The current landscape for XRP shows it is making efforts to find stability around the $2.10 mark following a notable decline of 12% from its previous peaks. This recent pullback has resulted in a slowdown of momentum, leaving investors to navigate an uncertain market. The struggle between buyers looking to uphold support and sellers aiming to leverage recent gains highlights the fragile balance in the current trading environment.

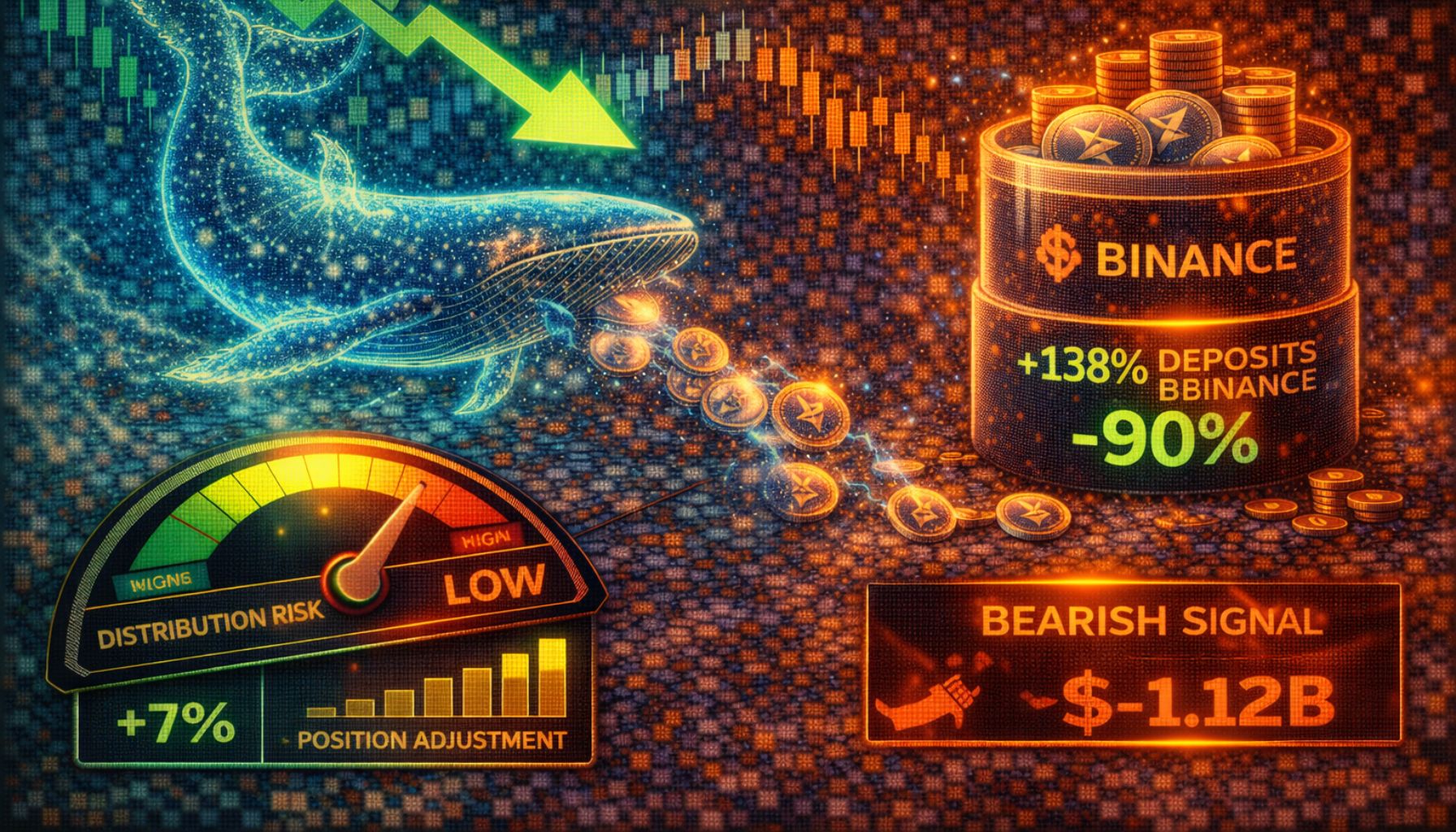

In a compelling analysis from CryptoQuant, there’s been a significant evolution in the flow of XRP on-chain. The data indicates that whale activity has been a dominating factor in exchange inflows, comprising about 60.3% of total transfers, while retail participants accounted for the remaining 39.7%. This separation emphasizes the different roles these groups play in price action.

Interestingly, while whales continue to be predominant, their engagement in the market has been on a gradual decline since mid-December. This represents a major shift compared to November, when whale movement surmounted 70% of overall flows.

