The world of Bitcoin mining is experiencing a significant surge, with the 7-day average Hashrate recently reaching a remarkable all-time high (ATH). This increase comes despite the recent downturn in the price of Bitcoin, indicating a robust underlying sentiment within the mining community.

New Highs in Bitcoin Hashrate

Bitcoin’s Hashrate reflects the total computational power that miners dedicate to the network. This metric is critical as it provides key insights into the overall health and activity level of the Bitcoin mining ecosystem. Each miner competes independently, making it a competitive, yet informative, gauge of network dynamics.

When the Hashrate climbs, it generally indicates that more miners are either coming online or that existing miners are expanding their operations. A rising Hashrate suggests that mining is deemed profitable, drawing in new participants eager to contribute their resources.

Conversely, a decline in Hashrate could signal potential issues, as some miners might be disconnecting their equipment from the network, often reflecting a decrease in profitability.

To visualize this trend, you can refer to a chart available on Blockchain.com, which tracks changes in the 7-day average Hashrate over the past year.

The recent data showcases that after a dip to 889 exahashes per second (EH/s) on August 3rd, the Hashrate jumped to its current high of 952.5 EH/s. This drop was notably concurrent with Bitcoin’s price slump to $112,000, highlighting the intrinsic link between miner revenues and cryptocurrency values.

Miners primarily generate income through block rewards, which are denominated in Bitcoin. Therefore, fluctuations in Bitcoin’s market price directly influence the USD value of the rewards miners receive.

Interestingly, the resurgence in Hashrate despite Bitcoin’s inability to reclaim its earlier prices indicates a potential bullish outlook among miners. This surge in computational power could reflect anticipation of future market improvements, yet only time will reveal whether this optimism is justified.

With the recent spike in the 7-day average Hashrate surpassing the previous record of 943.6 EH/s from June, we can expect an associated adjustment in mining Difficulty, leading to new high benchmarks.

The Difficulty setting on the Bitcoin blockchain dictates how challenging it is for miners to solve blocks and earn rewards. This system is essential for maintaining a controlled rate of new block creation, ensuring network stability. When Hashrate increases, the network automatically raises Difficulty to restore the average block-solving speed.

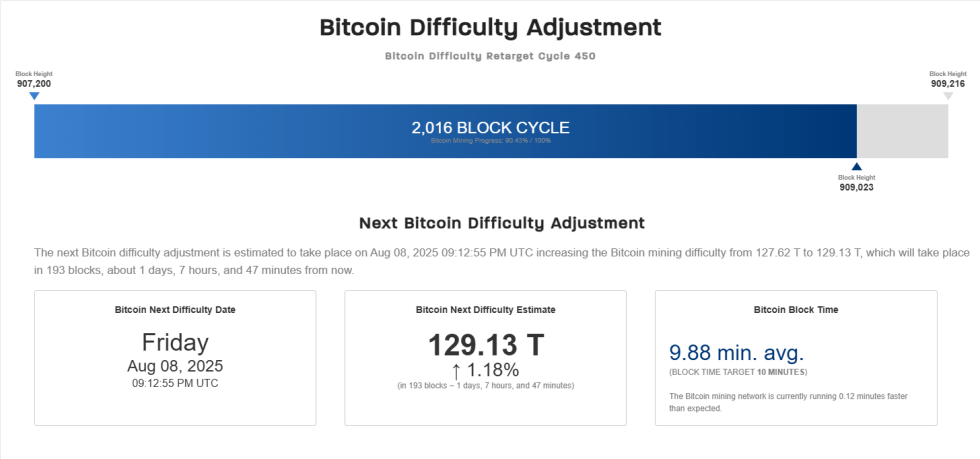

The next network adjustment is projected for Friday, with forecasts indicating a new ATH range for Difficulty at 129.13 terahashes, supported by data from CoinWarz.

Current Trading Conditions for Bitcoin

As of now, Bitcoin is trading near $116,300, marking a slight recovery with a 2% increase over the last 24 hours. This brief push in price may signal a momentary bullish sentiment amidst the prevailing market challenges.