In a thought-provoking dialogue with financial expert Alex Turner, Crypto Insight CEO Jordan Relic explained a compelling rationale for why exchange-traded funds (ETFs) based on spot XRP may experience higher demand compared to similar Ethereum offerings. His argument is grounded in three main pillars: the lack of staking incentives affecting ETF popularity, XRP’s foothold in established financial infrastructures, and an enthusiastic community poised for investment upon regulatory approval.

Why XRP May Outperform ETH Right Away

Relic’s initial argument revolves around immediate market mechanics: Ethereum offers staking yields that could deter ETF investments, while XRP presents no such barriers. “For savvy investors, the allure of staking rewards makes it less appealing to opt for an ETH ETF,” he elaborated. Those familiar with on-chain strategies are likely to seek direct staking benefits rather than ETF exposure, which currently lacks yield offerings.

Conversely, “with XRP not providing similar returns, there are no missed opportunities for investors,” he continued, suggesting that this absence of yield-related conflict could attract yield-conscious buyers to the ETF market. He believes this fundamental difference could shift dynamics until regulations allow staking within ETFs—a possibility that industry players are actively pursuing in discussions with regulatory bodies.

Next, he shifts gears to focus on strategic positioning. Relic portrays XRP as a frontrunner in a category distinct from Ethereum, aligning more closely with how traditional finance operates. He identifies XRP as essential for services like international payments, remittances, and institutional settlements, describing it as the backbone of modern finance.

In juxtaposition, he places Ethereum within a broad spectrum of evolving “open-source protocols,” asserting that its competitive edge has diminished over time. “Ethereum has had its moments … but it’s becoming outdated, slower, and more expensive to manage. Newer options are emerging that are far superior,” he noted, citing a technology analogy—“this is akin to comparing VHS tapes to streaming services. Technology evolves quickly.”

Regardless of differing opinions, his case for XRP ETF adoption remains clear: well-defined category leaders attract swifter advisor engagement and integration into portfolio strategies compared to offerings trapped in a competitive landscape.

The third aspect of Relic’s argument centers on market demand. He believes that demand for XRP exposure has been simmering and is ready to burst forth through regulated investment channels as soon as they launch. He estimates notable interest: “I foresee $6 billion flowing into XRP within the first month of its ETF launch,” he stated, further comparing it to Ethereum’s initial debut, predicting XRP’s rapid success.

This confidence partly stems from the nature of its prospective investor base. Relic points out that financial advisors who traditionally pair robust brands with crypto firms will likely embrace XRP’s potential as soon as a clear pathway is established, finally allowing the crypto community to access investment vehicles fitting retirement and institutional needs.

The Impending Launch of an XRP ETF

All of this hinges on one critical assumption: the timely arrival of an XRP ETF in the marketplace. On this topic, Relic expresses undeniable optimism. Following the resolution of Ripple’s legal battles, he asserts, “I truly believe an XRP ETF will hit the market this year … it’s simply a question of timing.”

He also highlights an overlooked supportive factor: the proposal for “universal listing guidelines” for single-asset ETFs from major exchanges like Binance, NYSE, and Cboe. “Recent guidelines indicate that any asset with a futures market in the U.S. lasting over six months qualifies for listing,” he explained, reinforcing the expectation for XRP due to its impending six-month futures market milestone.

As these standards are finalized, multiple crypto assets—including XRP—could enter the market simultaneously, sidestepping the lengthy regulatory processes that have previously stalled ETF launches.

Relic’s conviction in XRP’s framework—often criticized by blockchain purists—is viewed as a strength, particularly for institutional clients. “In many ways, a centralized system satisfies certain regulatory requirements,” he stated, mentioning compliance checks and jurisdictional regulations crucial for banks and traditional financial paths.

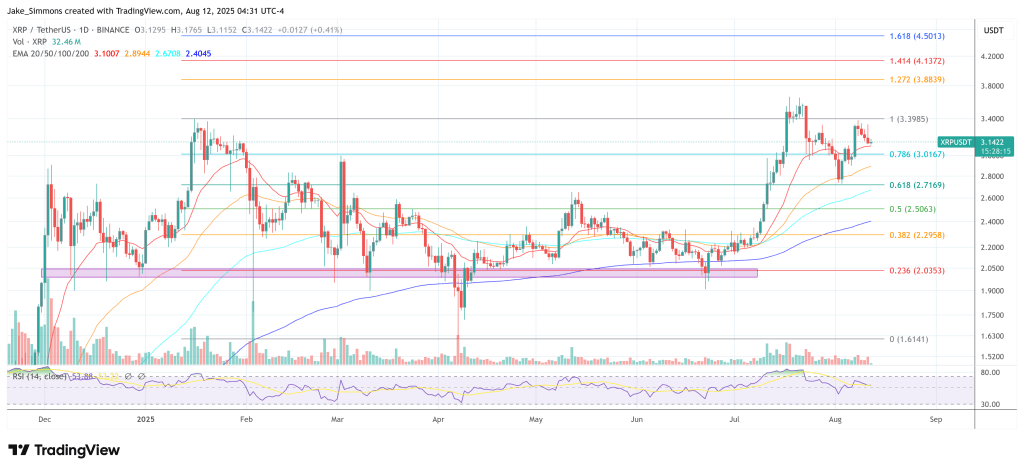

At the time of this analysis, XRP’s market price hovered around $3.14.