Injective has recently captured attention in the crypto landscape, experiencing an impressive surge of 27% since last week. This surge aligns with a revitalization in the broader cryptocurrency market, especially as Bitcoin approaches new all-time highs and various altcoins regain crucial support levels, reflecting heightened investor optimism. However, the price increase is only part of the story behind Injective’s impressive performance.

On Friday, the platform launched the Injective Council, a strategic initiative formed by prominent figures from leading Fortune 500 companies and notable Web2 firms. This council represents a significant move in Injective’s ongoing effort to enhance real-world application of blockchain technology. Its primary goals include promoting institutional adoption, advancing innovations in decentralized finance (DeFi), and overseeing the platform’s evolution toward comprehensive asset tokenization.

The community and investors have reacted positively to this announcement, interpreting it as a strong indicator of Injective’s commitment to long-term growth and development. Injective is carving a niche at the crossroads of traditional financial systems and the innovative potential of Web3 technologies.

Injective: Pioneering the Future of Institutional Web3

With the inauguration of the Injective Council, the project is boldly bridging the gap between conventional finance and decentralized technology. This council comprises leading organizations such as Google Cloud, Deutsche Telekom, BitGo, Republic, Galaxy, NTT Digital, and Korea Digital Asset Custody (KDAC), uniting their vast expertise in institutional finance, technology, and regulatory affairs.

This council aims to firmly establish Injective as the leading platform for integrating institutional finance with Web3. Through their collaborative efforts, the teams will facilitate impactful on-chain applications and enterprise-grade solutions. The input from each member will be crucial in steering the protocol’s future, influencing its development roadmap and governance frameworks.

Google Cloud’s technical proficiency will support Injective’s scalability goals, while Galaxy and BitGo offer vital insights into asset management, custody solutions, and tokenization. This synergy lays the groundwork for innovative financial products, including tokenized equities and credit markets. Additionally, Republic and NTT Digital enhance global outreach and regulatory perspectives, further solidifying Injective’s standing within the institutional market.

The initiation of the Injective Council transcends a mere milestone for the protocol. It heralds a significant shift within the crypto industry, underscoring that the integration of established finance and blockchain technology is becoming a tangible reality.

The INJ Price Action and Resistance Levels

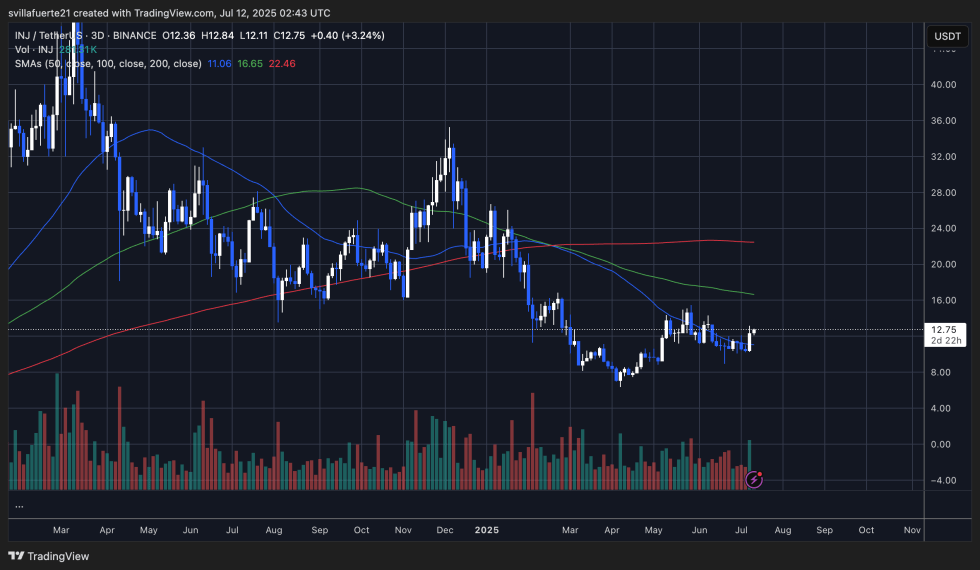

Injective (INJ) has demonstrated renewed bullish sentiment, with a remarkable gain of 27% since last Wednesday, closing its latest trading candle at $12.75. An analysis of the 3-day chart reveals a smooth rebound from the red 200-period moving average, which has provided essential support for weeks. This upward trajectory comes hand-in-hand with a notable increase in trading volume, indicating growing investor confidence.

Currently, INJ is facing the $12.75–$13 resistance zone, a level that has previously functioned as support in mid-2023 and resistance during the second quarter of 2025. A definitive breakout above this threshold could provide pathways to the 100-period simple moving average (SMA) near $16.65, followed by the pivotal $20 mark.

Interestingly, the alignment of all major moving averages (50, 100, 200) above the current price indicates that INJ remains within a larger bearish structure. If bulls can successfully regain the support of the 50-SMA at $11.06 and achieve a close above $13 with sustained volume, the chart could signal a favorable environment for a mid-term bullish continuation.

Visuals captured from Dall-E, with charts sourced from TradingView.