Last week, enthusiasm for crypto investment products thrived, with impressive net inflows totaling $2.7 billion across significant funds. According to CoinShares, this trend marks the 11th straight week of positive inflows, culminating in a year-to-date total of $16.9 billion.

The ongoing surge in interest can be largely attributed to institutional giants like BlackRock and Fidelity, as well as Grayscale and Bitwise, all witnessing escalating demand for their crypto offerings.

US Dominates Inflows as Bitcoin Captures Attention

In the latest reports, the United States led the charge with $2.65 billion of last week’s global inflow total. Other contributions were relatively small, with Switzerland providing $23 million and Germany $19.8 million.

Conversely, countries like Canada and Brazil faced mild outflows, while Hong Kong experienced a significant $132 million reduction in inflows throughout June, despite earlier activity in price surges.

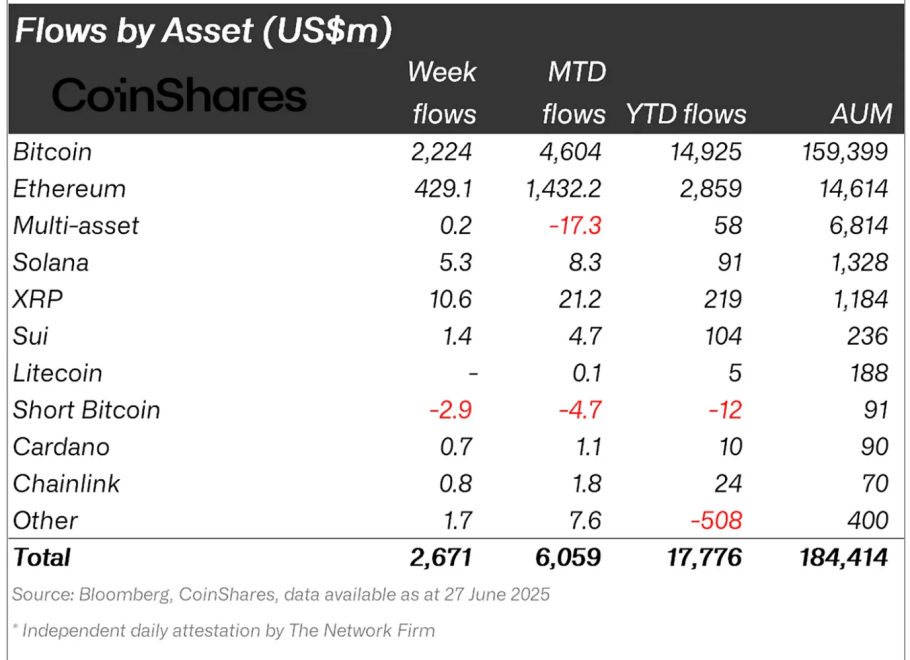

Bitcoin emerged as the primary asset for institutional investment, attracting a staggering $2.2 billion, approximately 83% of the week’s total inflows. However, short-Bitcoin products saw a decline of $2.9 million, culminating in year-to-date outflows for bearish positions at $12 million.

This movement indicates a prevailing market sentiment leaning towards long holdings, fueled by optimism surrounding Bitcoin’s price movements and future trajectories.

James Butterfill, CoinShares’ head of research, remarked that the mid-year performance aligns closely with the trends observed in 2024, which concluded June with $18.3 billion in inflows.

Butterfill pointed to several macroeconomic influences, including geopolitical tensions and evolving central bank policies, which may be motivating investors to diversify into digital assets.

He pointed out that uncertainties surrounding interest rate fluctuations and emerging economic indicators have likely encouraged investors to add cryptocurrencies to their diverse portfolios.

Ethereum Grows Steadily While Solana Falls Behind

Ethereum continues to benefit from robust institutional interest, with $429 million flowing into its associated products last week. So far this year, Ethereum-focused funds have attracted a total of $2.9 billion, establishing it as the second-most preferred asset among institutional players.

This surge in ETH investment aligns with the growing activity surrounding Layer 2 ecosystems, significantly enhancing its operational potential. Meanwhile, Solana struggles to garner attention, recording merely $91 million in inflows for the year.

Although Solana has made headway in sectors like DeFi and NFTs, it seems to be more attractive to speculative investors rather than large-scale institutional commitments at this juncture.

The contrast between Ethereum’s strong performance and Solana’s sluggish demand indicates that investors presently prefer more established platforms when distributing their capital into altcoins.

Featured image created with DALL-E, Chart from TradingView