The landscape of Bitcoin spot exchange-traded funds (ETFs) is evolving significantly, with current data indicating notable inflows in 2025 relative to previous years.

2025 Bitcoin Spot ETF Inflows Have Surpassed $14.8 Billion

Recent insights from CryptoQuant’s Lead Researcher, Julio Moreno, shed light on the influx patterns of US Bitcoin spot ETFs in 2025 when juxtaposed with 2024.

Bitcoin spot ETFs serve as investment tools that grant investors exposure to Bitcoin’s price shifts without the necessity for direct asset custody. The convenience of trading on conventional platforms means that investors can participate without dealing with the complexities associated with cryptocurrency wallets.

This advantage makes spot ETFs particularly appealing to those who may not be fully versed in digital asset management, allowing for seamless transitions into Bitcoin investments.

On January 10, 2024, the Securities and Exchange Commission (SEC) approved Bitcoin spot ETFs, which rapidly gained traction and have since become pivotal in the cryptocurrency market ecosystem.

While the year 2024 witnessed a consistent upward trajectory for these financial instruments, subsequent trends in 2025 have illustrated a more fluctuating landscape. Below is a graphical representation by Moreno that outlines the comparative net inflow trajectory of Bitcoin spot ETFs across both years.

The chart reveals that 2025’s Bitcoin spot ETF inflows started strong but were considerably impacted by market volatility; however, optimism is resurfacing as demand re-engages, causing a narrowing of previous gaps. Following a substantial wave of investments coinciding with breaking price records, 2025 now compares favorably against 2024.

Currently, cumulative net inflows for 2025 stand at approximately $14.838 billion, slightly above the $14.827 billion recorded during the same timeframe in 2024.

This momentum could signal a shift in demand dynamics relative to last year when inflows had plateaued. Should the current growth trajectory continue, 2025 may distinctly outperform its predecessor.

However, the longevity of this demand remains uncertain, particularly since 2024 experienced a surge in inflows during the latter months, driven by increasing investor enthusiasm as Bitcoin surpassed the $100,000 threshold.

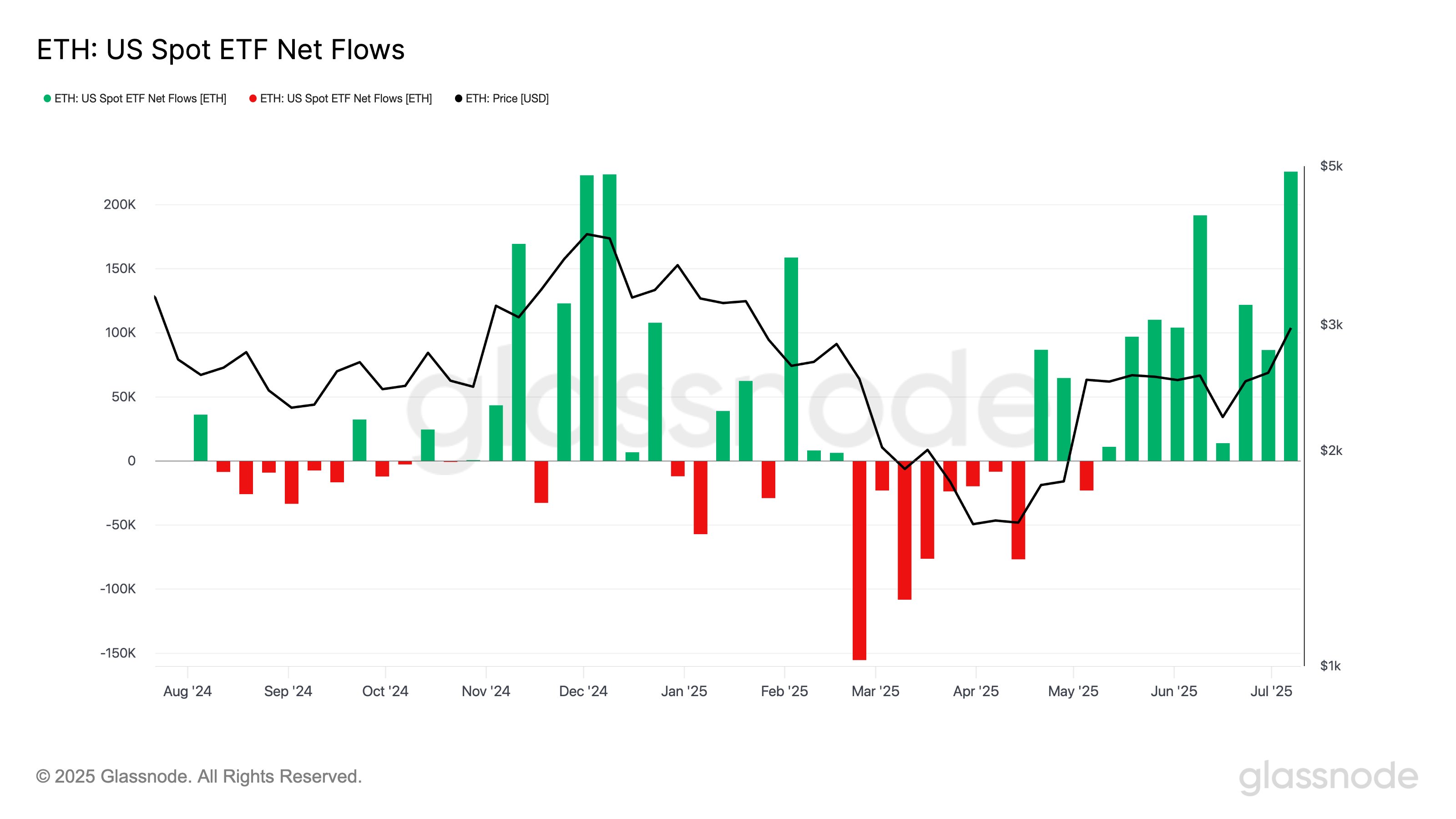

Additionally, on a related note, US Ethereum spot ETFs have been exhibiting remarkable growth, demonstrating consistently positive net flows over recent weeks.

Notably, the prior week marked a peak for Ethereum spot ETFs since their SEC approval in mid-2024, achieving inflows of 225,857 ETH.

Current Bitcoin Pricing Analysis

Bitcoin recently reached a new all-time high (ATH) exceeding $123,000, though it has since experienced a correction, with the price stabilizing around $117,300.