In a notable turnaround, the market for crypto assets has experienced a significant influx of investment, reversing previous trends that saw withdrawals. Recent statistics from CoinShares reveal that the total inflow reached an impressive $572 million, with various factors influencing investor behavior.

The report highlighted a dynamic week for investor sentiment, shaped by macroeconomic indicators and upcoming regulations in the crypto space. According to James Butterfill, the head of research at CoinShares, the week’s trends suggest a shifting landscape for cryptocurrency investments.

“At the beginning of the week, we observed outflows totaling $1 billion, primarily driven by concerns over economic growth linked to disappointing US payroll data. However, as the week progressed, a remarkable shift occurred, yielding $1.57 billion in inflows, likely fueled by government announcements regarding digital asset integration in retirement savings plans,” he commented. This policy adjustment seems to have re-energized institutional investor interest in cryptocurrencies.

Examining Regional Fluctuations and Asset Dynamics

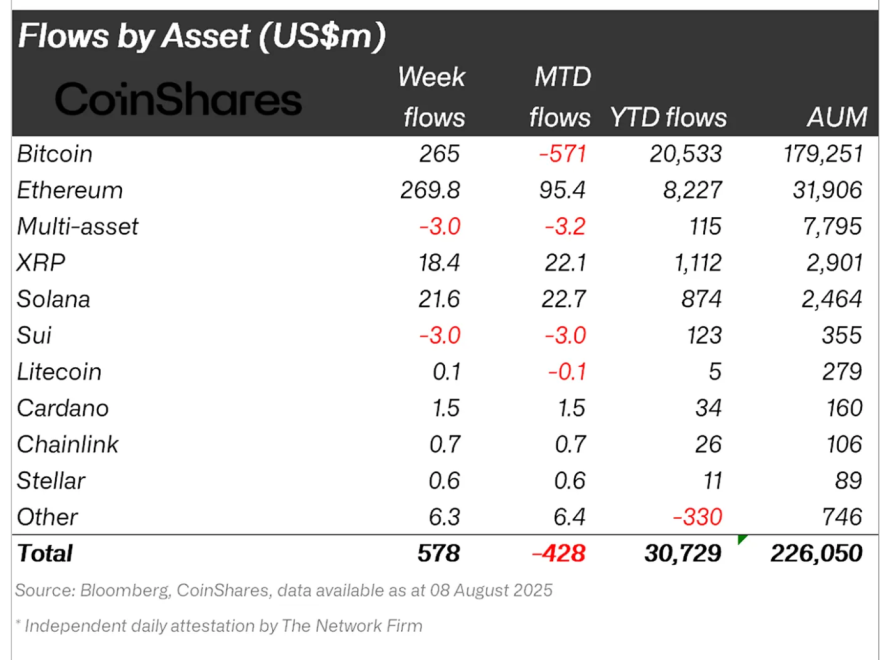

Inflow patterns exhibited clear regional disparities. The United States emerged as a dominant player, with net inflows of $608 million, while Canada followed with $16.5 million. Conversely, European markets displayed caution, as notable outflows were recorded in Germany, Sweden, and Switzerland, collectively amounting to $54.3 million.

CoinShares pointed out that broader seasonal trends, notably the typically subdued summer trading climate, contributed to a significant 23% drop in trading volumes for digital asset exchange-traded products (ETPs) compared to previous months.

Leading the charge in inflows, Ethereum products secured a remarkable $268 million, marking the highest inflow among crypto assets this week. This surge propelled Ethereum’s total year-to-date inflows to an unprecedented $8.2 billion, while increased asset valuations lifted total assets under management to a staggering $32.6 billion—an 82% rise since the year’s inception.

The rising interest in Ethereum-related ETPs correlates with an uptick in activity across its network, driven by developments in decentralized finance (DeFi) and staking sectors.

In contrast, Bitcoin witnessed a resurgence in investment following two weeks of outflows, bringing in $260 million in fresh inflows. Interestingly, short Bitcoin products faced $4 million in outflows, indicating a more balanced outlook among traders.

Additional altcoins also exhibited positive trends, with Solana attracting $21.8 million, XRP securing $18.4 million, and Near Protocol pulling in $10.1 million. These figures highlight that while Bitcoin and Ethereum predominately define inflow figures, investor interest in various altcoins remains robust.

Market Implications and Future Outlook

The rebound in crypto fund inflows could signal a resurgence of institutional confidence, particularly given the US government’s recent decision to integrate digital assets into specific retirement savings frameworks.

This regulatory change could pave the way for a significant increase in demand, particularly considering the vast potential of the US retirement market. However, the striking regional differences in inflows suggest that overall market sentiment continues to experience fluctuations.

As trading volumes remain lower than in previous months and macroeconomic uncertainties linger, the persistence of these inflows will depend on various factors, including market conditions, regulatory clarity, and performance trends of key assets like Bitcoin and Ethereum.

Image created with DALL-E; chart data sourced from TradingView.