success of the $HYPER presale, generating over $6 million in funding, underscores the increasing interest. Significant contributions from investors, including notable whale purchases of $74.9K, $54.1K, and $53.9K, illustrates the momentum behind this initiative.

The Broader Impact of Regulatory Changes on $HYPER

As the United States moves toward establishing clearer regulations surrounding Web3 and cryptocurrencies, the prospects for digital assets entering mainstream adoption appear promising. The latest government report outlines objectives aimed at reducing legal barriers, facilitating innovation, and enhancing investor protection.

This shift has ignited a surge in institutional investment, as recent acquisitions of $BTC by firms like Strategy and MANA reveal a growing confidence in cryptocurrency.

As the leading cryptocurrency, $BTC remains a focal point for many investors. Historically, when $BTC experiences upward movement, other altcoins tend to benefit from the ripple effect.

However, with the growing interest in $BTC, the urgency for effective scalability solutions on its network has never been higher. This is exactly why Bitcoin Hyper’s Layer 2 concept is crucial.

Currently, $HYPER is available for presale at an attractive price of $0.012475. Once the Layer 2 is launched, projections indicate a potential rise to $0.32, offering investors a staggering growth opportunity of approximately 2,466%.

Remember, investing in cryptocurrencies carries risks. Always conduct thorough research andonly invest what you can afford to lose.