Historically, increased whale activity on exchanges often signals upcoming distribution or selling pressure. The recent drop in this dominance suggests that large holders might be retreating from aggressive trading strategies after the latest market correction.

Whales Pull Back as XRP Seeks a Support Base

The report by CryptoQuant emphasizes that the easing of whale flows to Binance coincided with price adjustments in XRP. Following a price surge to approximately $3.20 in late 2025, the current value has navigated towards the $2.26 level, which signifies a cooling off from the intense speculation experienced during the preceding rally. Heavy inflows from whales typically hint at potential sell-offs or redistribution events. This downward trend in whale activity indicates that significant holders are not currently engaging in aggressive sales.

What’s noteworthy is the contrast with retail investor behavior. Data reflects that retail flow percentages have remained stable since mid-December, lacking any significant spikes in exchange moves. This points to an absence of panic selling from smaller investors amidst price adjustments. When both large and small players hold back on increasing sell pressure, it often leads the market away from rapid downward movements.

This combination of factors suggests the possibility of a re-accumulation phase for XRP, especially following its strong performance earlier in the cycle. Although whale activity remains high, its diminishing portion reduces the chances of a sudden sell-off occurring in the near future.

Nonetheless, it is essential to note that this equilibrium is tentative. A resurgence in whale flows to Binance could swiftly change the market’s outlook, signaling that distribution might recommence and downside risk could rise once more.

XRP Faces Challenges in Achieving Stability After Price Correction

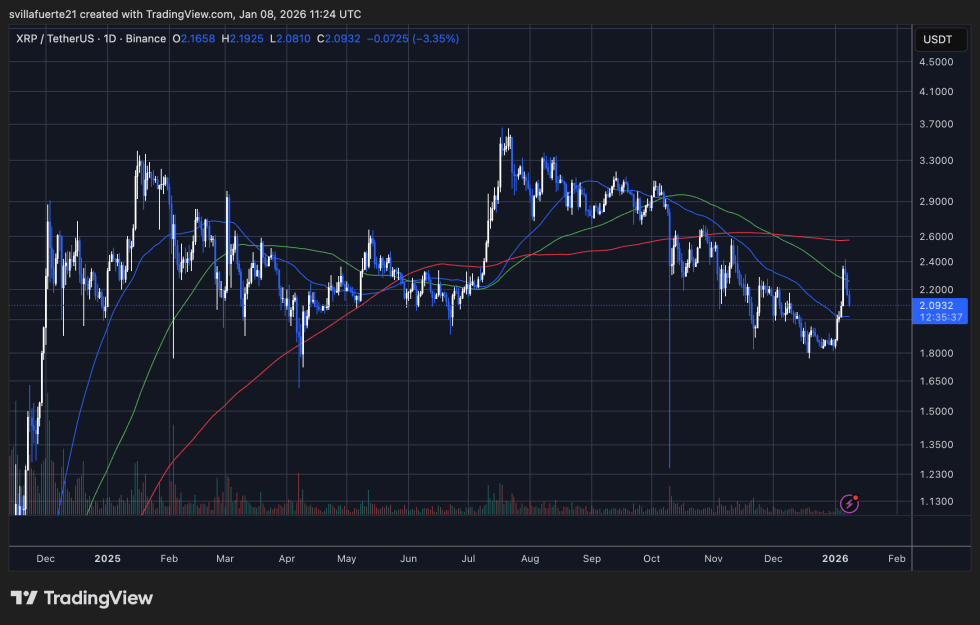

The daily chart for XRP indicates a market still struggling to find its footing following a sharp descent from late-2025 highs. After encountering resistance in the $3.30–$3.40 territory, XRP entered a prolonged downtrend, marking a series of lower highs and lower lows. This trend persisted throughout November and December, reinforcing ongoing bearish sentiments as prices fell below crucial moving averages.

At present, XRP seems to be attempting to stabilize around the $2.10 mark, which has turned into a short-term support area. The recovery from lows below $1.90 indicates that selling pressure may be weakening; however, the rebound still shows signs of weakness. Prices remain below the 50-day and 100-day moving averages, both of which are trending downward, presenting challenges near the $2.40–$2.60 range. Until XRP can break through these levels, any upward movements are likely to encounter significant selling pressure.

Overall volume during this rebound has been modest compared to the previous sell-off, hinting at a lack of strong buyer conviction. This observation supports the notion that the current increase could be corrective rather than the beginning of a sustained upswing. For XRP to negate its broader bearish outlook, it would need to firmly reclaim and hold above the $2.50 zone.

The current chart conditions reveal a heightened risk of consolidation. A failure to protect the $2.00 mark decisively could lead to renewed downward pressures toward past liquidity levels. Conversely, a break above the moving-average resistance would signal a substantial shift in market momentum.

Image sourced from ChatGPT; chart from TradingView.com.