Recent observations indicate a significant uptick in selling activities surrounding XRP, signaling potential challenges for investors. This shift raises concerns about the overall health of the market and investor behavior amidst fluctuations.

Market Dynamics for XRP

According to market experts, there has been a marked increase in selling pressure on XRP, coinciding with a notable decrease in prices. Analysts emphasize that the current climate could lead to long-term implications for those holding XRP.

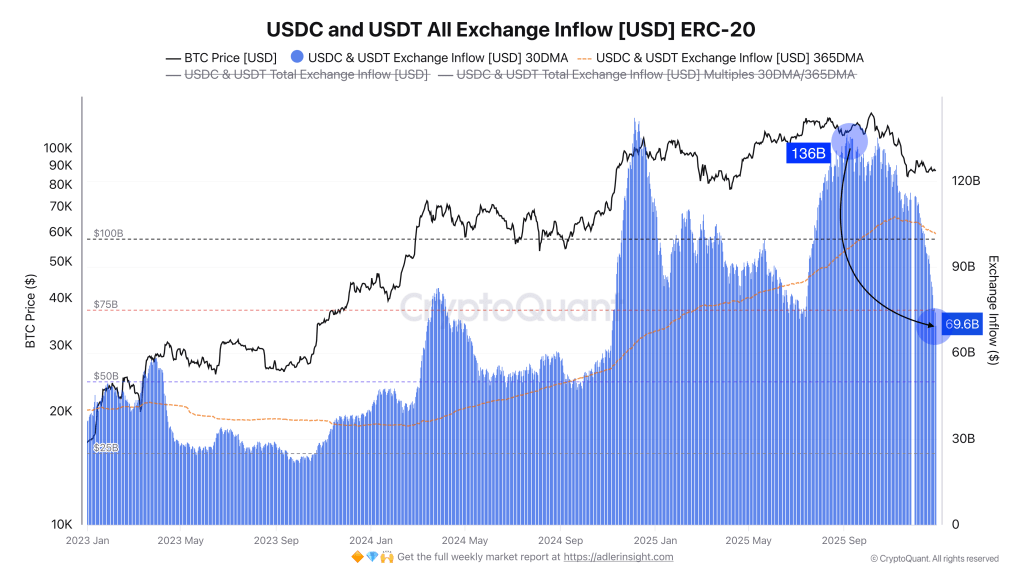

Specifically, the trading environment remains heavily influenced by major platforms, particularly Binance, which is noted for its high trading volume for cryptocurrencies. A surge in exchange inflows generally implies a higher likelihood of selling activity in the market.

Visualizing this trend is essential. Analysts recommend focusing on XRP movements into exchanges, as escalating inflows generally suggest an increased intent to sell. The surge in inflows, especially on significant platforms, raises flags regarding market stability.

Many analysts point out that the shift became evident around mid-December. After a stable period, the inflows jumped significantly, indicating a diverse range of trading activities encompassing large daily volumes. This trend could imply an ongoing distribution phase rather than a clean market adjustment.

The repetitive nature of these inflows illustrates a concerning situation for XRP as many market participants appear to be liquidating assets. This could suggest a shift in tactics among investors from holding strategies to a more aggressive profit-taking stance.

Investor Behavior Insights

Recent data suggests a noticeable change in how investors approach trading decisions, moving towards the idea of liquidating older positions for profit in light of recent price movements. Analysts express that this dynamic can significantly affect the overall ecosystem of XRP and beyond.

To establish a legitimate accumulation phase, analysts stress that sustained inflows need to stabilize or decrease. Continuous elevated selling pressure could exacerbate the current market correction, leading to even deeper declines.

Wider Market Trends

Looking at the larger market context, it’s evident that liquidity constraints are affecting many cryptocurrencies, as stablecoin volumes have plateaued. This stagnation can impede new capital from entering the crypto space, which may further complicate XRP’s recovery.

Expert observations indicate that available liquidity is essentially sidelined, not actively flowing into exchanges as might be expected. This trend has led to a marked decline in average monthly inflows compared to previous months.

Sentiment Analysis

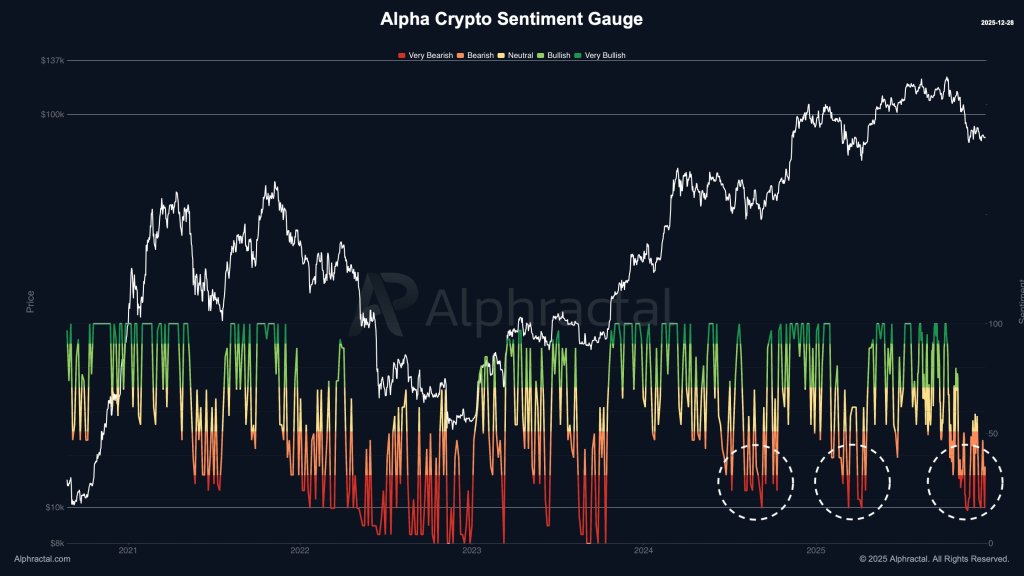

Market sentiment has recently shifted towards bearish perspectives following a comprehensive sentiment assessment. As bearish beliefs spread, analysts caution about the possible ramifications if the sentiment persists, stating that collective market psychology often leads to unexpected reversals.

Furthermore, caution is advised when interpreting these signals, especially in a turbulent market environment. Investors should be wary of making hasty decisions based on fleeting sentiments. Recent experiences highlight the importance of patience, especially as the market appears to be entering a prolonged period of adjustment since November.

As of the latest update, XRP trades at approximately $1.90, reflecting a cautious sentiment in the marketplace.