The cryptocurrency market is witnessing a vibrant resurgence, powered primarily by significant movements from major players like Bitcoin and Ethereum. Bitcoin has crossed the significant threshold of its previous record, hitting approximately $118,000—a notable leap from $112,000. At the same time, Ethereum has surged past crucial resistance around $2,850, reigniting excitement across various altcoins. This powerful rally is prompting renewed optimism among traders, with many experts forecasting the onset of an extended bull market in the near future.

Adding to this momentum are intriguing political dynamics within the US, particularly surrounding the Federal Reserve. Speculation has arisen regarding the potential resignation of Jerome Powell, the Fed Chairman. This speculation coincides with ongoing pressure from President Donald Trump, who is advocating for interest rate cuts—an agenda that Powell has refrained from pursuing. As markets react to these rumors of impending leadership changes within the central bank, there’s a palpable anticipation about how such shifts in monetary policy could influence risk assets, especially cryptocurrencies.

With bullish trends emerging alongside pivotal macroeconomic factors, confidence is steadily growing that the cryptocurrency sector may be on the brink of a transformative growth phase. Investors are now keenly observing whether this current rally sustains its momentum and if potential leadership shifts at the Fed could further stimulate capital inflows into the crypto space.

Market Anticipates Possible Changes at the Federal Reserve

The cryptocurrency landscape is stepping into uncertain yet potentially vibrant territory, with discussions intensifying around a possible change in leadership at the US Federal Reserve. Prominent voices like William J. Pulte, the US Director of Federal Housing, have amplified these conversations by referencing a significant statement from a high-ranking member of Fannie Mae. According to Pulte, “I’m optimistic that Powell’s resignation might be in the cards. This could signal a strong economic turnaround for our nation,” hinting at rising calls for a more market-responsive Fed.

As more details emerge, Pulte has contributed to the buzz, given the unprecedented media focus on Jerome Powell’s role as Fed Chair. While headlines abound, bond markets are proceeding with caution, as evidenced by rising yields which suggest that investors may not fully account for the possibility of his resignation just yet.

The implications of a Powell resignation are monumental. Should this occur, a successor aligned with President Trump—who has advocated for a drastic 300+ basis point cut—could steer monetary policy in a dramatic new direction. Such a shift would represent one of the most radical monetary transitions in recent history, potentially having profound effects on risk assets including cryptocurrencies.

A more accommodating Fed led by a chair sympathetic to Trump could create a fertile environment for capital to flow into the digital asset space, potentially triggering a prolonged bull run for cryptocurrencies. Market participants are now waiting in anticipation for confirmation or denial of these pivotal changes, which could reshape both traditional and digital finance landscapes.

Crypto Market Cap Poised for Significant Breakout

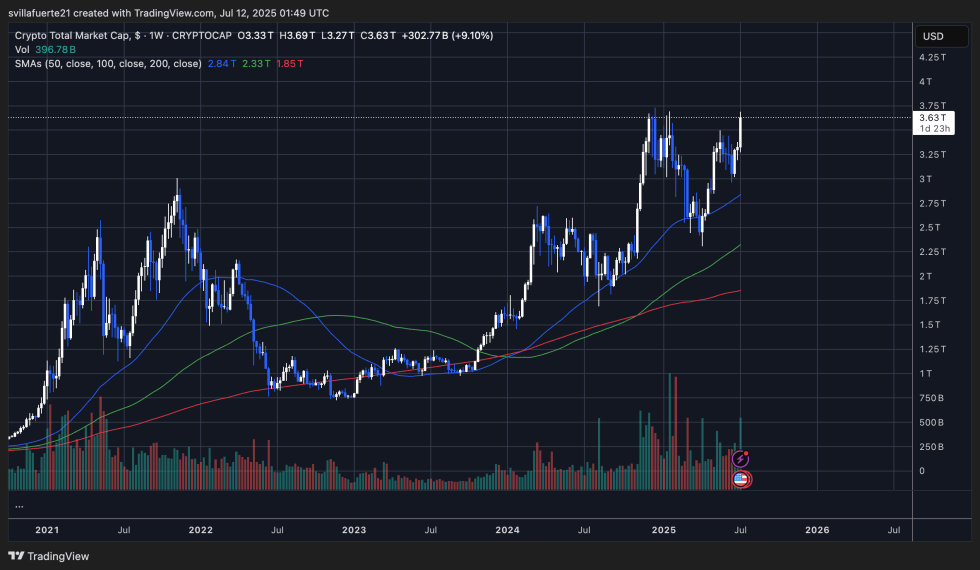

Recent trends show that the total crypto market capitalization has surged to $3.63 trillion, reflecting a robust 9.10% gain over the past week, and it is inching closer to its all-time high of around $3.75 trillion. Notably, the prevailing trend underscores a steady upward trajectory that began in early 2023, characterized by successive higher lows and increasing trading volume. The market cap has consistently rebounded from its 50-week moving average, signaling strong bullish momentum.

After a lengthy period of consolidation, this latest breakout effort is particularly noteworthy. The market is now revisiting highs established earlier this year, and a clean break beyond $3.75 trillion could pave the way for unprecedented growth. If validated, this would signify the highest total crypto valuation ever recorded.

Accompanying this surge in market cap is a rise in trading volume, indicative of increasing confidence and wider market participation. Key drivers include Bitcoin’s ascent above $112K and Ethereum’s breakthrough past $2,850, both of which have propelled altcoins higher as well. A confirmed breakout in market cap would not only bolster the broader bullish narrative but also potentially attract institutional investments and rekindle retail enthusiasm.

All eyes remain on the developments as traders navigate the transforming landscape of cryptocurrencies, eager for the next big move in this dynamic market.