The market capitalization of XRP surged by approximately $16.6 billion in just a brief period of thirteen hours. However, blockchain analyst Dom (@traderview2) pointed out that the net spot inflows that contributed to this incredible spike amounted to merely $61 million.

“Have you ever considered how a $16.6 billion rise in XRP’s market value occurs? … Just $61 million. That’s the net buying pressure we identified in the past 13 hours,” Dom shared on X, further elaborating, “Indeed, just $61 million of buying activity resulted in a $16.6 billion market cap increase. This shows you that market cap figures can be misleading — what truly counts is liquidity.”

According to Dom’s analysis, each dollar entering centralized exchanges was amplified over 270 times into notional capitalization. EGRAG CRYPTO (@egragcrypto), another analyst, commented that the typical relationship between net flows and market valuation can fluctuate between “15× to 30×” under usual circumstances.

This incident underscores why market capitalization, calculated as total circulating supply multiplied by the most recent price, is merely a snapshot devoid of financial context. The price is primarily determined by the last trade, which can instantaneously affect the valuation of all circulating tokens.

How Can $61 Million Drive Such Growth?

Insights into order-book micro-structure provide the initial explanation. In major centralized platforms like Binance, Upbit, and Coinbase, much of the liquidity resides far beyond the top orders. The visible spread might appear negligible compared to the billions of dollars believed to be in circulation.

As additional bids engage with the ask orders, both automated and human market-makers adjust their prices upward, leading to an immediate revaluation of every existing token. This process creates a geometric rise (or fall) in market capitalization that can greatly surpass the underlying cash flow until market corrections or profit-taking restore balance.

The situation with XRP exemplifies the significant distinction between realized capitalization—reflecting actual purchase prices paid by holders—and the headline market cap. Data from Ripple’s quarterly reports indicates that about half of the total supply remains inactive, suggesting that the effective free float is considerably smaller than the listed 59 billion. Thus, when inactive coins do not fill buy orders, minor flows can bring about significant price changes. Analysts warn that the same mechanics can exacerbate declines during periods of limited liquidity.

For traders, Dom concludes that this incident serves as “a critical reminder to prioritize volume-weighted liquidity indicators over just market cap figures.” Whether this 16-hour surge is seen as a positive indicator or merely an interesting statistical anomaly, it serves as a valuable lesson about how cryptocurrency markets still behave more like emerging stocks than established commodities: prices are set at the margin, which can often be incredibly thin.

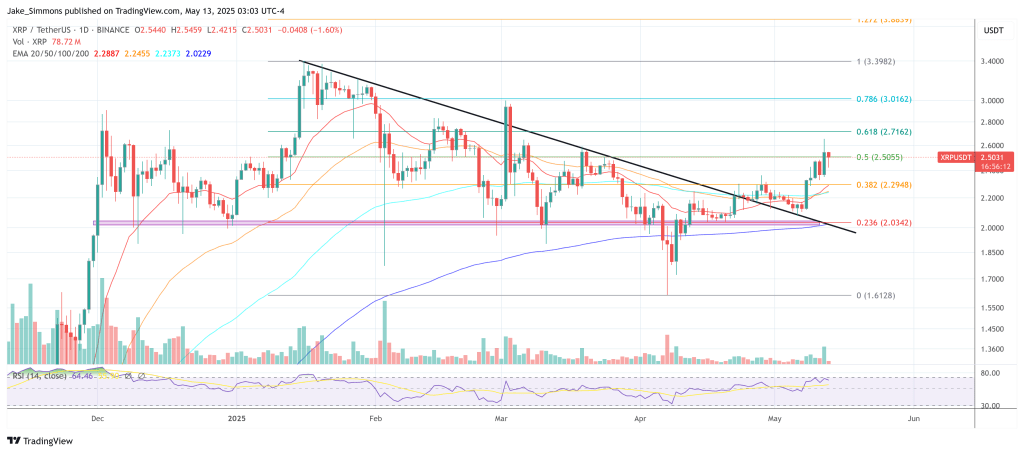

As of the latest update, XRP was trading at $2.50, with a 24-hour transaction volume just above $11 billion, resulting in a market cap of $146.2 billion, solidifying its position at No. 4 in market rankings.