Recent on-chain statistics indicate that the average Bitcoin Hashrate has risen to an impressive 942 EH/s, signaling a robust recovery and positioning itself close to its all-time peak.

Recovery of Bitcoin Hashrate: An In-Depth Look

The term “Hashrate” describes an essential metric in the Bitcoin ecosystem, capturing the overall computational power contributed by miners to the blockchain. This raw processing energy is crucial since Bitcoin operates on a proof-of-work (PoW) consensus mechanism.

Within this system, miners compete to solve complex algorithms and validate transactions, determining who gets to add the next block to the chain. While this computational power is not necessarily synchronized, the overall Hashrate provides valuable insights into mining activities and trends.

A surge in the Hashrate often indicates that more miners are actively participating in the network, whether by entering the space or expanding their existing operations. This uptick suggests that Bitcoin mining is becoming increasingly lucrative for these validators.

Conversely, a decline in Hashrate may reflect that some miners are exiting the network, possibly due to profitability concerns or external market pressures.

To illustrate, here’s a trend chart from Blockchain.com depicting the 7-day average Bitcoin Hashrate over the past year:

The graph clearly demonstrates a notable dip in the 7-day average Bitcoin Hashrate, which fell to approximately 796.2 EH/s a month ago, on June 28th. This drop was likely influenced by a temporary stall in Bitcoin’s price rally, entering a phase of consolidation.

For miners, a significant portion of their earnings stems from the block subsidy—a fixed Bitcoin reward for successfully adding blocks to the blockchain. As Bitcoin’s price rises, so does the value of this reward, prompting miners to adjust their strategies accordingly.

After last month’s low, the growing Hashrate indicates a resurgence as miners reintroduced more computational power. This growth aligns with Bitcoin’s price breaking past earlier resistance levels toward new all-time highs.

Interestingly, even though Bitcoin has slightly cooled off in recent weeks, miners have continued to ramp up their efforts, resulting in the current 7-day average of 942 EH/s, just shy of the record 943.6 EH/s achieved in mid-June.

This development is noteworthy, particularly against the backdrop of a rising Bitcoin Difficulty level.

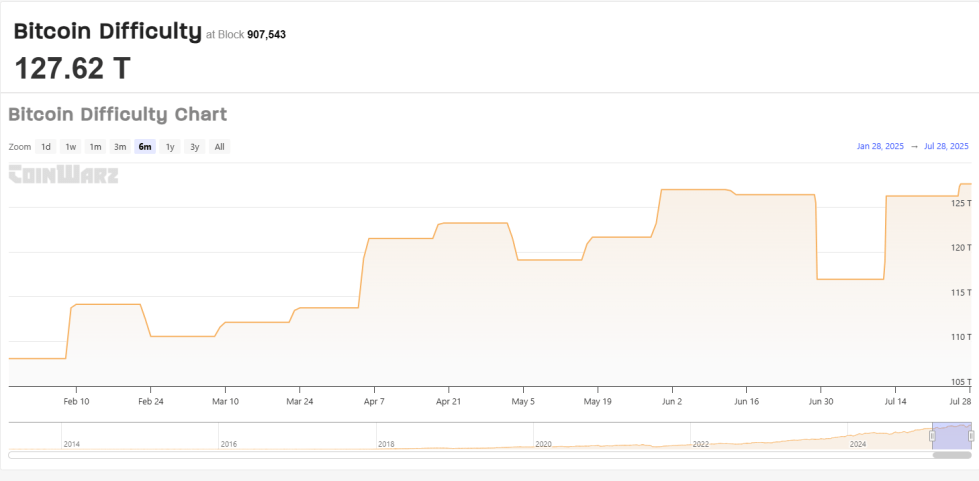

The accompanying chart from CoinWarz highlights that Bitcoin Difficulty has reached 127.62 terahashes, surpassing the previous record of 126.98 terahashes established last month.

This Difficulty metric is critical, as it regulates how challenging it is for miners to discover the next block, ensuring that they only receive block subsidies approximately every ten minutes. This mechanism maintains a stable flow of newly minted Bitcoin, regardless of mining power increases.

So, why do miners continue to enhance their computational power? The straightforward answer lies in the need to remain competitive. Historically, the Hashrate has shown an upward trend, and this momentum is likely to continue. Miners that fail to scale their operations accordingly risk falling behind and earning less revenue.

Current Bitcoin Price Dynamics

At the time of this writing, Bitcoin is trading at approximately $118,900, reflecting a 1% increase over the past week.