On August 5, 2025, Base, the Ethereum Layer-2 solution created by Coinbase, faced a significant disruption lasting 33 minutes, halting block production on its Mainnet. The incident was triggered by unexpected congestion on the blockchain combined with issues related to an unprepared backup sequencer. Although Base boasts a design aimed at ensuring high availability via multiple sequencer instances controlled by Conductor—a component of the OP Stack—a critical failure in the handoff process necessitated manual intervention to restore service.

This incident stirred considerable concern within the cryptocurrency community. Investors and users began questioning the overall reliability of the network, noting that Layer-2 scaling solutions are intended to provide seamless and dependable operations. The unfortunate outage underscored the potential vulnerabilities within the sequencer infrastructure, leading to skepticism about Base’s ability to sustain uptime and stability during peak usage times.

With confidence in the platform temporarily shaken, some critics highlighted the risks associated with centralized management of sequencers. In contrast, supporters pointed to the rapid response as a mitigating factor that helped avert a more extended disruption. Nonetheless, the reputational damage raises alarms for both institutional users and DeFi projects looking to deploy on the network. The upcoming weeks are pivotal as the Base team seeks to address these issues and restore faith in the platform.

Base Reports On Network Disruption: Causes and Solutions

In the aftermath of the network disruption, Base released a comprehensive postmortem analysis detailing the underlying issues and the corrective actions taken. The root cause was identified as a failure during the sequencer handoff within the High Availability (HA) system, overseen by Conductor, which is designed to mitigate downtime and eliminate single points of failure.

At approximately 6:07 am UTC, the active sequencer began to lag due to a surge in on-chain transactions. Conductor, operating as it should, attempted an automated handoff to a new sequencer. However, this new sequencer was still being provisioned and not ready to generate blocks. Normally, if the newly appointed sequencer is incapable, Conductor would initiate another handoff. However, since itself was not fully operational on this sequencer, it was unable to perform another transfer.

By 6:09 am UTC, the monitoring systems detected the problem, prompting immediate attention from the Base team. The situation was officially acknowledged at 6:12 am UTC. The engineers took action by pausing Conductor’s HA software to halt the problematic leadership transfers and manually elected a functional sequencer. Operations returned to normal by 6:40 am UTC.

To avert similar issues in the future, Base is undertaking significant revisions to its infrastructure. This includes ensuring that all sequencers added to the cluster are capable of leadership transfer when elected. Furthermore, enhanced testing procedures are being implemented to validate these solutions prior to deployment. The goal is to strengthen Base’s system resilience and prevent future disruptions.

Ethereum Reacts to Market Conditions Amidst Caution

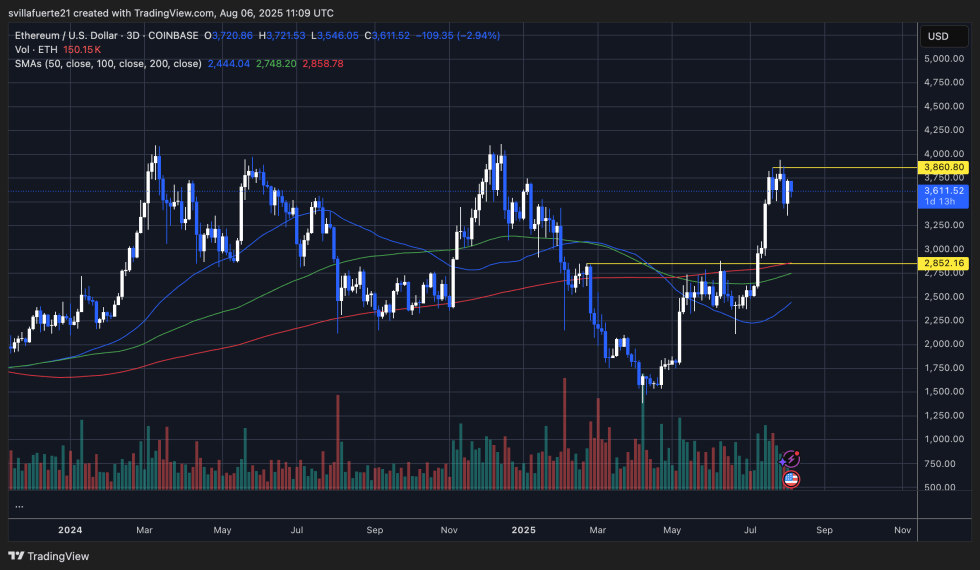

Currently, Ethereum (ETH) is trading at $3,611.52, reflecting a notable decrease from its recent peak of $3,940. The cryptocurrency is encountering challenges in regaining bullish momentum, struggling to maintain a position above the $3,700 resistance level. A review of the charts indicates that ETH is now in a consolidation phase following an aggressive climb from $2,852.16, which is a crucial support level should market conditions worsen.

The 50-day moving average has become a dynamic resistance level near the $3,640 mark, while the 100-day and 200-day moving averages remain positioned below the current price, signifying an overall bullish trend. However, the recent pullback near the $3,860.80 level indicates that bullish sentiment may be faltering in the short term.

Although Base does not have its own native token, its performance is intrinsically linked to the broader Ethereum Layer-2 ecosystem narrative. Investors are keenly observing if ETH can stabilize above the $3,600 threshold, as any continued weakness may exacerbate doubts surrounding the entire Layer-2 market.

Image sourced from Dall-E, chart from TradingView